Q&A: What is PAYG withholding?

In this article

If you’re running a business in Australia, or thinking of doing so, you’ve probably wondered, ‘What is PAYG withholding?’ In short, it’s not something you can skip. It’s a core part of the Australian tax system. And every employer must get it right to stay compliant with the Australian Taxation Office (ATO).

In this simple guide, we define PAYG withholding, explain why it matters, and share what you need to know to comply.

What is PAYG withholding?

Pay As You Go (PAYG) withholding refers to the collection of income tax from your employees each time you pay them. You take out the right amount of tax from their wages or salary and send it to the ATO.

If you employ staff, you must do PAYG withholding. You normally don’t withhold from contractors, though, unless:

they don’t give you an Australian Business Number (ABN), or

you’ve both agreed to a voluntary withholding arrangement.

If you skip or mess up PAYG, you risk penalties from the ATO.

As an employer, PAYG withholding helps you meet your tax obligations. For employees (and some contractors), it takes care of their income tax as they earn, instead of hitting them with a big bill at the end of the year.

The system keeps tax simple, fair, and easy to manage for everyone.

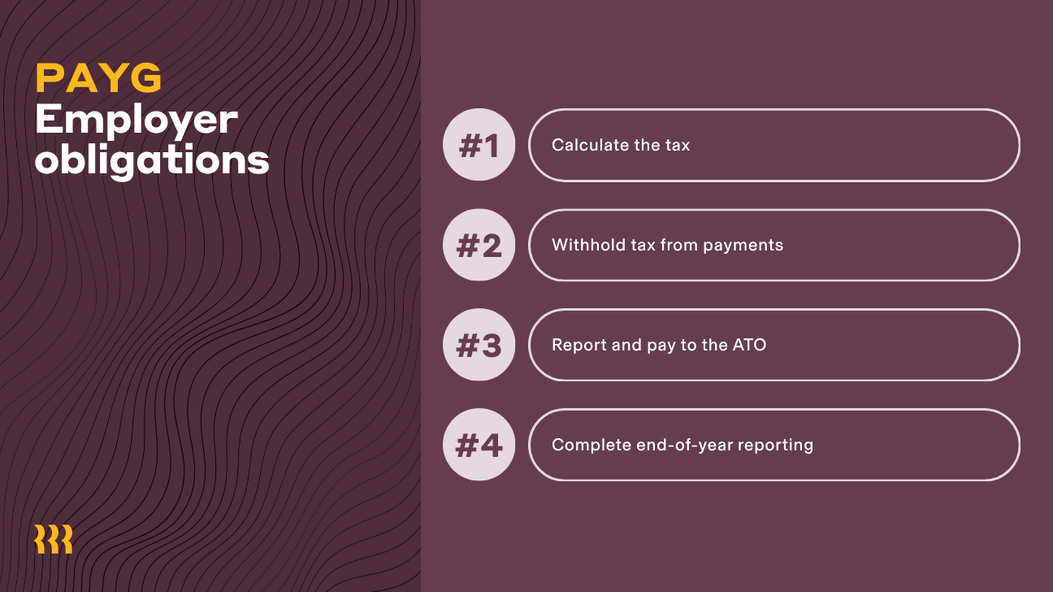

PAYG withholding obligations for employers

Here’s what you need to do to stay compliant:

1. Calculate the tax

Use the ATO’s current tax tables or compliant payroll software to calculate how much to withhold from each pay. These tools consider things like:

wages, salaries, bonuses, and allowances

whether the employee has claimed the tax-free threshold on their tax file number (TFN) declaration

any additional deductions or adjustments

There are specific ATO tax tables for cases like lump-sum payments or missing TFNs/ABNs.

2. Withhold tax from payments

After calculating the tax, deduct the correct amount from each payment to employees (and from certain contractors if they haven’t given an ABN or are under a voluntary agreement).

Put the withheld funds aside to remit to the ATO.

3. Report and pay to the ATO

You report your PAYG withholding through Single Touch Payroll (STP) each time you pay your employees. STP sends your pay and tax details directly to the ATO in real time. You pay the withheld amount to the ATO when you lodge your Business Activity Statement (BAS).

Payment frequency depends on your withholder status:

Small withholders (≤ $25,000 p.a.) pay quarterly.

Medium withholders ($25,001–$1M p.a.) pay monthly.

Large withholders (> $1M p.a.) pay within 6–8 days of each pay event.

As of July 2025, the ATO has been progressively shifting some employers to shorter payment cycles as part of its annual review.

4. Complete end-of-year reporting

STP sends pay and tax details to the ATO every time you run payroll. So, thankfully, there’s no need to do it again at tax time. All you need to do when the financial year ends is finalise your STP records to confirm everything’s correct.

Once you do that, employees can view their Income Statement in myGov.

If you pay contractors under voluntary agreements, you can choose whether to include them in STP. If you do, you don’t need to issue a separate payment summary. If you don’t, you must still give them a PAYG payment summary and include it in your annual report to the ATO.

This final step wraps up your PAYG reporting for the year and keeps both you and your staff compliant.

How to register for PAYG withholding

Hiring employees for the first time or starting a new business? Then, you need to register for PAYG withholding before you make your first payment that requires withholding.

You can register by:

logging into ATO Online services for business (or asking your tax/BAS agent to do it)

calling the ATO directly, or

if you don’t have an ABN but still need to withhold, completing form NAT 3377 to open a PAYG withholding account

If you’re applying for a new ABN, you can select PAYG withholding at the same time through the Australian Business Register (ABR).

Take the stress out of PAYG withholding with Rippling

PAYG withholding can be tricky to manage, but Rippling keeps it simple. It’s an all-in-one workforce management platform that brings HR, Payroll, and IT together in one place, so all your employee data stays connected.

Rippling calculates the correct tax to withhold, sends STP data to the ATO in real time, and keeps employee and contractor details up to date automatically. With everything in one system, it’s easier to stay accurate, compliant, and on top of payroll. Gone are the days of wasting hours of your precious time on admin!

PAYG withholding FAQs

What is the PAYG withholding rate in Australia?

If an employee doesn’t provide a TFN: Withhold at 47% (for Australian residents) or 45% (for foreign residents).

If a supplier doesn’t quote an ABN: Withhold 47% from payments over $75 ex GST and report it in your no-ABN annual report.

Do I need to make PAYG instalments for my business?

Possibly. If your business earns income from trading or investments, the ATO may require PAYG instalments. These act as regular pre-payments of income tax to tend to your tax liability throughout the year.

Is PAYG withholding compulsory?

Yes. Every Australian business that employs staff must withhold PAYG tax and send it to the ATO. Failing to do so can lead to financial penalties and director-level liability.

Disclaimer

Rippling and its affiliates do not provide tax, accounting, or legal advice. This material has been prepared for informational purposes only, and is not intended to provide or be relied on for tax, accounting, or legal advice. You should consult your own tax, accounting and legal advisers before engaging in any related activities or transactions.

Author

The Rippling Team

Global HR, IT, and Finance know-how directly from the Rippling team.

Explore more

See Rippling in action

Increase savings, automate busy work, and make better decisions by managing HR, IT and Finance in one place.