STSL tax: What it is and how it works

In this article

The Study and Training Support Loans (STSL) is an umbrella term that represents an Australian government initiative. It covers HECS-HELP and other applicable study and training loans. The aim of STSL is to assist Australians repay their student and training-related debts.

As an employer, you have an essential role in the collection of these STSL repayments through your payroll system.

In this article, we provide a general guide to managing STSTL tax.

What is STSL tax?

The Study and Training Support Loan (STSL) tax is part of Australia's income tax system. It involves employees with eligible study and training loans servicing their loans via payroll deductions. It works in a similar way to income tax payments.

When an employee has an STSL and their income exceeds the threshold set by the ATO, you need to withhold STSL repayments from their wages. For the 2025-26 year, these repayments use marginal rates instead of a flat percentage.

It's the employee's responsibility to tell you if they have an STSL debt. They do this via their Tax File Number (TFN) declaration or a withholding declaration during the onboarding process. It's your responsibility to withhold the right amount each pay run and send it to the ATO along with the employee's regular income tax. And it's up to the ATO to manage the loan balance and apply the repayments against what they owe.

Student loans subject to STSL tax

Here are some of the student loans subject to STSL tax:

Higher Education Loan Program (HELP): This loan helps eligible students cover tuition fees for university or higher education providers. There are different HELP loans. The applicable one depends on the student's circumstances.

VET Student Loans (VSL): This program helps eligible students undertake various diploma-level and above vocational education and training.

Student Financial Supplement Scheme (SFSS): This closed in 2003. However, those who have existing loans still make their compulsory repayments via the tax system. The SFSS offered voluntary loans to help tertiary students pay for expenses related to their studies.

Student Start-up Loan (SSL): The SSL assists eligible higher education students who receive Youth Allowance or Austudy payments. Prior to 2016, The Student Start-up Loan was the Student Start-up Scholarship.

Trade Support Loan (TSL): The TSL was previously known as the Australian Apprenticeship Support Loan (AASL). It offers financial support to apprentices over a four-year period.

Each of these training loans is subject to compulsory repayments. Though, as mentioned, this only happens when an employee's repayment income exceeds the minimum repayment threshold set by the ATO.

Employer obligations under STSL

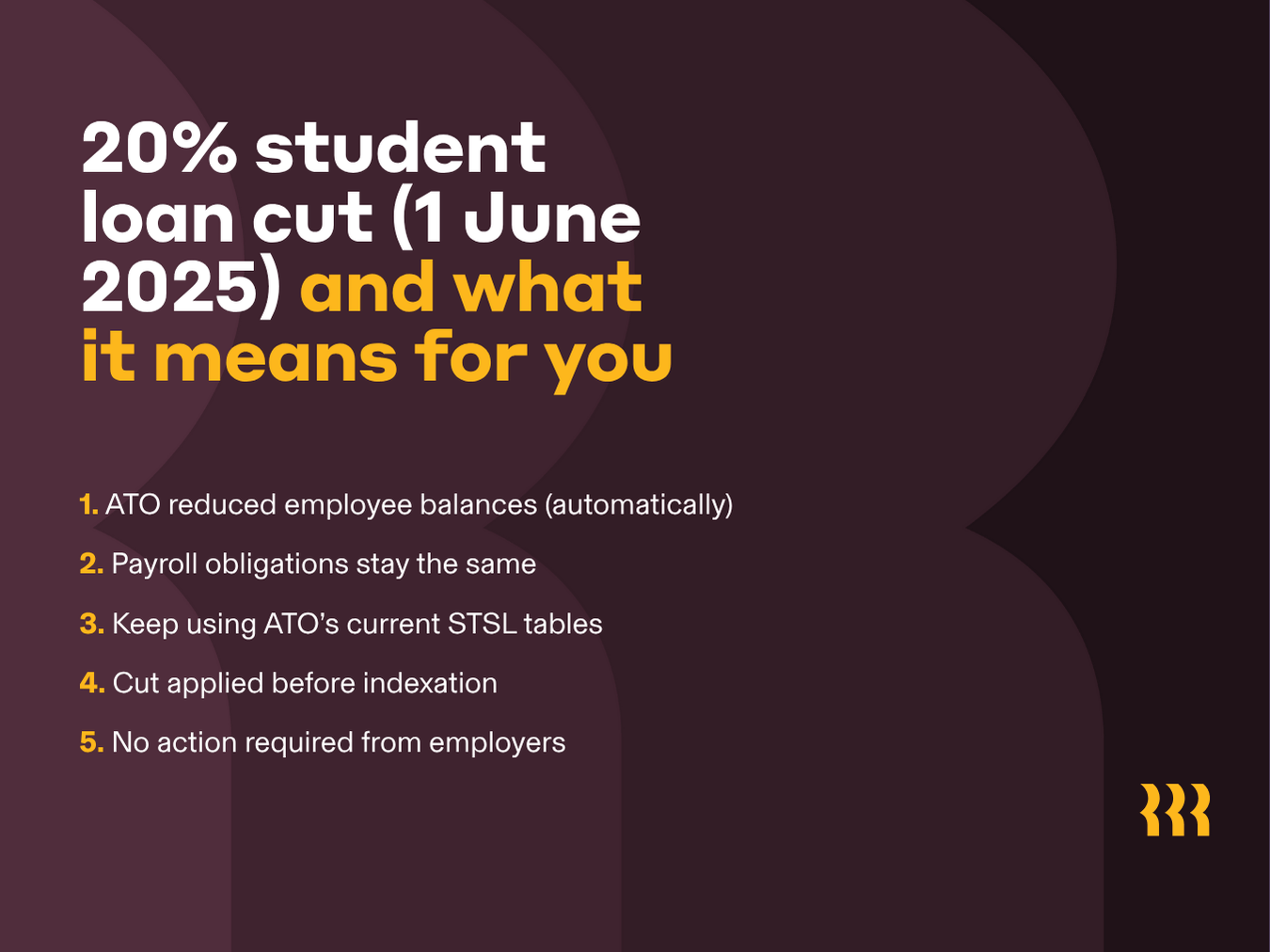

As an employer, your main obligation within the STSL system is to deduct the correct repayments from eligible employees’ pay. From 2025 to 26, you work out those repayments using marginal rates, starting at $67,000. To do this correctly, apply the ATO’s current tax tables or use its online calculator.

You need to deduct the correct repayment amount in alignment with your payroll cycle, which may be weekly, fortnightly, or monthly. You report the STSL amounts through Single Touch Payroll (STP) with the rest of your PAYG withholding. Payment deadlines are the same as for PAYG:

Small withholder (you withhold $25,000 or less in a year)

You pay quarterly → due 28 days after the end of each quarter.

Medium withholder (you withhold between $25,001 and $1 million in a year)

You pay monthly → due on the 21st of the following month.

Large withholder (you withhold more than $1 million in a year)

You pay twice monthly:

Amounts withheld 1st–15th of the month → due on the 21st of that same month.

Amounts withheld 16th–end of the month → due on the 7th of the following month.

Staying up to date with ATO schedules and paying on time helps you avoid penalties for late or incorrect withholding.

How to process STSL deductions in payroll

Follow these steps to make sure you’re handling STSL correctly for your employees:

1. Collect employee tax declarations

When you onboard a new hire, they complete a TFN declaration. This form tells you whether they have an STSL. If an existing employee later takes on a loan or repays one in full, they can update you with a withholding declaration. Recording this information correctly in your payroll system is the first important step. It's the trigger for you to withhold extra repayments.

2. Check the ATO’s annual income thresholds

As you now know, STSL repayments only kick in once an employee’s repayment income goes over the ATO’s annual threshold. Currently, the income threshold starts at $67,000. Repayment income includes:

taxable income

reportable fringe benefits

reportable super contributions

some other amounts the ATO specifies.

If your employee earns under the threshold, you don’t need to withhold anything. Once they’re over, you withhold using the ATO’s Schedule 8 tax tables or online calculator. These get updated each year. So, make sure you’re using the latest version!

3. Determine the repayment rate

From 2025–26, repayments no longer use a flat percentage across all income. Instead, they work like tax brackets, whereby you apply marginal rates:

Up to $67,000 → no repayment

$67,001 – $125,000 → 15c for each $1 over $67,000

$125,001 – $179,285 → $8,700 plus 17c for each $1 over $125,000

$179,286 and over → 10% of total repayment income

So if an employee earns $73,000, you don’t just take 3% of $73,000. You need to work it out using the marginal formula. The bad news is that it's complex. The good news is that modern payroll software can do the math for you and make it much easier.

Example calculation

Let's say your employee earns $73,000 in repayment income.

The repayment threshold is $67,000.

That means that the first $67,000 has no STSL repayment.

The amount over the threshold is:

$73,000 – $67,000 = $6,000.

The marginal rate for this band ($67,001 – $125,000) is 15c for each $1 over $67,000.

$6,000 × $0.15 = $900 repayment for the year.

To work out the per-fortnight deduction:

$900 ÷ 26 fortnights = $34.62 per fortnight.

4. Set up automated deductions in payroll software

Most good payroll systems let you flag whether an employee has an STSL debt. Once you 'tick that box', the software applies the right ATO tables each pay run (weekly, fortnightly, or monthly) and withholds the correct amount. This reduces the risk of under- or over-deducting.

5. Report deductions via STP

Each time you pay your employees, you need to report their STSL deductions through STP. You also send the withheld amounts to the ATO with your PAYG withholding.

As mentioned above, the deadlines are the same as for PAYG.

6. Finalise at the end of the financial year

At the end of the financial year, you need to finalise your payroll reporting through STP. This confirms to the ATO that your reporting (including all STSL deductions) is complete and correct. The deadline is 14 July. This is unless the ATO gives you extra time.

Your role as the employer is to withhold and report the STSL amounts each pay cycle. You don’t calculate the final compulsory repayment. The ATO does this when the employee lodges their tax return. The amounts you’ve withheld go toward that repayment.

If you’ve withheld more than needed, the ATO refunds the extra to the employee. If you’ve withheld less, the ATO makes up the difference by charging the employee directly. Therefore, if your STP reporting is late or wrong, it can hold up your employees’ tax returns. It can also create compliance issues for your business.

7. Update when an employee repays their STSL loan

It’s up to the employee to tell you once they have fully repaid their STSL debt. They usually do this through a withholding declaration. When they let you know, you need to update their payroll record straight away so you stop withholding extra amounts.

If you keep deducting repayments after the employee clears the debt, you must still send those amounts to the ATO through STP. The ATO will then refund the overpayment to the employee at tax time. You can’t refund it directly through payroll.

End of financial year reporting and reconciliation

As an employer, you must ensure the ATO receives correct information on your employees’ compulsory repayments. As each financial year comes to a close, reconcile all STSL deductions to ensure accuracy and stay compliant.

At tax time, employees don't report their STSL repayments to the ATO manually. Rather, the ATO relies on the payroll data you submit through STP to help them manage repayments. If there are any inconsistencies in the data you submit, it can cause errors in the ATO’s calculations. This can mean potential issues for your employees and your business. These issues may include ATO penalties, employee frustration, and administrative burden, for example.

What to do if an employee repays their STSL loan

It's the employee's responsibility to inform you once they repay their STSL in full. Once they let you know, it's important that you update your payroll system to reflect this right away. This will stop any more deductions for compulsory repayments being withheld from their pay.

If you deduct a compulsory repayment by mistake after this point, you can simply correct the employee’s records and give them a refund. If this happens, you must update your STP tax declarations to ensure accurate employee repayment reporting to the ATO.

STSL tax FAQs

What happens if an employee has multiple employers in Australia?

Only the primary employer deducts STSL tax repayments. The primary employer is the one who pays the employee the highest income. If an employee has more than one job, they must let their secondary employer know not to withhold additional STSL repayments. They can do this when they complete their TFN Declaration form. This assures that their repayments reflect their overall repayment income across all their jobs.

If an employee doesn’t submit a TFN Declaration form, it may lead to all their employers deducting STSL tax repayments. This would obviously lead to an overpayment. If this happens, the ATO will reconcile the overpayments when the employee lodges their tax return.

Is the Student Financial Supplement Scheme still available under the STSL system?

The Student Financial Supplement Scheme (SFSS) is no longer available. It closed in 2003. However, existing loans under SFSS are still subject to compulsory repayments through the tax system.

How does exempt foreign employment income affect STSL repayments?

Exempt foreign income doesn’t count toward an employee’s STSL repayment income. Only the taxable income they earn in Australia counts toward their compulsory repayments. As an employer, you must withhold repayments based only on the income your employee earns in Australia. Managing or accounting for any income they earn overseas is not your responsibility.

Simplify STSL tax with Rippling

It's vital to comply with STSL tax obligations. By doing so, you can make sure your business and your employees align with ATO regulations. Effective management of compulsory repayments for study and training loans under the STSL umbrella is an essential element of payroll accuracy. Tools like ATO calculators and innovative payroll software can make the process a lot easier.

Rippling can automate and streamline the calculation and reporting of STSL repayments. The platform also meshes seamlessly with STP for real-time submissions to the ATO. What's more, Rippling makes the onboarding process a lot more efficient. It does this by putting the delivery and collection of new hires' TFN declaration forms on autopilot. This means you can ensure accurate record-keeping from the get-go!

With Rippling on your side, you can free up time, lessen the risk of manual errors, and stay effortlessly compliant. The result? More time and energy to focus on other important areas of your business.

Disclaimer

Rippling and its affiliates do not provide tax, accounting, or legal advice. This material has been prepared for informational purposes only, and is not intended to provide or be relied on for tax, accounting, or legal advice. You should consult your own tax, accounting and legal advisers before engaging in any related activities or transactions.

Author

The Rippling Team

Global HR, IT, and Finance know-how directly from the Rippling team.

Explore more

See Rippling in action

Increase savings, automate busy work, and make better decisions by managing HR, IT and Finance in one place.