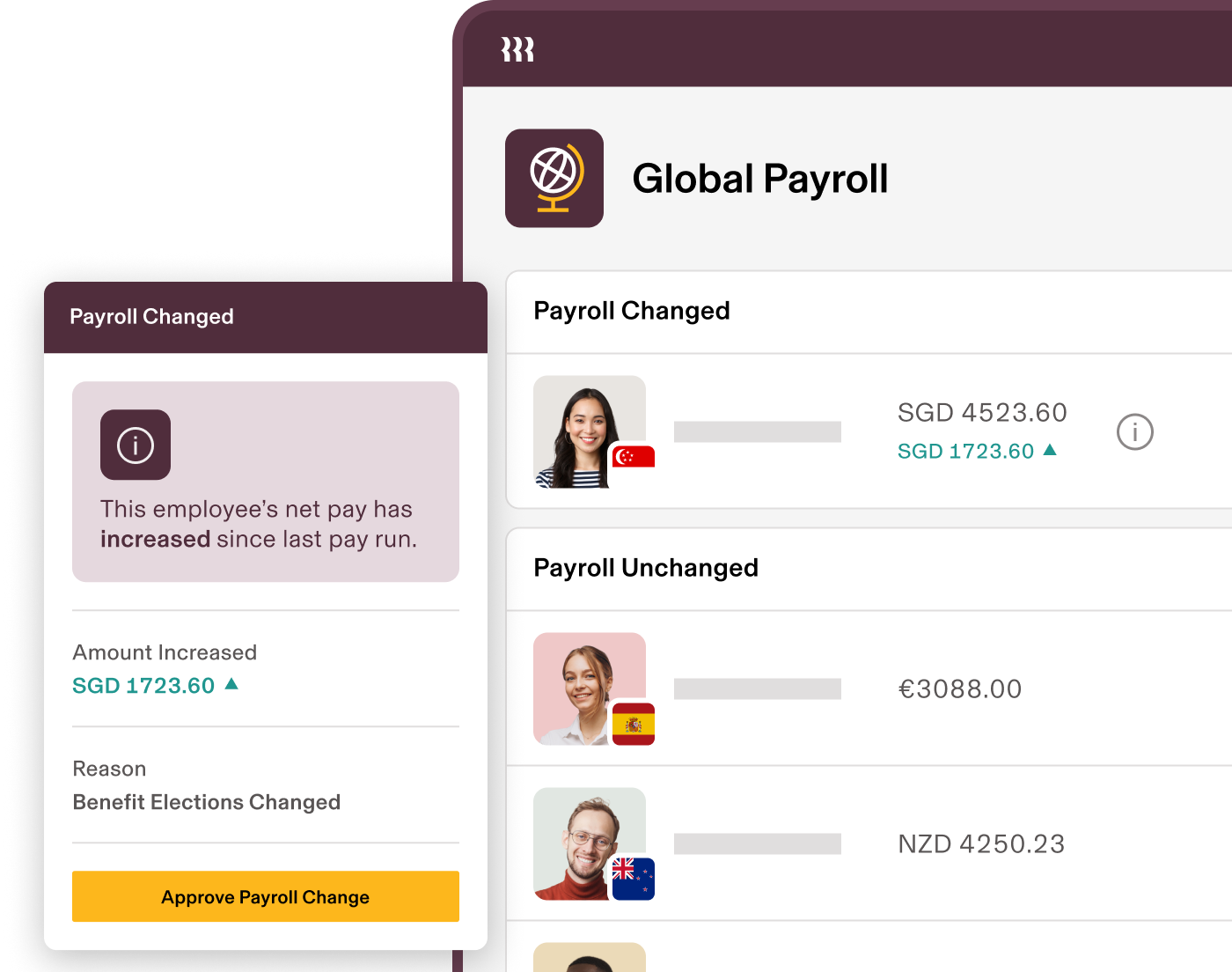

A simple way to compliantly pay

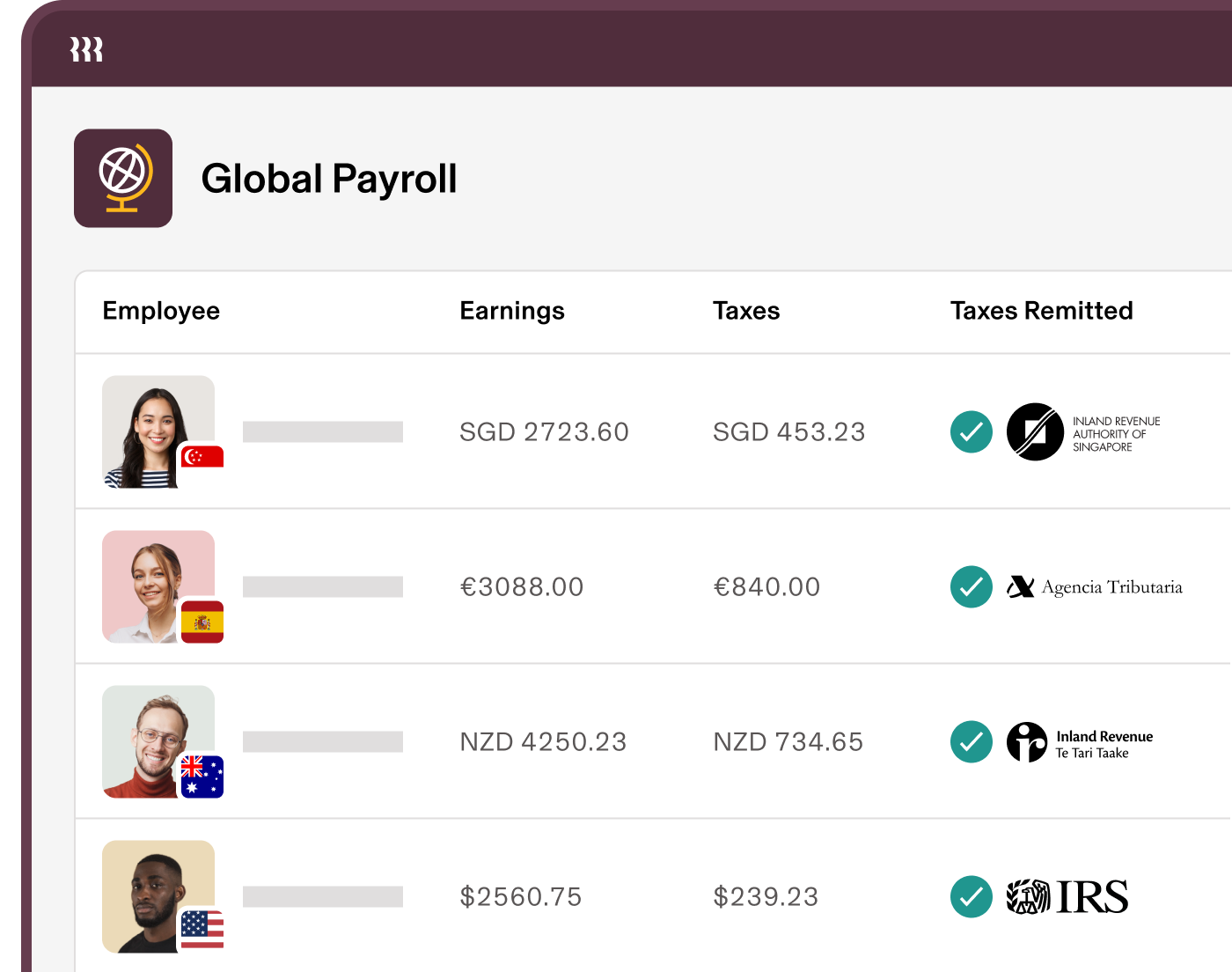

Manage compliance with local payroll and overtime requirements. We'll calculate pay amounts for you and remit payments on your behalf.

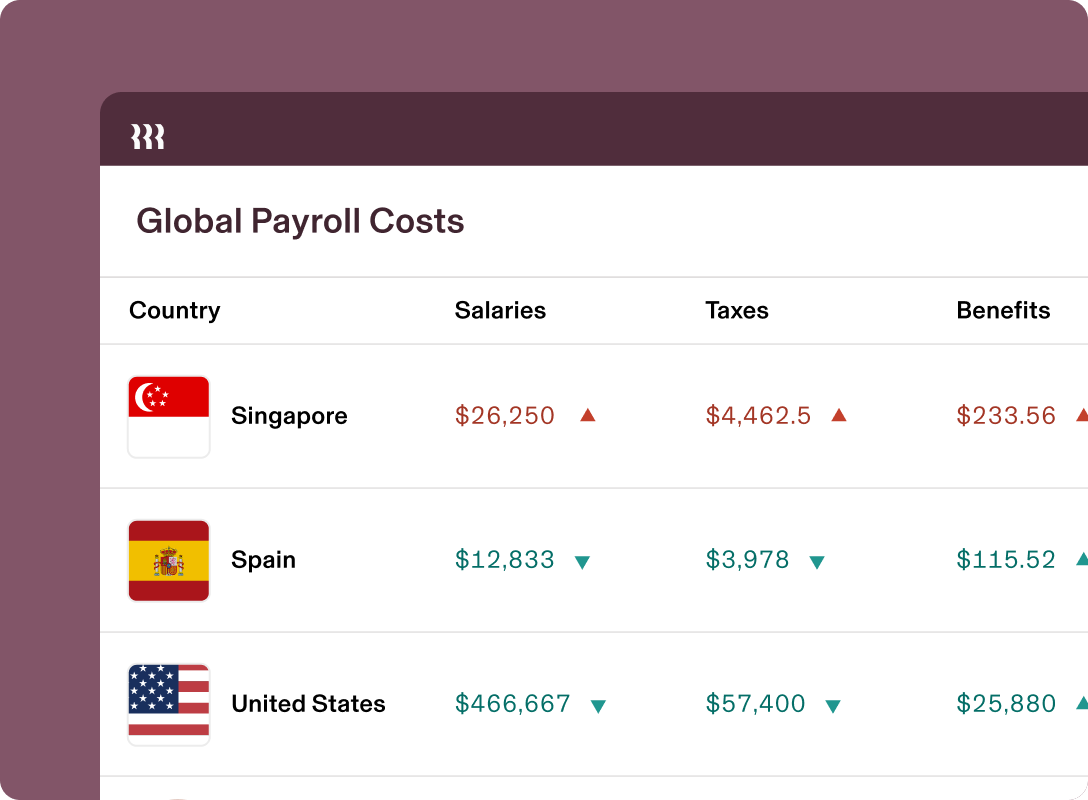

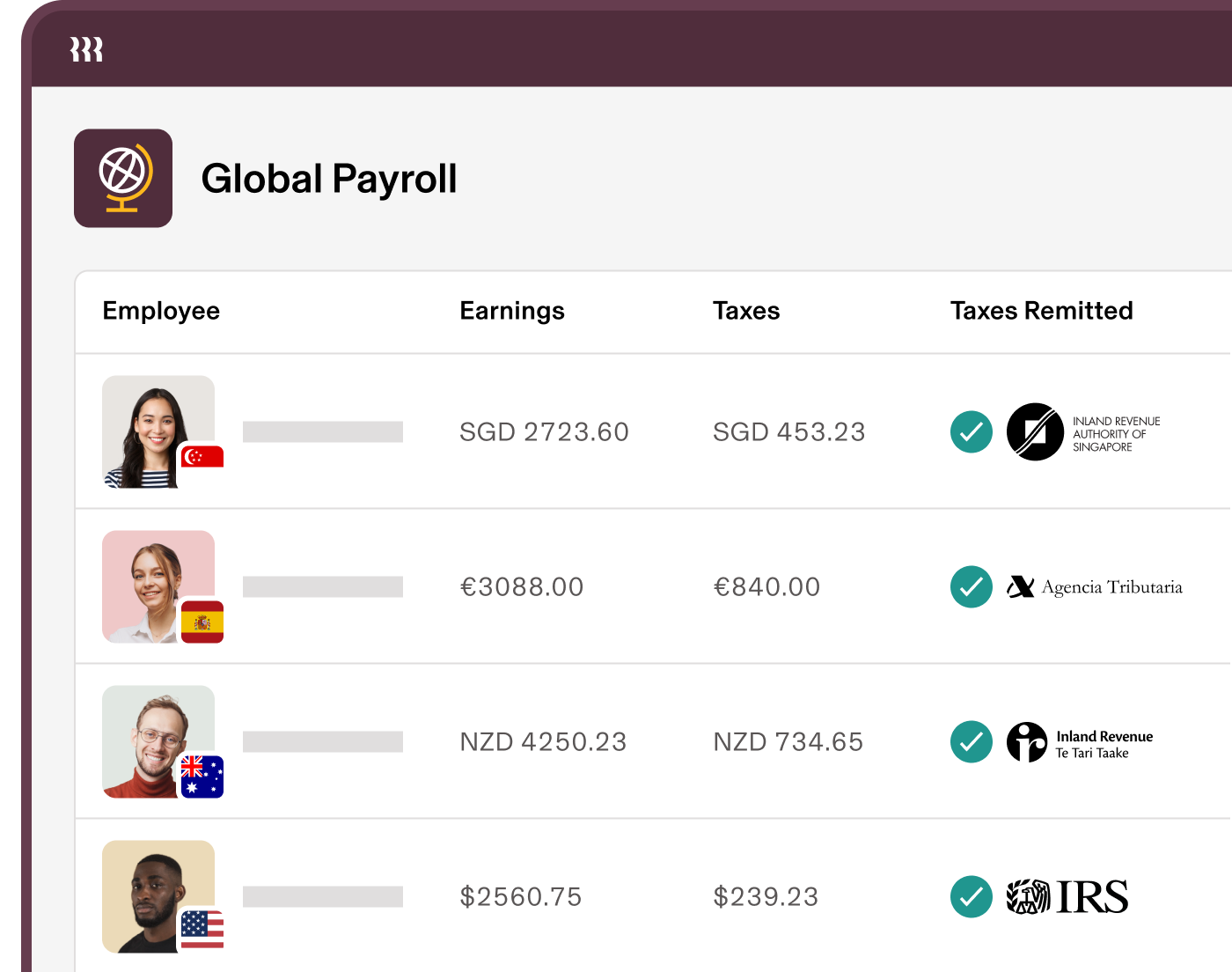

We'll handle the calculations

Rippling calculates and transmits payroll taxes and mandatory benefits, tailored to local national, local, and industry-specific requirements.

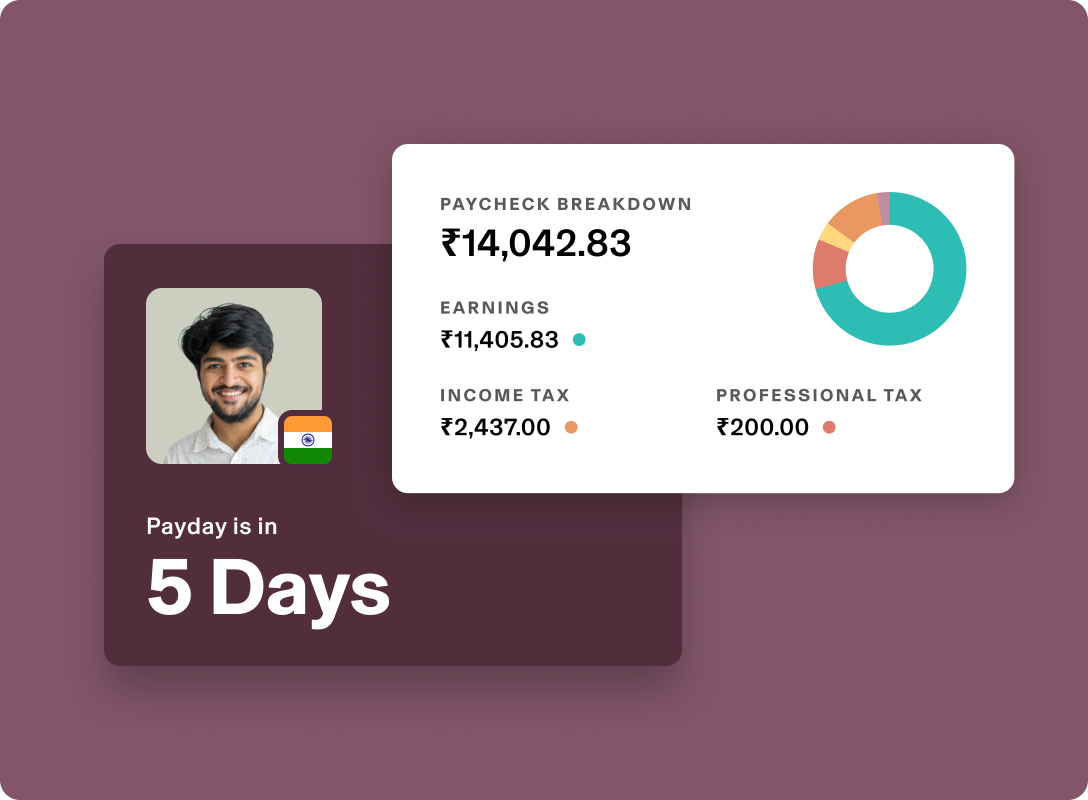

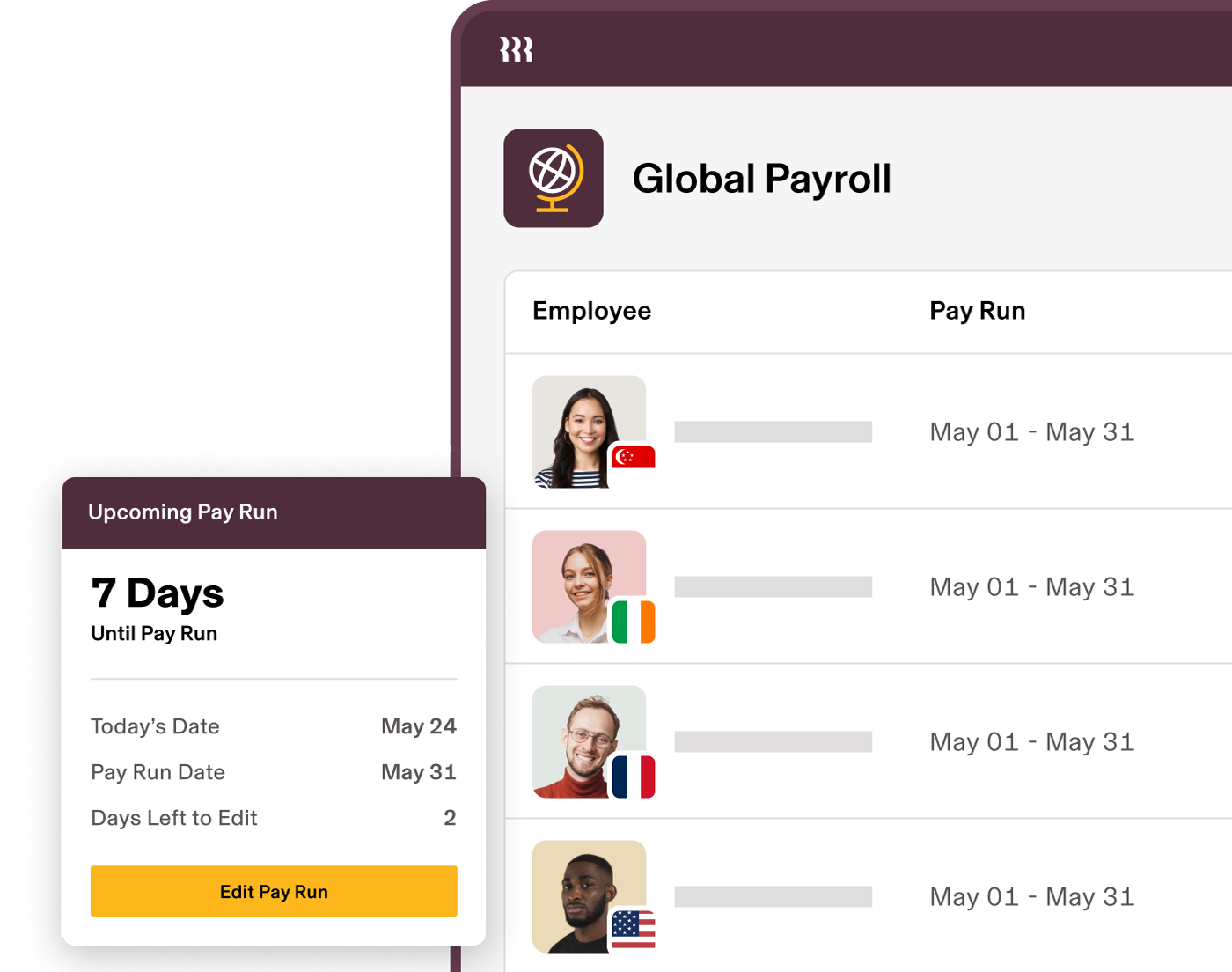

Get built-in freedom

Have the flexibility to adjust or approve pay runs until just days before pay day. Need even more flexibility? Off-cycle pay runs are free.

Run payroll with confidence

A simple, intuitive flow, paired with time-saving automation and integrations, makes global pay runs on Rippling faster and reduce errors.