Must-have payroll software RFP template for midsize businesses in 2025

![[Blog - Hero Image] Payroll money](http://images.ctfassets.net/k0itp0ir7ty4/70b0IaqkwPFMXVEzVq8SOF/2526e71eef2555079e1df04c371c6267/Header_Payroll_01__2_.png)

In this article

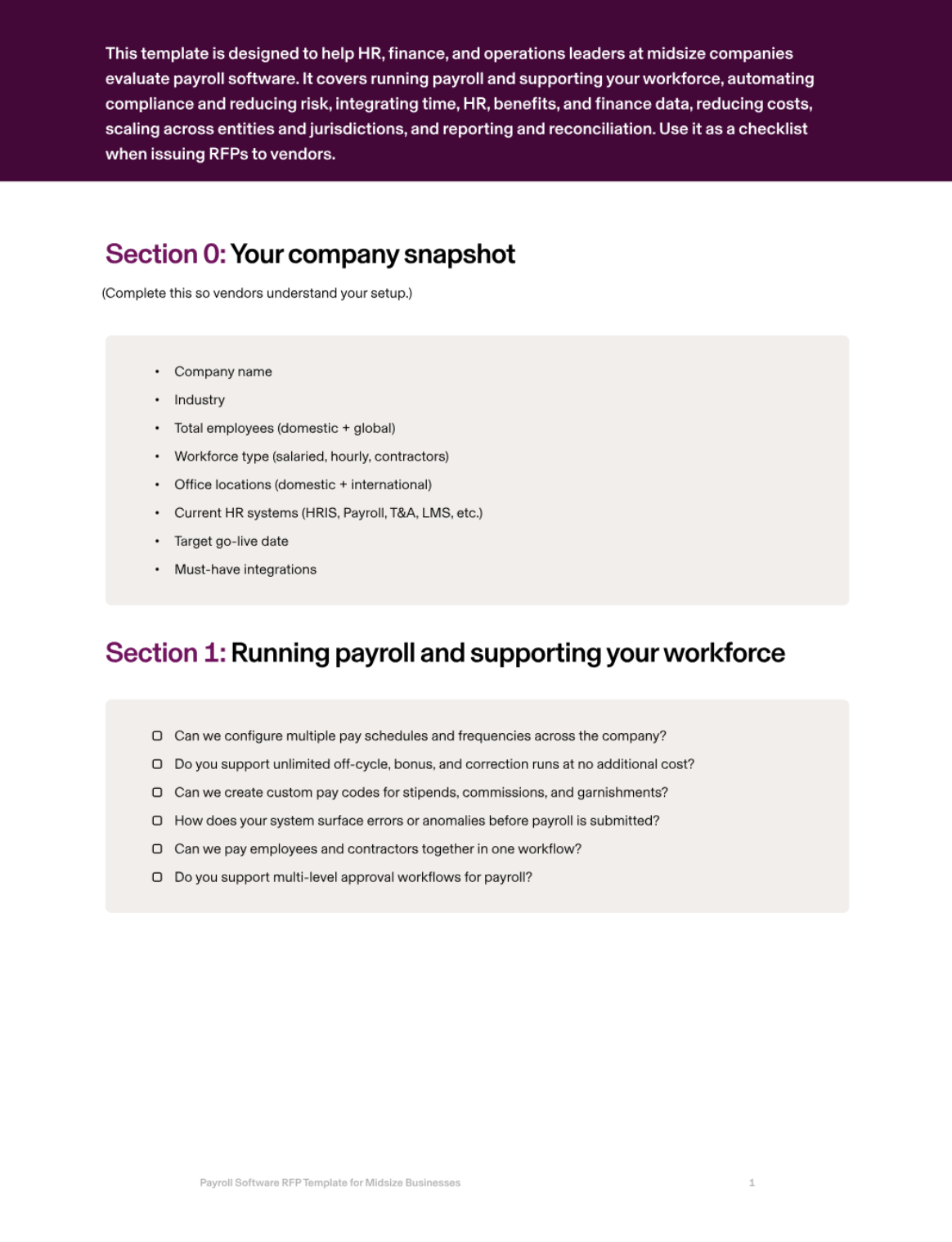

For midsize businesses, payroll isn’t just about getting paychecks out on time — it’s about managing complexity. As headcount grows into the hundreds, so do the challenges: multi-state compliance, multi-entity structures, different pay frequencies, and integration across finance, HR, and benefits systems. Manual workarounds and disconnected platforms that may have worked at a smaller scale now introduce risk, delay, and inefficiency.

The right payroll software for midsize businesses should eliminate manual reconciliation, ensure airtight compliance, and provide finance and HR leaders with accurate, real-time insights. It should handle complex pay rules, multi-step approvals, and reporting across entities, while still being intuitive enough for employees to self-serve.

This guide outlines the most important areas to evaluate when selecting payroll software for midsize companies, what best-in-class looks like, and the RFP questions to include in your process. Plus, we’ll give you a downloadable template so you can start evaluating vendors ASAP.

1. Running payroll and supporting your workforce

Midsize businesses often have a mix of pay schedules (biweekly, semimonthly, monthly), commission structures, bonuses, and garnishments to manage.

Payroll software should support unlimited runs, allow for custom pay codes, and compare current runs against previous ones to surface anomalies. It should also unify employees and contractors in a single workflow to eliminate duplication.

Rippling delivers exactly this: customizable pay types, unlimited off-cycle runs, and side-by-side comparisons to catch discrepancies before payroll is finalized.

RFP questions to ask

Can we configure multiple pay schedules and frequencies across the company?

Do you support unlimited off-cycle, bonus, and correction runs at no additional cost?

Can we create custom pay codes for stipends, commissions, and garnishments?

How does your system surface errors or anomalies before payroll is submitted?

Can we pay employees and contractors together in one workflow?

Do you support multi-level approval workflows for payroll?

2. Automating compliance and reducing risk

With employees across multiple states — and often multiple entities — midsize businesses need payroll that automates compliance at scale.

Software should handle tax registrations, filings, and remittances automatically while applying state and local rules (wage, leave, overtime). Audit readiness also becomes critical at this stage: every payroll action should be logged immutably, with exportable reports available on demand.

Rippling guarantees tax filings are accurate and on time, applies jurisdiction-specific rules instantly when employees relocate, and creates audit-ready logs to support compliance at scale.

RFP questions to ask

Do you automatically register and maintain payroll tax accounts across multiple states?

Are federal, state, and local filings fully automated with remittances included?

How are compliance rules updated and applied when employees move or entities expand?

Do you support garnishments and remit them automatically?

Can we export immutable audit logs for every payroll action?

Do you indemnify clients against penalties caused by system errors?

3. Integrating time, HR, benefits, and finance data

At the midsize level, siloed systems create reconciliation headaches and slow down finance closes.

Payroll should natively integrate with time tracking, HRIS, and benefits so all data flows automatically — no CSV uploads. Finance requires robust integration into accounting and ERP systems like NetSuite, QuickBooks, and Xero, with support for multi-dimensional general ledger mapping (department, cost center, entity, project).

Rippling provides this end-to-end: HR and benefits data sync directly into payroll, time and attendance flows in automatically, and journals post into your ERP with the right dimensions.

RFP questions to ask

Do approved timecards flow directly into payroll with jurisdiction-specific rules?

Do onboarding, promotions, and terminations update payroll in real time?

How do benefit elections and employer contributions sync with payroll?

Which accounting/ERP systems do you integrate with?

Do you support multi-entity, multi-dimensional GL mapping?

Can payroll journals be scheduled and posted automatically to our ERP?

4. Reducing costs

As companies grow, vendor sprawl adds unnecessary expense and complexity.

Payroll software should consolidate HR, payroll, time, and benefits into one platform, reducing manual work and vendor fees. It should also eliminate hidden payroll costs, like charges for corrections or off-cycle runs.

Rippling delivers cost efficiency by unifying payroll with HR, benefits, and time tracking in one system, while offering unlimited off-cycle runs and filings without extra fees.

RFP questions to ask

What’s included in base payroll pricing, and what features are billed separately?

Do you charge for off-cycle runs, corrections, or year-end filings?

How does your system help reduce admin time for payroll teams?

Can your platform consolidate HR, payroll, time, and benefits to reduce vendor costs?

Do you provide benchmarks or ROI analysis for midsize customers?

5. Scaling

Midsize businesses are often multi-entity and multi-state, and may already be exploring global expansion. Payroll should scale seamlessly, with support for multiple entities, complex approval workflows, and global payroll from the same system.

Rippling supports 50-state compliance out of the box, manages multi-entity structures, and adds native global payroll when needed — allowing you to pay employees and contractors in their local currencies without switching systems.

RFP questions to ask

Do you support multi-entity payroll, with separate rules and approvals per entity?

How do you handle employees working across multiple states?

Can payroll rules adapt automatically when employees relocate?

Do you support international payroll and payments in local currencies?

How do you scale compliance coverage for new jurisdictions or entities?

6. Reporting and reconciliation

Midsize finance teams need robust reporting that goes beyond pay stubs. Payroll data should be easy to segment by entity, department, or geography, and variance reports should be available across pay runs. Reconciliation should be automated with GL syncs to ERP/accounting platforms, and audit-ready reporting should be a given.

Rippling provides real-time dashboards, customizable reporting, and automated journals to ERP systems, giving midsize businesses the visibility they need to manage payroll as a strategic function.

RFP questions to ask

What dashboards are included (labor costs, taxes, headcount, entity-level spend)?

Can we build custom reports and schedule them for stakeholders?

Do you provide variance reporting across payroll cycles?

Do you support consolidated reporting across multiple entities?

How do payroll journals integrate with our ERP/GL system?

How long are payroll records retained, and are they permanently accessible?

How Rippling helps midsize businesses

Rippling Payroll is designed to simplify complexity for midsize organizations. Whether you have 50 employees or 500, Rippling lets you run payroll in minutes while ensuring every pay run is accurate, compliant, and audit-ready. Our payroll engine handles multiple pay schedules, garnishments, commissions, and unlimited off-cycle runs — without added fees.

Because Rippling is built on a unified HR platform, every change ripples across systems automatically. New hires onboard in 90 seconds, benefits deductions sync instantly, approved hours flow straight into payroll, and journal entries post directly to your ERP. You can compare runs side-by-side to catch discrepancies, generate immutable audit logs for compliance, and configure multi-step approval workflows for added control.

Rippling also helps midsize businesses cut costs by replacing multiple vendors with one unified platform. Payroll, HR, time, and benefits all live in one system, eliminating manual reconciliation and reducing vendor sprawl. Employees get self-service access to pay stubs, tax forms, and direct deposit, lowering the number of support requests hitting your HR team.

And Rippling scales with you. We support all 50 states, manage multi-entity compliance seamlessly, and offer native global payroll — so when you expand internationally, you can continue paying employees and contractors in their local currencies without migrating systems.

With Rippling Payroll, midsize businesses can:

Run payroll in minutes, regardless of complexity

Automate tax filings with a 100% accuracy guarantee

Manage payroll across multiple entities and states seamlessly

Pay domestic and international employees from one system

Replace siloed vendors with one unified platform

Empower employees with modern self-service tools

Generate real-time reports and ERP journals for faster close cycles

Rippling RFP for payroll software for midsize businesses example

Question to ask | Rippling Answer | |

|---|---|---|

Running payroll and supporting your workforce | Can we configure multiple pay schedules and frequencies across the company? | Yes — Rippling supports multiple pay schedules and frequencies (biweekly, semimonthly, monthly) within the same system. |

Do you support unlimited off-cycle, bonus, and correction runs at no additional cost? | Yes — Rippling allows unlimited off-cycle, bonus, and correction payroll runs with no extra fees. | |

Can we create custom pay codes for stipends, commissions, and garnishments? | Yes — admins can configure custom pay types for stipends, commissions, garnishments, and more. | |

How does your system surface errors or anomalies before payroll is submitted? | Rippling compares pay runs line-by-line with previous runs and flags anomalies like duplicate entries or missing hours before submission. | |

Can we pay employees and contractors together in one workflow? | Yes — Rippling unifies employee and contractor payments in one workflow for simplified processing. | |

Do you support multi-level approval workflows for payroll? | Yes — Rippling supports configurable, multi-step payroll approval workflows. | |

Automating compliance and reducing risk | Do you automatically register and maintain payroll tax accounts across multiple states? | Yes — Rippling registers and maintains state and local tax accounts automatically. |

Are federal, state, and local filings fully automated with remittances included? | Yes — Rippling calculates, files, and remits federal, state, and local taxes automatically with a 100% accuracy guarantee. | |

How are compliance rules updated and applied when employees move or entities expand? | Rippling updates jurisdictional rules continuously and applies them automatically when employees relocate or when entities are added. | |

Do you support garnishments and remit them automatically? | Yes — Rippling supports all garnishment types and remits them automatically on your behalf. | |

Can we export immutable audit logs for every payroll action? | Yes — Rippling generates immutable audit logs for every payroll action, exportable at any time. | |

Do you indemnify clients against penalties caused by system errors? | Yes — Rippling indemnifies clients for penalties resulting from system-caused filing errors. | |

Integrating time, HR, benefits, and finance data | Do approved timecards flow directly into payroll with jurisdiction-specific rules? | Yes — approved hours sync directly into payroll, with overtime and break compliance rules automatically applied. |

Do onboarding, promotions, and terminations update payroll in real time? | Yes — Rippling HRIS is the source of truth; lifecycle events automatically update payroll. | |

How do benefit elections and employer contributions sync with payroll? | Benefit deductions and employer contributions update payroll automatically in real time. | |

Which accounting/ERP systems do you integrate with? | Rippling integrates directly with QuickBooks, Xero, and NetSuite for seamless reconciliation. | |

Do you support multi-entity, multi-dimensional GL mapping? | Yes — Rippling supports mapping by department, project, entity, and cost center. | |

Can payroll journals be scheduled and posted automatically to our ERP? | Yes — Rippling can automatically post payroll journals with configurable schedules. | |

Reducing costs | What’s included in base payroll pricing, and what features are billed separately? | Base payroll includes unlimited runs, filings, garnishments, and year-end forms. Optional add-ons include Time & Attendance, Benefits, and Global Payroll. |

Do you charge for off-cycle runs, corrections, or year-end filings? | No — Rippling includes off-cycle payroll runs, corrections, and W-2/1099 filings at no additional cost. | |

How does your system help reduce admin time for payroll teams? | Rippling automates over 95% of payroll admin work, reducing time spent on data entry, reconciliation, and compliance. | |

Can your platform consolidate HR, payroll, time, and benefits to reduce vendor costs? | Yes — Rippling consolidates payroll, HR, time, and benefits into one unified platform, cutting vendor spend and admin hours. | |

Do you provide benchmarks or ROI analysis for midsize customers? | Yes — Rippling provides benchmarks and ROI analysis based on similar midsize organizations. | |

Scaling | Do you support multi-entity payroll, with separate rules and approvals per entity? | Yes — Rippling supports multi-entity payroll, with configurable rules and approval workflows for each entity. |

How do you handle employees working across multiple states? | Rippling automatically applies compliance rules for each jurisdiction and calculates taxes accurately. | |

Can payroll rules adapt automatically when employees relocate? | Yes — Rippling automatically updates payroll rules when an employee’s address changes. | |

Do you support international payroll and payments in local currencies? | Yes — Rippling supports native global payroll, allowing you to pay employees and contractors internationally in local currencies. | |

How do you scale compliance coverage for new jurisdictions or entities? | Rippling continuously updates compliance rules and supports seamless entity and jurisdiction expansion. | |

Reporting and reconciliation | What dashboards are included (labor costs, taxes, headcount, entity-level spend)? | Rippling provides dashboards for labor costs, taxes, headcount, variance reporting, and entity-level spend. |

Can we build custom reports and schedule them for stakeholders? | Yes — Rippling includes customizable reporting with scheduled delivery to stakeholders. | |

Do you provide variance reporting across payroll cycles? | Yes — Rippling flags deltas in gross pay, deductions, and taxes across cycles automatically. | |

Do you support consolidated reporting across multiple entities? | Yes — Rippling supports consolidated and entity-level reporting for multi-entity organizations. | |

How do payroll journals integrate with our ERP/GL system? | Rippling automatically posts journals with multi-dimensional GL mapping to ERP and accounting systems. | |

How long are payroll records retained, and are they permanently accessible? | Payroll records are retained permanently in Rippling and can be exported for audits and compliance reviews. |

Ready to evaluate vendors?

Disclaimer

Rippling and its affiliates do not provide tax, accounting, or legal advice. This material has been prepared for informational purposes only, and is not intended to provide or be relied on for tax, accounting, or legal advice. You should consult your own tax, accounting, and legal advisors before engaging in any related activities or transactions.

Hubs

Author

The Rippling Team

Global HR, IT, and Finance know-how directly from the Rippling team.

Explore more

See Rippling in action

Increase savings, automate busy work, and make better decisions by managing HR, IT, and Finance in one place.

![[Blog - Hero Image] Payroll](http://images.ctfassets.net/k0itp0ir7ty4/ETvyHP3pmEXRExpvQNdWq/004bbf55d4815bf1eb846c8996d67fc0/payroll.jpg)

![[Blog - Hero Image] Global payroll](http://images.ctfassets.net/k0itp0ir7ty4/6oFsV48ZtQByRWRMg8Prk7/6f6fd768526ba3231ca024d5fd25e36e/Header_Payroll_04_SEO_.png)

![[Blog - Hero Image] HR automation](http://images.ctfassets.net/k0itp0ir7ty4/6SDKHnjQrSgYRJvG5H8AHE/f29102adb200a5e82e81b880b43fee4c/Header_HR_Automation_01__1_.png)