The 26 best payroll software options for Australian businesses

In this article

Payroll is one area where small mistakes can have big consequences. In Australia, you need to pay people correctly, as well as meet strict rules around STP Phase 2 reporting, superannuation, and award interpretation.

If compliance slips, it can lead to penalties from the ATO, as well as damage trust with your team.

To find the best options on the market, I reviewed and scored 26 of the leading platforms against six factors: compliance, features, support, pricing, scalability, and user satisfaction. Each tool received a weighted score based on this framework, with Rippling rated the best payroll software in Australia.

Here’s an overview of my findings. If you’d like to see the complete list and how I added up the scores, you can view the full breakdown of my research in this spreadsheet here.

Platform | Score (out of 5) | Best for | Choose this if you need… | Starting price* |

|---|---|---|---|---|

1. Rippling | 4.40 | All-in-one global payroll and Australian compliance | HR, IT, and Payroll in one platform | $12 AUD employee/month |

2. KeyPay | 4.35 | Local payroll for small and medium businesses | Advanced award engine and compliance automation | $4-6 AUD employee/month |

4.20 | Australian HR and payroll | Award interpretation and mobile HR tools | $19 AUD employee/month | |

4. ClockOn | 4.10 | Small businesses needing rostering and payroll | Time and attendance, with STP compliance | Free plan (12 months) |

5. Roubler | 4.05 | Shift-based businesses | Rostering, time and attendance, and payroll | Pricing on request |

6. Xero Payroll | 4.05 | Small businesses on Xero accounting | Native accounting integration | $35 AUD per month |

7. MYOB Payroll | 4.05 | MYOB users | Payroll tied to MYOB accounting | $9 AUD per month |

4.05 | QuickBooks users | STP-compliant payroll with QuickBooks Online | $6 AUD employee/month | |

9. Microkeeper | 3.85 | Small to mid-sized businesses | Low-cost payroll and biometric attendance | $2.25 AUD employee/month |

10. Humanforce | 3.85 | Mid-market and enterprise businesses | Workforce management and payroll for shift teams | Pricing on request |

11. ReadyTech | 3.85 | Complex organisations | HR and payroll tailored for AU compliance | Pricing on request |

12. ELMO | 3.75 | Australian and New Zealand mid-sized organisations | HR and payroll in one platform | $35+ AUD per month |

13. foundU | 3.70 | Small businesses | Award engine and mobile employee portal | $12-15 AUD employee/month (with minimum charge) |

14. Reckon | 3.65 | Micro-businesses | Budget-friendly Australian payroll option | $3.50 AUD per month |

3.65 | Large enterprises | Global ERP and payroll integration | $199 AUD employee/year | |

16. Oracle Cloud HCM | 3.55 | Enterprise payroll | Configurable global payroll and analytics | Pricing on request |

17. Dayforce | 3.55 | Enterprises with complex pay | Real-time payroll and analytics | $22-31 AUD employee/month |

18. Payroller | 3.55 | Micro-businesses | STP-compliant payroll with mobile app | $2.99 AUD employee/month |

19. CloudPayroll | 3.45 | Australian and New Zealand small to mid-sized firms | Specialist payroll provider with an Australian helpdesk | $9.95 AUD per pay run |

3.45 | Mid to large enterprises | Enterprise-grade HR and payroll | Pricing on request | |

3.45 | Mid to large enterprises | Configurable HRIS and payroll for compliance | Pricing on request | |

22. UKG Pro | 3.30 | Enterprise HR and payroll | HR, talent, and payroll with analytics | $21-29 AUD employee/month |

3.10 | Global enterprises | AI-driven payroll automation | $8 AUD employee/month | |

24. Ascender | 3.05 | Large Australian enterprises | Legacy Australian payroll with Dayforce integration | Pricing on request |

25. Deel | 2.85 | Distributed global teams | Global payroll and EOR in 100+ countries | $29 USD employee/month |

26. Papaya Global | 2.85 | Global enterprises | Payroll aggregation across 160 countries | $12 USD employee/month |

The 12 best payroll software options in Australia

Now that we’ve looked at all 26 options, it’s time to zoom in on the 12 payroll platforms worth your attention. In this deeper dive, we’ll outline what makes each one stand out, where they may fall short, and how to decide if they’re the right fit for your business.

Rippling

KeyPay

Employment Hero

ClockOn

Roubler

Xero Payroll

MYOB Payroll

QuickBooks Payroll

Microkeeper

Humanforce

ReadyTech

ELMO

1. Rippling

Rippling combines HR, IT, compliance, and global payroll in one platform, making it one of the most versatile options on the market.

What puts Rippling at the top of this list is its ability to replace multiple systems without adding complexity. Unlike many competitors, it balances strong Australian compliance with global scalability, making it a genuine all-in-one solution for both local and growing businesses.

Starting price: $12 AUD per employee, per month.

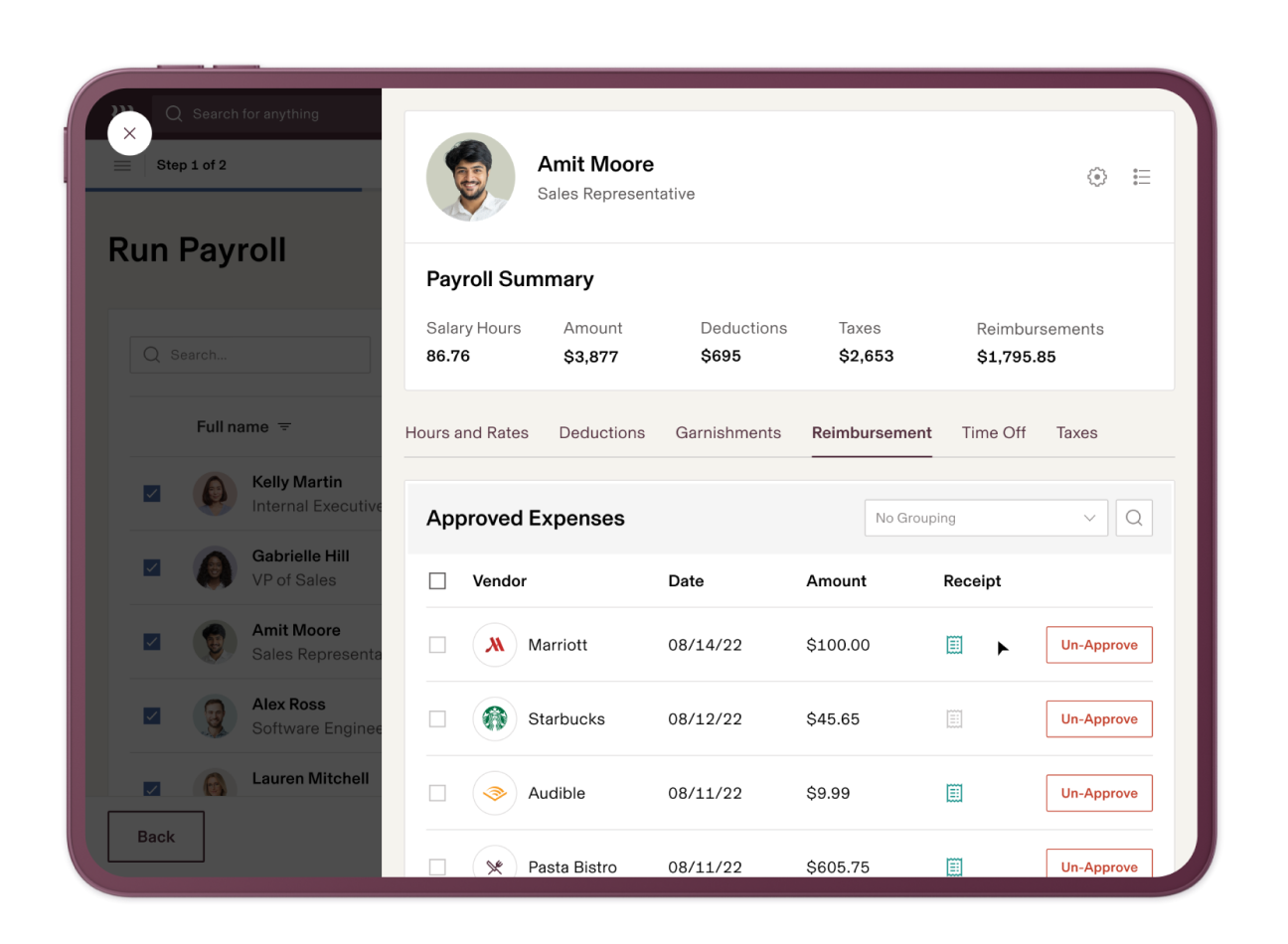

Source: Rippling

Why do companies choose Rippling?

- Combines payroll, HR, and IT in one system with more than 600 integrations

- Global payroll capabilities with local Australian compliance built in

- Automated compliance reduces the risk of costly errors

- Helpful support with fast online response times

"Rippling makes it simple to manage everything HR and payroll-related in one place. The platform is very intuitive, onboarding is smooth, and the automation saves a lot of time compared to handling tasks manually.” - Rippling Capterra review.

User-flagged challenges

Award interpretation requires a paid add-on.

No live phone support during Australian business hours.

The learning curve can be steep for teams migrating from simpler systems.

Is Rippling right for your business?

Rippling is a great option if you want an easy-to-navigate, modern platform that handles both Australian compliance and global payroll. It’s best for businesses that are growing fast and want one system to manage all their payroll, HR, and IT functions without needing multiple tools.

2. KeyPay

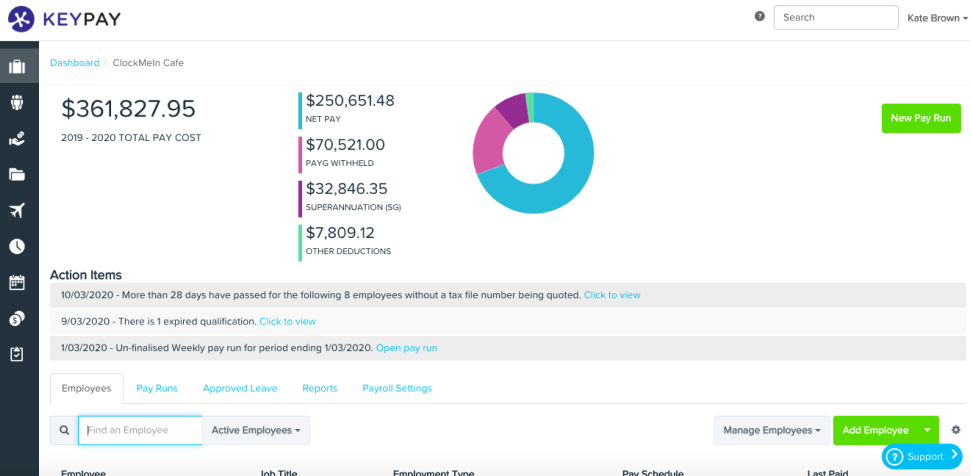

KeyPay is a cloud-based payroll platform built for Australian businesses, with a strong focus on compliance.

Its standout feature is their Pay Conditions, which automates modern award interpretation and payroll calculations. This feature can be a major time saver for SMBs managing award-covered staff. Employees can also access their own data through their mobile app, and the platform integrates directly with Xero, MYOB, QuickBooks, and NetSuite.

Starting price: $4-6 AUD per employee, per month.

Source: Keypay

Why do companies choose KeyPay?

- Automates award interpretation to simplify compliance

- Integrates with Xero, MYOB, QuickBooks, and NetSuite

- Includes a mobile app for employee self-service

“KeyPay honestly makes processing payroll a breeze. It's the most easy to use, streamlined system I've had the pleasure of using. The built in award interpreter is fantastic!” - KeyPay Capterra review.

User-flagged challenges

Pricing is on request and can be costly for larger teams.

Support hours aren’t clearly listed, with most help routed through the Help Centre.

Advanced features, such as the Pay Conditions, are only available on higher-tier plans.

Is KeyPay right for your business?

KeyPay is a great choice if you run an SMB in Australia that needs automated award compliance and accounting integrations. It’s especially useful in industries where award interpretation is complex. However, you might want to avoid KeyPay if you want clear pricing upfront or need fast phone-based support.

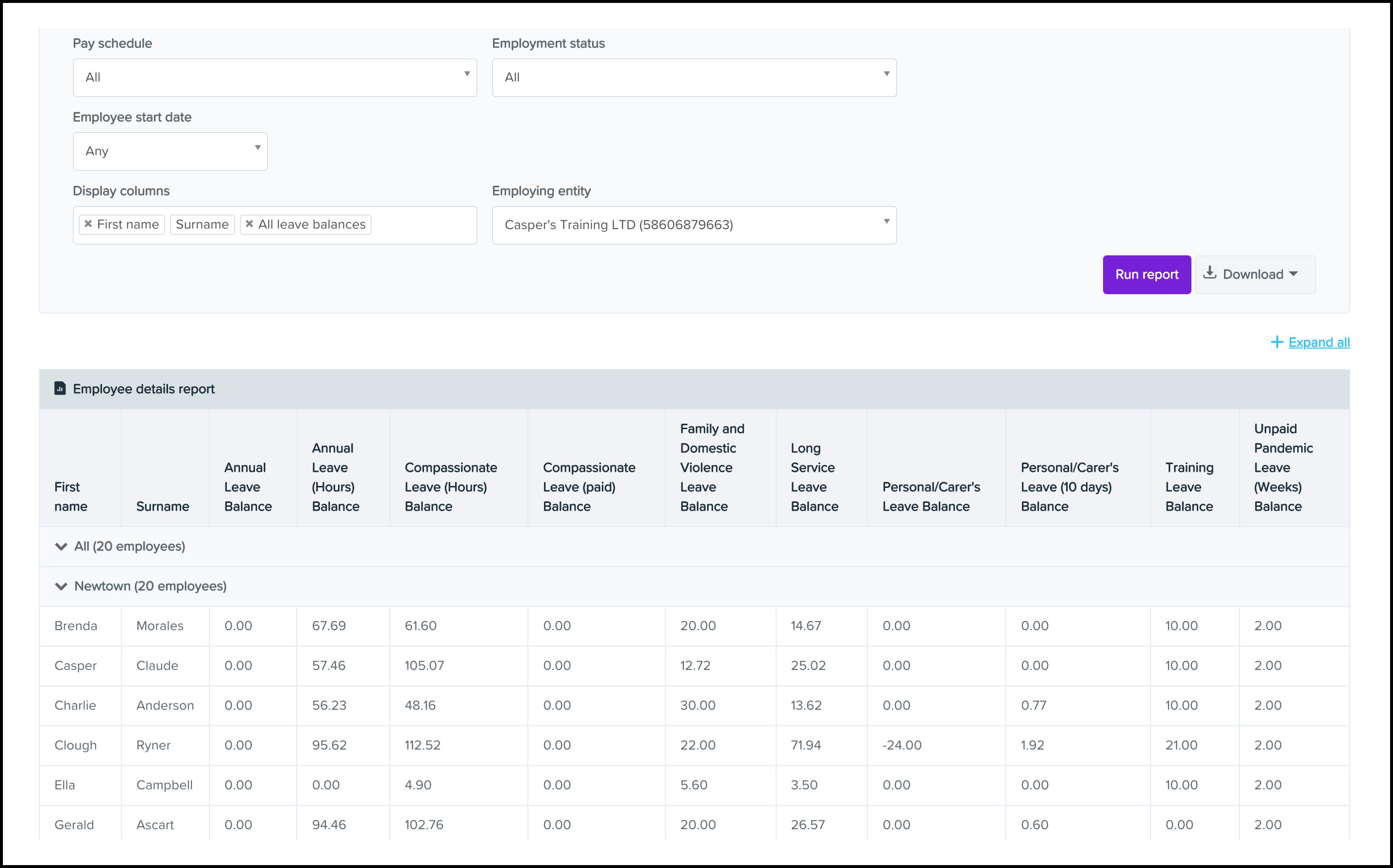

3. Employment Hero

Employment Hero is a locally built HR and payroll platform designed specifically for Australian businesses. It’s part of their broader HR suite, which also covers onboarding, engagement, and benefits, making it more than just payroll software.

What puts Employment Hero near the top of this list is its balance of compliance and usability. Through automating award interpretation and integrating directly with Xero and QuickBooks, it can help businesses stay compliant while simplifying day-to-day HR tasks.

Starting price: $19 AUD per employee, per month.

Source: Employment Hero

Why do companies choose Employment Hero?

- Built-in awards save time on compliance

- Integrates with Xero and QuickBooks for smoother payroll runs

- Offers employee self-service through both web and mobile apps

“The platform is user-friendly and makes managing HR tasks much more efficient, from payroll to employee management. I especially appreciate the self-service features, which empower employees to manage their own information and requests.” - Employment Hero Capterra review.

User-flagged challenges

Initial setup can be time-consuming, especially when migrating from multiple systems

Some features are less intuitive to navigate

Customer support response times can be slow during busy periods

Is Employment Hero right for your business?

Employment Hero is a good fit if you want an all-in-one HR and payroll system that simplifies everyday admin and gives employees more control through self-service tools. However, if you need fast, hands-on support or you’re migrating from multiple older systems, be prepared for setup to take longer.

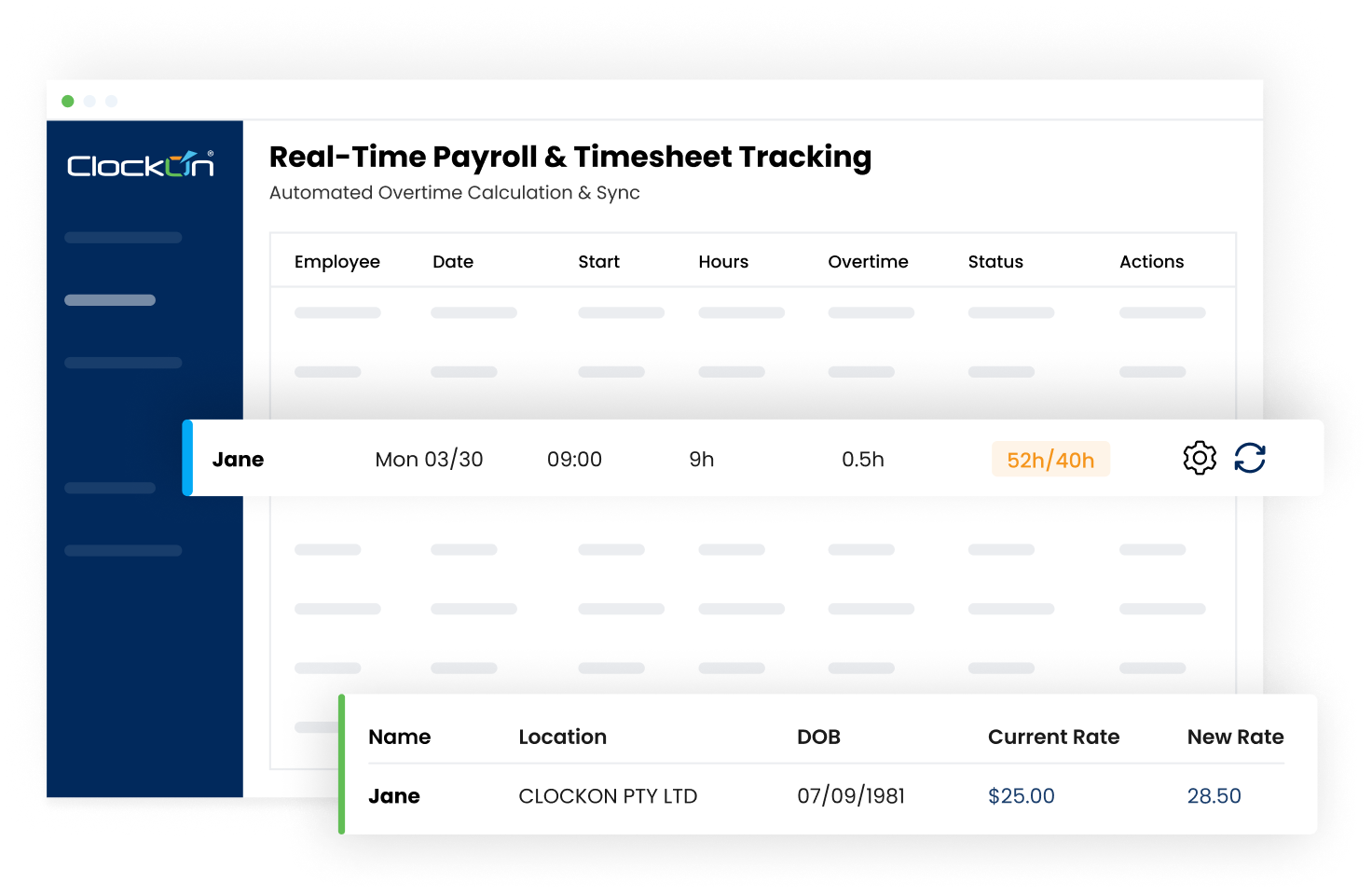

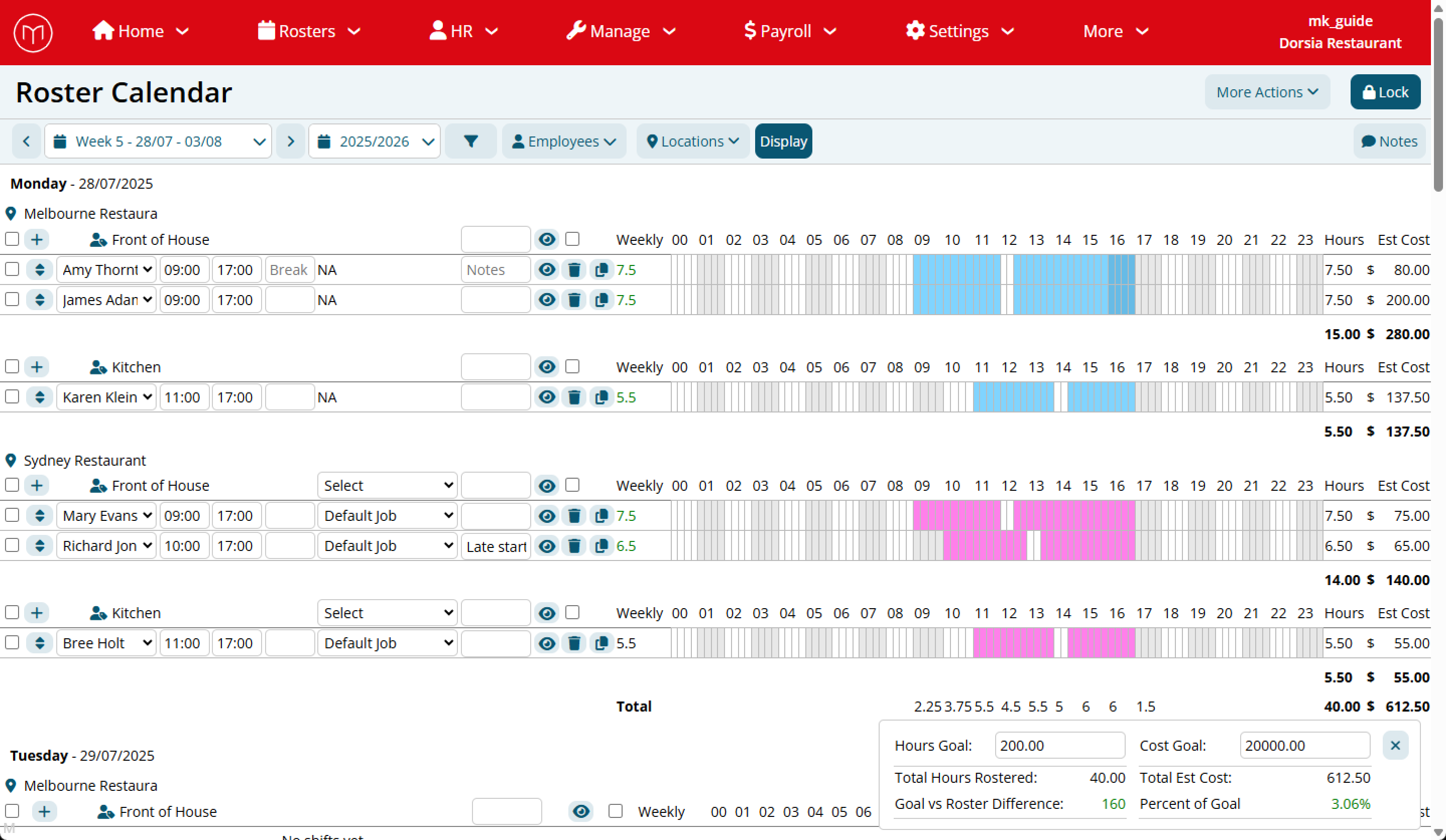

4. ClockOn

ClockOn is an Australian payroll system that brings rostering, time and attendance, and payroll together in one platform. It includes built-in award interpretation and STP Phase 2 compliance, and gives staff access via a mobile app. Businesses can also choose between cloud and on-premise deployment.

What makes ClockOn stand out is its workforce management focus. Features like shift costing and rostering visibility make it particularly valuable for industries such as hospitality, healthcare, and retail.

Starting price: Free for the first 12 months, then paid plans apply.

Source: ClockOn

Why do companies choose ClockOn?

- All-in-one payroll, rostering, and time tracking in a single system

- Award interpretation and STP Phase 2 reporting built in

- Support is often described as personal and responsive, with real people answering queries

“The initial set up and follow up was very good and I can not give the staff concerned enough praise. I like the ease of reporting wage information to the Government.” - ClockOn Capterra review.

User-flagged challenges

Some users report slow loading times and issues with the mobile app

Limited reporting options, especially for verifying STP submissions with the ATO

The interface can feel dated, and customisation options are limited

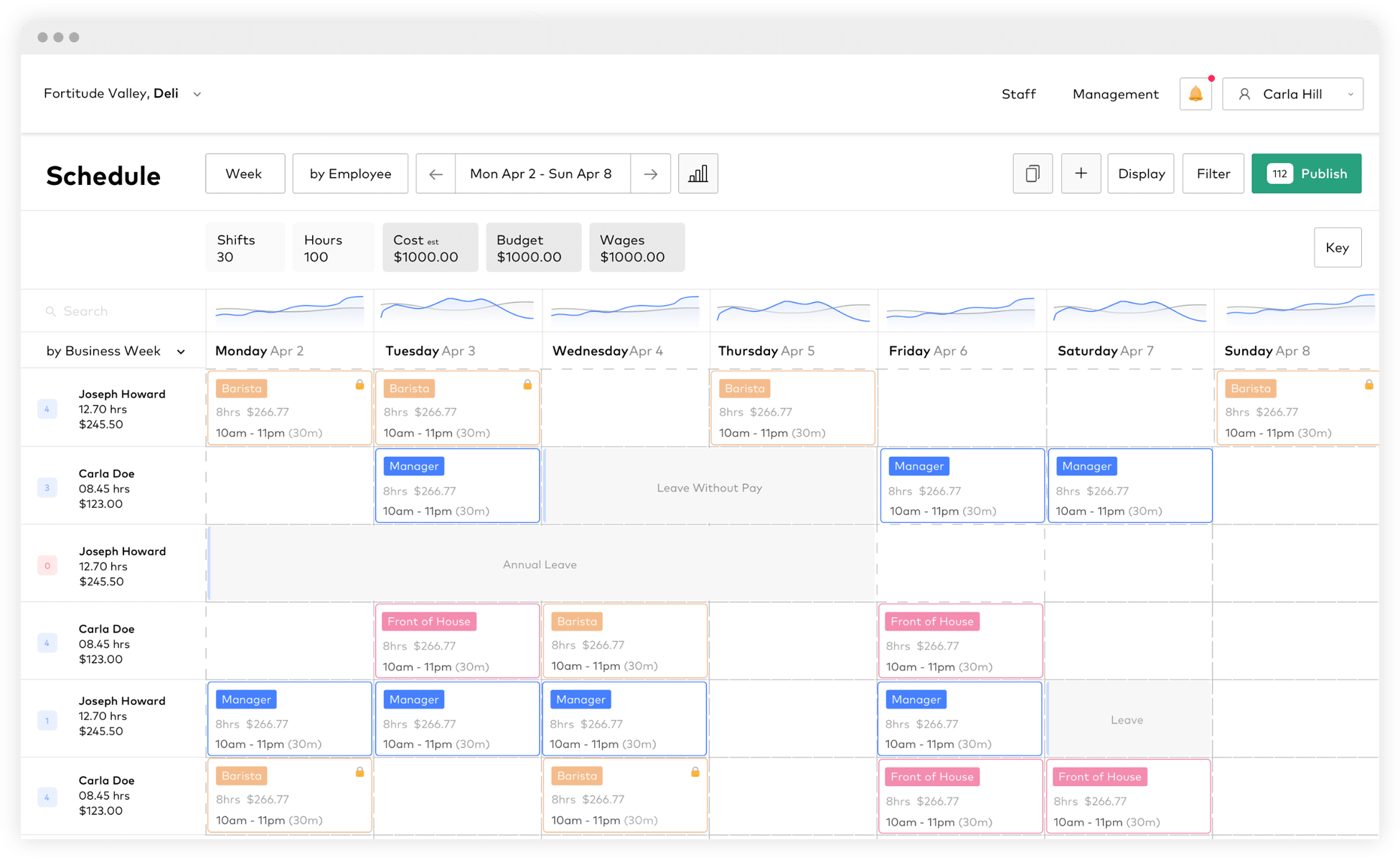

5. Roubler

Like ClockOn, Roubler is an Australian workforce management platform built for shift-based industries like retail, hospitality, and healthcare.

It combines onboarding, rostering, time and attendance, and payroll in one platform, with built-in STP Phase 2 compliance and award interpretation. Employees can also clock in, view rosters, and access payslips through a mobile app.

Starting price: $35 AUD per month (starter plan).

Source: Roubler

Why do companies choose Roubler?

- Streamlines rostering, time tracking, and payroll in one system

- End-to-end design means fewer separate tools to manage

- Mobile app makes it simple for staff to access shifts and payslips

“Overall really good, saved heaps of money by replacing a few different systems to using just one. I no longer need to do payroll as they manage that all for me.” - Roubler Capterra review.

User-flagged challenges

Some users find the employee app buggy or laggy at times

Holiday management features cause issues for some teams

Support responses can be inconsistent depending on the problem

6. Xero

Xero is one of Australia’s most popular accounting platforms, and its payroll add-on makes it especially appealing for small businesses that want everything in one place.

What makes Xero stand out is its simplicity and accessibility. Business owners, bookkeepers, and accountants can all collaborate in real time, with payroll data flowing seamlessly into financial reports. For sole traders, micro-businesses, and growing SMBs, it’s a good way to manage simple payroll.

Starting price: AUD $35 per month.

Source: Xero Payroll

Why do companies choose Xero?

- Fully integrated with Xero accounting for seamless reporting

- STP Phase 2 compliant with automated superannuation

- Simple to use, cloud-based platform with mobile access

“We are very happy with Xero, it offers us everything that we need for a small business. It is very visual and intuitive and constantly being updated with new and better features.” - Xero Capterra review.

User-flagged challenges

Pricing increases make it less competitive for payroll alone

Payroll setup can be tricky, particularly for AU and NZ compliance

Limited reporting depth compared to specialist payroll tools

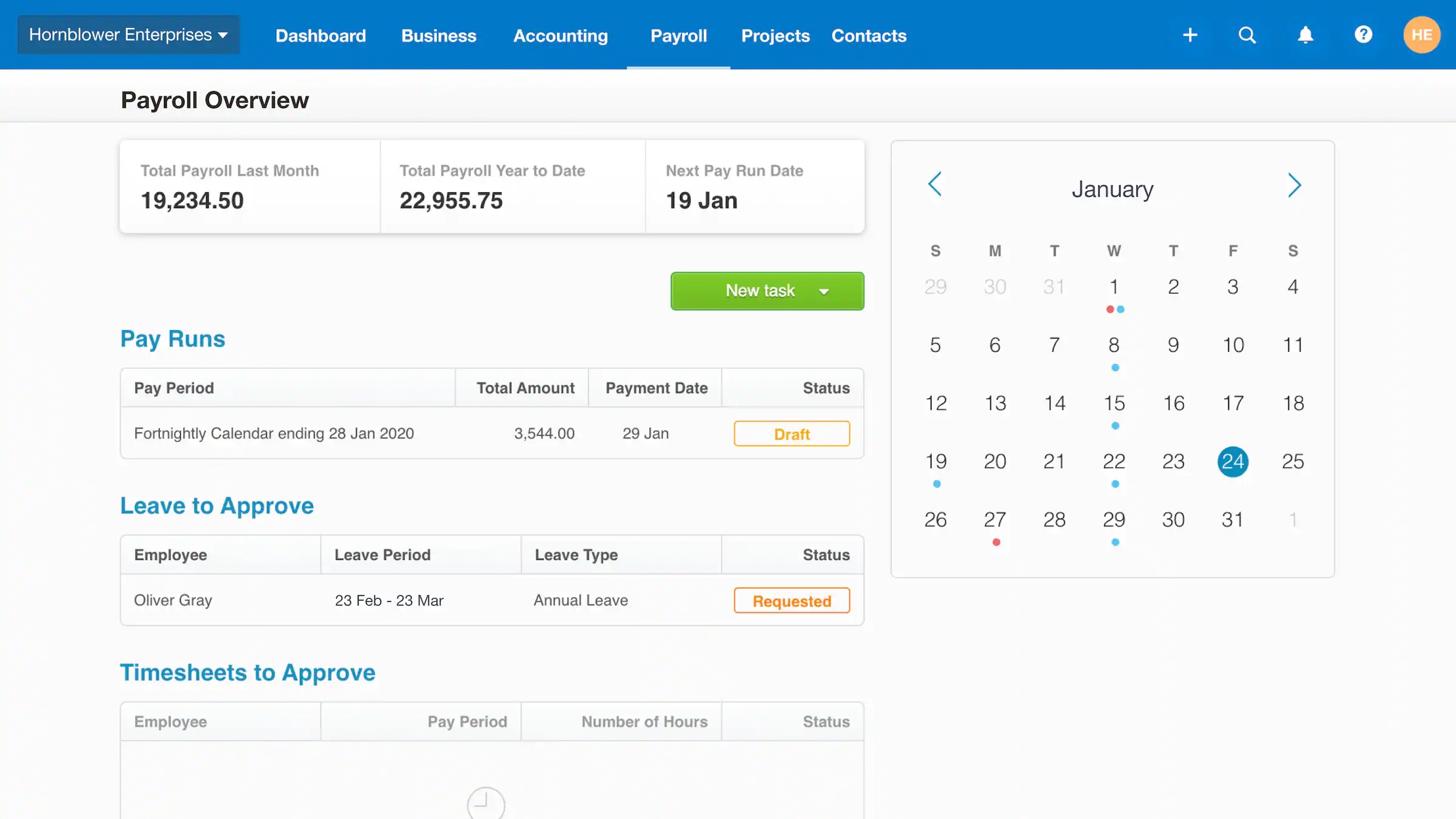

7. MYOB Payroll

MYOB is a long-standing name in Australian accounting, and its payroll solution is built directly into the same platform. For small businesses already using MYOB for bookkeeping, the integration makes it simple to run payroll, stay compliant, and manage employee records in one place.

Starting price: $9 AUD per month (up to four employees).

Source: MYOB

Why do companies choose MYOB?

- Native payroll integrated with MYOB accounting

- STP Phase 2 compliant with automatic super guarantee updates

- Employee self-service app for timesheets, rostering, and payslips

“The financial reporting abilities of MYOB Business are very good and very well developed. They present accurate and real time reports that allow for a large volume of information to be automatically reported from a business management point of view.” - MYOB Capterra review.

User-flagged challenges

The interface can feel dated compared to newer cloud-native tools

Customer support can involve long wait times during busy periods

Advanced features may require additional setup or paid upgrades

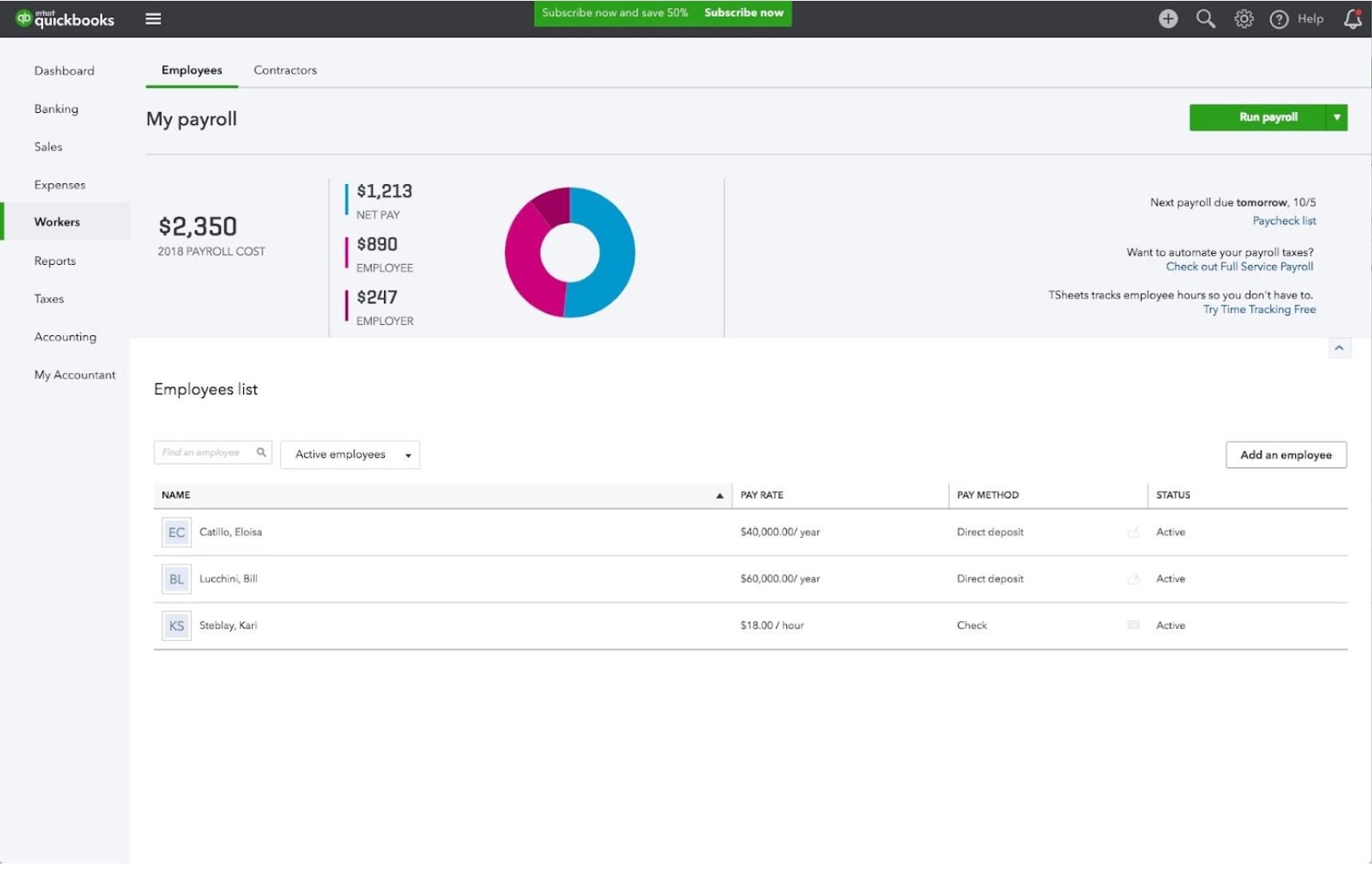

8. QuickBooks Payroll

QuickBooks Payroll is part of their broader accounting platform, designed to give small businesses an easy way to run payroll alongside their bookkeeping.

The main appeal of QuickBooks Payroll is its simplicity and tight integration with QuickBooks Online, making it a natural choice for businesses already on that system. It also offers flexible plans for small to mid-sized teams.

Starting price: $6 AUD per employee, per month.

Source: QuickBooks

Why do companies choose QuickBooks Payroll?

- Built directly into QuickBooks Online for a seamless experience

- STP Phase 2 compliant with automatic super updates

- Simple interface designed for small business owners and accountants

“Easy to use after initial setup with good customer support available by phone. Initial free 1 hour training sessions provided when signing up. More affordable than other accounting software programs.” - QuickBooks Capterra review.

User-flagged challenges

Limited award interpretation compared to specialist payroll providers

Customer support can be inconsistent, especially during peak times

Pricing can get expensive as team sizes increase

9. Microkeeper

Microkeeper is an Australian payroll and workforce platform that integrates rostering, time and attendance, and payroll into one system. It’s designed to simplify award compliance and provide accurate attendance tracking through biometrics.

Starting price: $2.25 AUD per user, per month.

Source: Microkeeper

Why do companies choose Microkeeper?

- Combines payroll, rostering, and attendance in one system

- Biometric clocking helps reduce time fraud and errors

- Affordable pricing makes it attractive for smaller businesses

“I've been using Microkeeper for my growing not-for-profit, with numerous departments, and rather quirky pay rate rules, etc. And Microkeeper has been such a time saver. What used to take me up to an hour with 8 employees now takes me less than 20 minutes.” - Microkeeper Capterra review.

User-flagged challenges

Biometric time tracking can feel intrusive for some employees

Its tracking raises privacy concerns for employees

Interface feels less modern compared to newer competitors

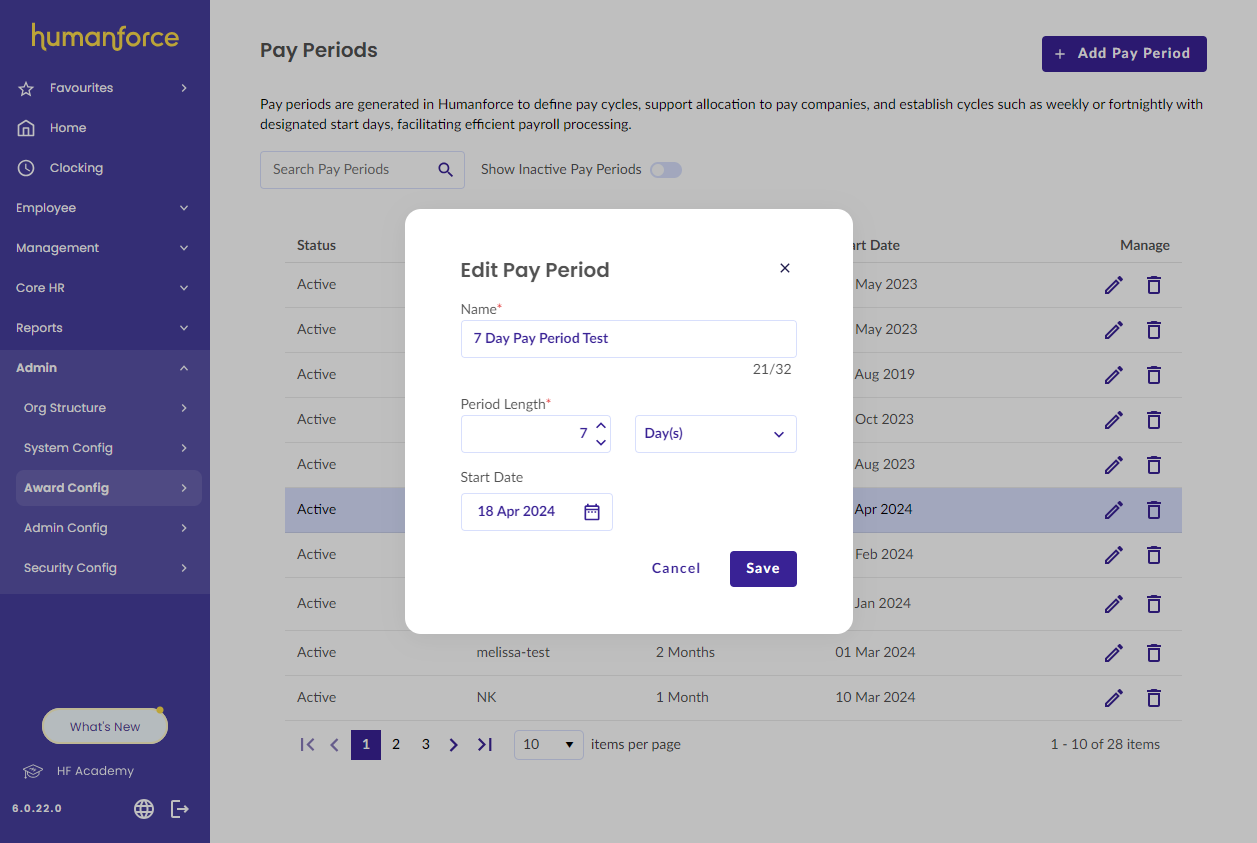

10. Humanforce

Humanforce is built for mid-sized and enterprise organisations with large, shift-based workforces. Its strengths are in industries like hospitality, retail, and healthcare, where managing rosters, time and attendance, and payroll in one system saves admin time.

Starting price: Pricing upon request.

Source: Humanforce

Why do companies choose Humanforce?

- Strong rostering and time and attendance features

- Mobile self-service app for staff to view shifts and payslips

- Engagement tools designed for frontline workers

“Rostering staff looked aesthetically good and easy to follow. Building rosters was quite simple.” - Humanforce Capterra review.

User-flagged challenges

Support can be inconsistent, with tickets left unresolved for long periods

Platform performance can lag or crash when handling larger data loads

The interface feels outdated compared to newer competitors

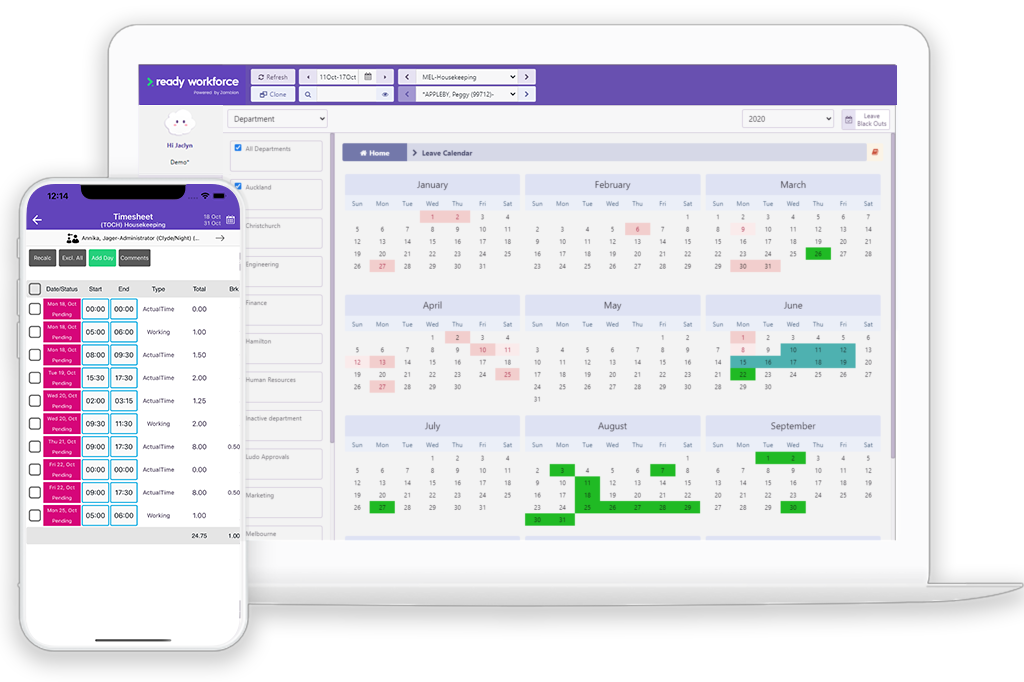

11. ReadyTech (Ready Workforce)

ReadyTech is a payroll and workforce management platform designed for mid-to-large organisations across sectors like government, education, and corporate. It combines payroll, HR, and rostering with Australian compliance built in, making it suitable for complex workforce structures.

Starting price: Pricing upon request.

Source: ReadyTech

Why do companies choose ReadyTech?

- End-to-end payroll, HR, and workforce management in one system

- Cloud-based platform with AU-based support teams

- Employee self-service for pay, leave, and onboarding

“I have to say the best thing about RT is their approach to Customer Success. They go out of their way to help, offer solutions and ensure you have what you need.” - ReadyTech G2 review.

User-flagged challenges

Set up and award interpretation may take time and training

Limited to AU/NZ compliance with no global payroll features

Real-time monitoring tools (like geo-tracking and detailed attendance logs) can feel intrusive for staff

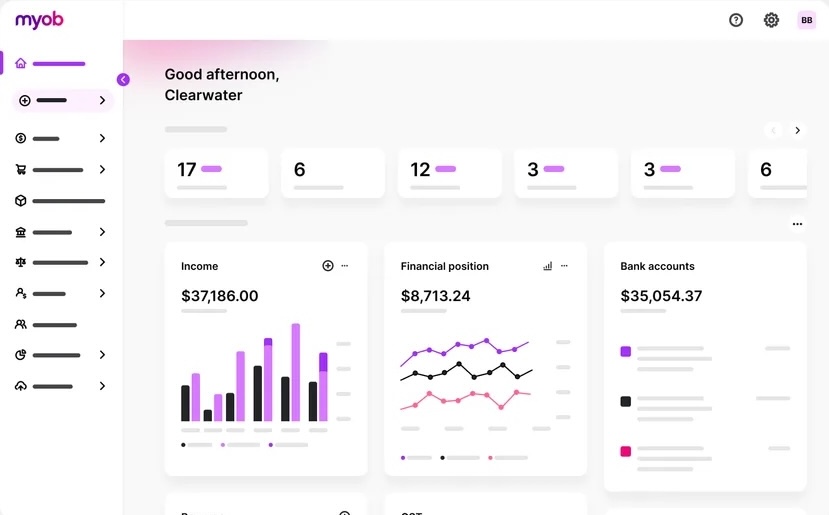

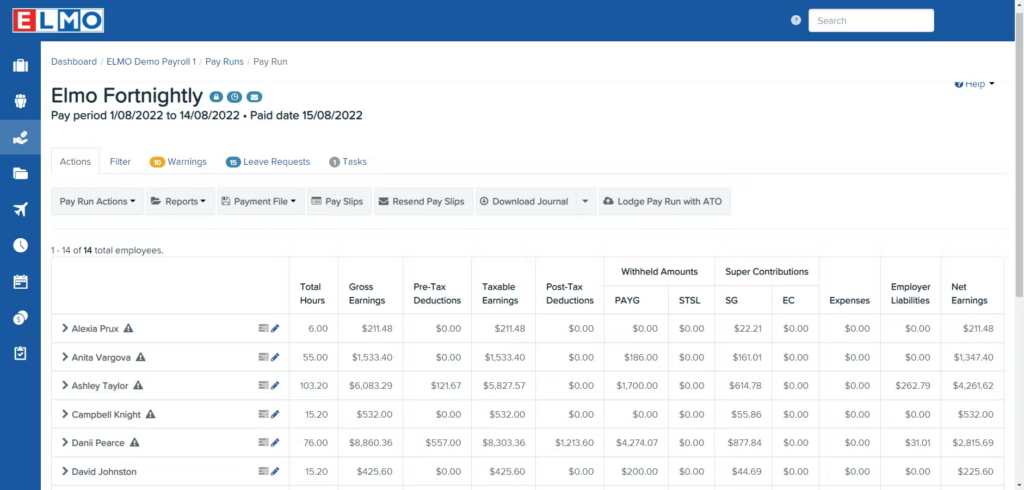

12. ELMO Payroll

ELMO is an Australian-owned HR and payroll platform that combines payroll, recruitment, onboarding, and performance management in one system.

It’s designed for mid-sized businesses that want an all-in-one HR platform with strong compliance for Australia and New Zealand.

Starting price: $35 AUD per month.

Source: ELMO

Why do companies choose ELMO?

- Designed specifically for AU and NZ compliance needs

- Allows businesses to start with payroll and add HR functions later

- Cloud-based with integrations into Microsoft and Okta

“Overall I have enjoyed using Elmo, there seems to be a big shift towards user engagement which has been very positive and they are open to feedback.” - ELMO Capterra review.

User-flagged challenges

Some features are outdated or buggy, with parts relying on legacy frameworks

Customer support and implementation can be slow or frustrating

Limited transparency around pricing before signing contracts

What should I consider when choosing payroll software?

If you’ve read through all the functions and features, but are still feeling unsure about what your business actually needs, consider how the platform would support your wider business goals. Here are seven key factors to help you decide.

1. Compliance and STP accuracy

For many Australian businesses, software with built-in ATO compliance is non-negotiable. For this, you’ll want STP Phase 2 reporting, automatic superannuation updates, and award interpretation.

Even small mistakes can lead to big fines, so compliance should be a top priority when making your choice.

2. Pricing transparency

Payroll costs can add up. Make sure to compare per-employee pricing with flat monthly fees, and check what’s included in each tier.

Many providers hide advanced features like award interpretation or onboarding behind higher-tier plans. Make sure you know exactly what you’re paying for before signing up.

3. Ease of use for staff

Most employees would like to have direct access to their payroll, leave balances, and benefits. Look for platforms with self-service options that let staff check things without needing to reach out to HR or the finance team.

4. Support availability

If your payroll software has an issue, you’ll want to be able to get quick support. Check whether vendors offer local Australian support hours and live support, or ticket systems and chatbots. Delayed support can mean late pay runs, which negatively affect your staff.

5. Integration with existing tools

Make sure the system you choose integrates with your accounting software (Xero, MYOB, QuickBooks). A simple integration prevents double data entry, saves your team time on admin work, and reduces reconciliation errors.

6. Scalability for growth

What works for a 10-person team may not suit 200 employees. Some platforms scale with multi-entity, global payroll, or advanced workforce management features, while others are designed purely for local SMBs. If you know you want to grow, choose a tool that you won’t need to replace in a couple of years.

7. Employee monitoring and privacy

Some platforms include time tracking, geolocation, or biometric logins. While these can reduce time fraud, they are intrusive and often negatively impact trust and autonomy with your employees. Decide early whether you want any level of monitoring in your system, and check how the software handles data privacy.

Key payroll compliance changes in 2025

A number of new rules have come into effect this year, changing what’s expected from payroll systems. Here are the recent compliance changes all Australian employers should be aware of.

The right to disconnect

The Right to Disconnect is a workplace law that gives employees the ability to ignore unreasonable work contact outside their normal hours. This can be calls, emails, or instant messages. It doesn’t ban all after-hours communication, but it does mean staff can say no if the request is unreasonable.

As of August 2025, the rule applies to all Australian businesses. For payroll and HR teams, it’s important to update rosters, on-call arrangements, and policies so staff know when they’re expected to respond and when they’re not.

Criminalisation of wage theft

Since 1 January 2025, deliberate wage theft has become a criminal offence under changes to the Fair Work Act. It was introduced after years of high-profile underpayment cases in industries like hospitality and retail, where staff were missing out on entitlements due to deliberate or repeated non-compliance.

For employers, this raises the stakes on payroll accuracy. Using software that applies the right award rates and entitlements helps reduce the risk of mistakes.

Superannuation guarantee increase

The Superannuation Guarantee rose to 11.5% on 1 July 2024 and then to 12% on 1 July 2025.

The 12% rate is in effect now and applies based on the payment date (not when the work was performed). Make sure your payroll is calculating 12% on ordinary time earnings, and that any templates or accrual rules were updated from 1 July 2025 to avoid underpayments and ATO penalties.

Payday super changes

Payday super is a new rule that will require employers to pay superannuation at the same time as wages, instead of quarterly. The rule takes effect from the 1st of July 2026 and is designed to help workers grow their savings faster.

For payroll teams, this means more frequent processing. Choosing software that’s already ‘payday super ready’ will make the transition much smoother.

Paid parental leave super contributions

From 1 July 2025, the government will begin paying 12% super on Commonwealth Paid Parental Leave Pay for children born or adopted on or after that date.

Contributions are made annually, after the financial year ends. Employers don’t need to process these contributions directly, but HR teams should update policies and communications so staff understand the change.

Payroll software that grows with your business

A great payroll system offers more than simply processing payslips on time. It can minimise compliance risks, saving hours of unnecessary admin, and build trust by always paying your employees the correct amount, on time. Once you have a good system in place, your finance team can spend more time on strategic growth rather than chasing errors.

As we’ve covered, there is a platform to suit every type of business, from simple tools for small teams to specialist software for award-heavy industries.

If you are still looking for one system that combines payroll, HR, IT, and compliance, and can also support you as you expand into new markets, Rippling is the platform that brings it all together.

If you’d like to watch the Rippling software in action, book your free demo today.

FAQs

What is payroll processing?

Payroll processing is the full workflow of how a business calculates pay, applies tax and super, and records the payments for employees and contractors. This can also include handling STP reporting to the Australian Taxation Office.

What should you look for in payroll software in Australia?

When choosing payroll software in Australia, look for features that reduce errors: automated payroll, STP-enabled software, and tools that handle payroll taxes, leave requests, and employee self-service.

How does Single Touch Payroll (STP) work?

Single Touch Payroll (STP) is the ATO system that reports wages, tax and super every pay run. To stay compliant, it’s helpful to have STP-compliant software that handles STP Phase 2 and keeps an accurate audit trail. You can learn more about STP on the ATO's website.

Can payroll software also manage employee benefits and leave?

Yes, most platforms also include employee benefits, leave management, and self-service portals where staff can submit leave requests or check their payslips. This frees up some time for HR and payroll managers.

What’s the difference between standalone payroll and accounting-integrated payroll?

Standalone payroll software focuses only on paying staff and meeting payroll and compliance rules. Accounting and payroll platforms integrate the business's wider finances with their payroll.

Disclaimer

Rippling and its affiliates do not provide tax, accounting, or legal advice. This material has been prepared for informational purposes only, and is not intended to provide or be relied on for tax, accounting, or legal advice. You should consult your own tax, accounting and legal advisers before engaging in any related activities or transactions.

Rippling editorial policy: Rippling puts our customers (and prospective customers!) first. The Rippling team is committed to providing information supported by product data, expert insights, and real customer feedback to inform all of our content. All of our content is reviewed by product experts for accuracy and freshness.

Hubs

Author

Maaike van Dijk

Manager, Solutions Consulting

Maaike van Dijk is the Manager of Solutions Consulting for APAC at Rippling. Based in Sydney, she leads the regional team and has extensive experience in HR technology across Australia, New Zealand, and internationally. She works with businesses to simplify and automate global hiring, onboarding, and compliance, helping them modernise their workforce systems. Prior to Rippling, Maaike held senior consulting roles at LiveHire.

See Rippling in action

Increase savings, automate busy work, and make better decisions by managing HR, IT and Finance in one place.