Must-have payroll software RFP template for enterprises in 2025

![[Blog - Hero Image] Payroll](http://images.ctfassets.net/k0itp0ir7ty4/ETvyHP3pmEXRExpvQNdWq/004bbf55d4815bf1eb846c8996d67fc0/payroll.jpg)

In this article

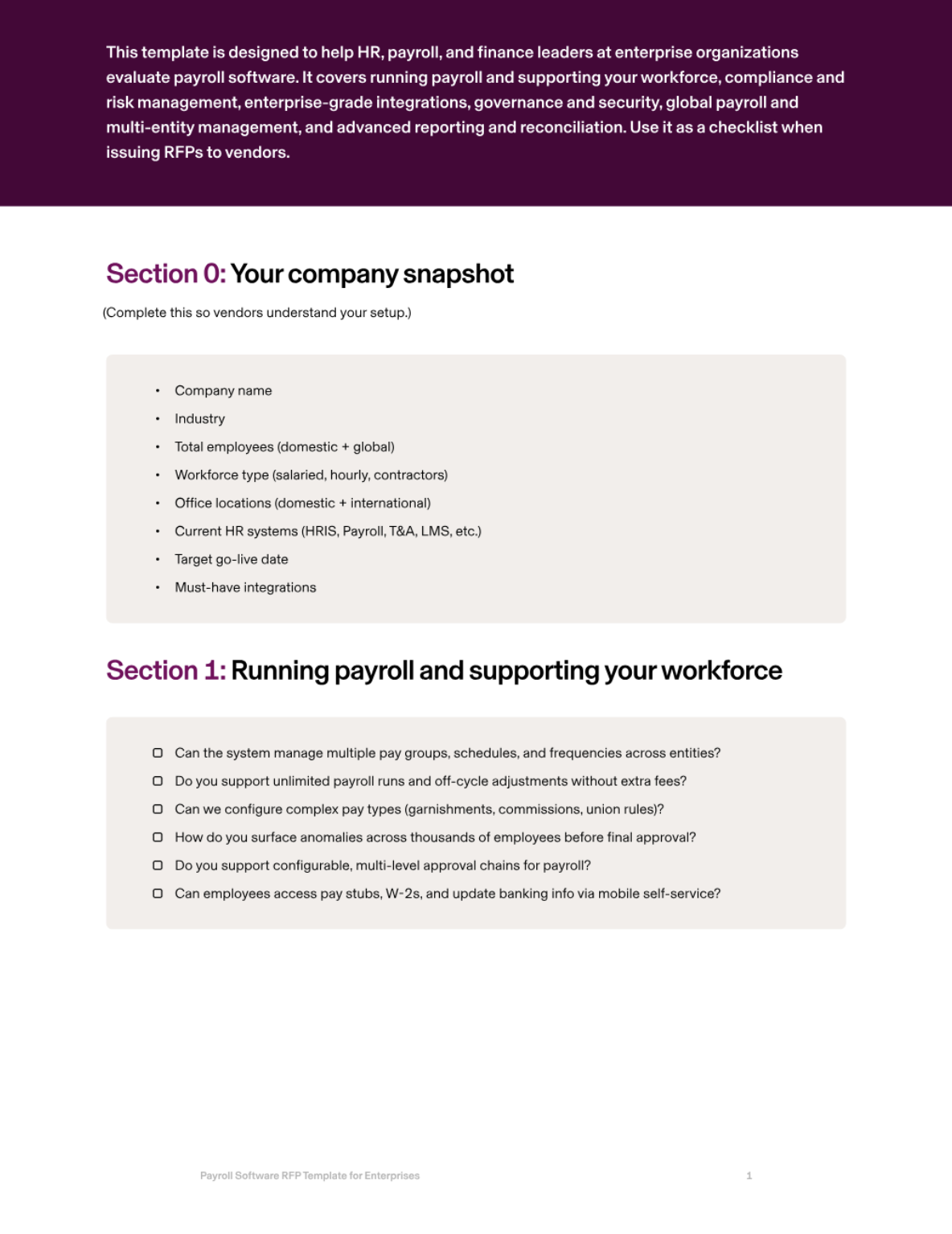

At the enterprise level, payroll isn’t just a back-office process — it’s a mission-critical system of record. With thousands of employees, multi-entity structures, and operations across multiple jurisdictions, payroll complexity grows exponentially. Errors or delays aren’t just frustrating; they can create compliance risks, reputational damage, and material financial penalties.

The right payroll software for enterprises should do more than process paychecks. It must unify global and domestic payroll in a single system, automate compliance across jurisdictions, integrate seamlessly with HR, finance, and benefits systems, and provide the configurability and oversight large organizations require.

This guide outlines the areas you should evaluate when selecting enterprise payroll software, what best-in-class looks like, and the RFP questions you need to ask. Plus, we’ll share a free downloadable template so you can start evaluating vendors ASAP.

1. Running payroll and supporting your workforce

For enterprises, payroll involves multiple pay groups, frequencies, and complex pay structures: garnishments, union rules, commissions, bonuses, and multi-rate employees.

The right payroll platform should support unlimited runs, multiple schedules across entities, and provide anomaly detection before approval. It should also allow for multi-level approval chains and audit-ready logs of every decision.

Rippling’s payroll engine handles all of this in minutes, with customizable pay types, line-by-line comparisons across runs, and enterprise-grade approval workflows.

RFP questions to ask

Can the system manage multiple pay groups, schedules, and frequencies across entities?

Do you support unlimited payroll runs and off-cycle adjustments without extra fees?

Can we configure complex pay types (garnishments, commissions, union rules)?

How do you surface anomalies across thousands of employees before final approval?

Do you support configurable, multi-level approval chains for payroll?

Can employees access pay stubs, W-2s, and update banking info via mobile self-service?

2. Compliance and risk management

Enterprises face significant compliance burdens: multi-state, multi-country, garnishments, leave policies, and evolving tax regimes. Manual compliance tracking isn’t feasible.

Payroll systems must automate tax registrations, filings, and remittances globally, while maintaining immutable audit trails. The provider should guarantee accuracy and indemnify against system-caused errors.

Rippling automates filings across jurisdictions, applies wage and leave rules by location, supports garnishments, and provides error-free guarantees with audit-ready logs.

RFP questions to ask

Do you automatically register and maintain tax accounts across states and countries?

Are federal, state, local, and global tax filings automated with remittances included?

How do you manage and remit garnishments at scale?

Do you guarantee filing accuracy and indemnify for penalties caused by system errors?

How do you update and apply compliance rules across multiple jurisdictions?

Do you provide permanent, immutable audit trails for every payroll action?

3. Enterprise-grade integrations

Large companies require deep integrations across HR, time tracking, benefits, accounting, and ERP systems.

Rippling offers direct integrations into accounting/ERP systems and ties payroll data directly to HRIS, benefits, and time tracking, eliminating duplicate entry and reconciliation.

RFP questions to ask

Which ERP/accounting systems do you integrate with (NetSuite, SAP, Oracle, etc.)?

Do you support multi-dimensional GL mapping (entity, project, cost center, geography)?

How are payroll journals posted — automatically or manually?

Do approved timecards and leave sync directly into payroll?

Do benefit elections and contributions update payroll automatically?

Can lifecycle events (onboarding, promotions, terminations) update payroll in real time?

4. Governance, controls, and security

At enterprise scale, governance is critical. Payroll systems must provide granular, role-based access, configurable approval workflows, and enterprise-grade security (SOC 2, ISO 27001). Audit logs should be immutable, exportable, and easily filtered by entity, team, or geography.

Rippling provides configurable roles, dynamic permissions, multi-step approval workflows, and built-in audit logs that withstand external review.

RFP questions to ask

Do you support configurable, role-based access by entity, geography, or function?

Can we create multi-level payroll approval workflows with conditional logic?

What certifications do you hold (SOC 2 Type II, ISO 27001, GDPR compliance)?

Are audit logs immutable and exportable for audits?

How do you handle sensitive data access and separation of duties?

Can permissions adapt automatically when employee roles change?

5. Global payroll and multi-entity management

Enterprises often operate across multiple states, countries, and legal entities. Payroll software should unify domestic and international payroll into one system, support multi-entity reporting, and pay employees and contractors in local currencies.

Rippling enables enterprises to manage U.S. and global payroll from a single platform, apply jurisdiction-specific rules automatically, and generate consolidated reporting across entities and geographies.

RFP questions to ask

Do you support both domestic and international payroll in one system?

Can you pay employees and contractors globally in their local currencies?

Do you support multi-entity payroll rules, approval chains, and reporting?

How are compliance updates managed across different countries?

Do you provide consolidated and entity-level payroll reporting?

How do you ensure accuracy when managing payroll across multiple jurisdictions?

6. Advanced reporting and reconciliation

Enterprise finance teams need more than basic reports — they need real-time dashboards, variance analysis, and consolidated reporting across entities and countries.

Payroll should integrate tightly with ERP/finance systems and provide audit-ready outputs for compliance.

Rippling offers customizable reporting, variance analysis across runs, and automated journal entries into ERP systems, giving leaders the visibility they need.

RFP questions to ask

What dashboards do you provide (labor costs, taxes, headcount, entity-level reporting)?

Do you support consolidated reporting across entities and countries?

Can we build and schedule custom reports for leadership?

Do you provide variance analysis across payroll runs?

How do payroll journals integrate with ERP/accounting systems?

Are payroll records permanently retained and accessible for audits?

How Rippling helps enterprises

Rippling Payroll is built to handle the scale and complexity of enterprise organizations. With the ability to run global and domestic payroll in one system, Rippling gives enterprises confidence that every employee and contractor is paid accurately, on time, and in compliance with every jurisdiction they operate in. Payroll runs in minutes, no matter how complex, with unlimited off-cycle runs and configurable pay types for union rules, commissions, and garnishments.

Because Rippling is built on a unified HR platform, payroll is always connected to HR, time, and benefits data. Approved hours, new-hire information, promotions, and terminations all flow directly into payroll without manual entry. Finance teams get automated journal entries into ERP systems like NetSuite and SAP, with multi-dimensional mapping by entity, department, or cost center.

Rippling also gives enterprises the governance they require: role-based access controls, multi-level approval workflows, and immutable audit logs. With SOC 2 Type II and ISO 27001 certifications, Rippling provides enterprise-grade security and compliance out of the box.

Employees get a modern self-service experience, accessing pay stubs, tax forms, and direct deposit updates through Rippling’s web and mobile apps — reducing support tickets for HR and payroll teams. And with Rippling’s native global payroll, enterprises can pay employees and contractors worldwide in local currencies, ensuring compliance without adding more vendors or systems.

With Rippling Payroll, enterprises can:

Run payroll in minutes, regardless of complexity or scale

Automate tax filings globally with a 100% accuracy guarantee

Pay employees and contractors worldwide in local currencies

Manage payroll across multiple entities in one system

Integrate payroll seamlessly into ERP and finance systems

Configure governance and approvals to meet enterprise standards

Generate real-time, consolidated reporting across jurisdictions

Rippling RFP for payroll software for enterprises example

Question to ask | Rippling Answer | |

|---|---|---|

Running payroll and supporting your workforce | Can the system manage multiple pay groups, schedules, and frequencies across entities? | Yes — Rippling supports multiple pay groups and frequencies (biweekly, semimonthly, monthly) across entities in one system. |

Do you support unlimited payroll runs and off-cycle adjustments without extra fees? | Yes — Rippling allows unlimited regular, bonus, and correction payroll runs at no additional cost. | |

Can we configure complex pay types (garnishments, commissions, union rules)? | Yes — Rippling supports all garnishment types, commissions, union rules, and custom pay codes. | |

How do you surface anomalies across thousands of employees before final approval? | Rippling compares runs line-by-line against history, flagging discrepancies like duplicate entries, missing hours, or unusual variances. | |

Do you support configurable, multi-level approval chains for payroll? | Yes — Rippling provides configurable, multi-step approval workflows with conditional logic. | |

Can employees access pay stubs, W-2s, and update banking info via mobile self-service? | Yes — employees can self-serve via Rippling’s mobile app to view stubs, download tax forms, and update direct deposit details. | |

Compliance and risk management | Do you automatically register and maintain tax accounts across states and countries? | Yes — Rippling registers and maintains payroll tax accounts across all states and supported countries. |

Are federal, state, local, and global tax filings automated with remittances included? | Yes — Rippling calculates, files, and remits all payroll taxes automatically with a 100% accuracy guarantee. | |

How do you manage and remit garnishments at scale? | Rippling handles all garnishment types and remits them automatically. | |

Do you guarantee filing accuracy and indemnify for penalties caused by system errors? | Yes — Rippling guarantees filing accuracy and indemnifies clients against penalties resulting from system errors. | |

How do you update and apply compliance rules across multiple jurisdictions? | Rippling continuously updates wage, leave, and tax rules via in-house experts and applies them automatically. | |

Do you provide permanent, immutable audit trails for every payroll action? | Yes — Rippling maintains immutable, exportable audit logs for every payroll action. | |

Enterprise-grade integrations | Which ERP/accounting systems do you integrate with (NetSuite, SAP, Oracle, etc.)? | Rippling integrates directly with NetSuite, QuickBooks, Xero, and supports journal exports for SAP and Oracle. |

Do you support multi-dimensional GL mapping (entity, project, cost center, geography)? | Yes — Rippling supports mapping payroll data to multiple dimensions including entity, department, project, and cost center. | |

How are payroll journals posted — automatically or manually? | Rippling posts journals automatically to integrated accounting and ERP systems with configurable schedules. | |

Do approved timecards and leave sync directly into payroll? | Yes — approved timecards and leave policies sync automatically into payroll with compliance rules applied. | |

Do benefit elections and contributions update payroll automatically? | Yes — Rippling updates payroll in real time when benefit elections or contributions change. | |

Can lifecycle events (onboarding, promotions, terminations) update payroll in real time? | Yes — Rippling HRIS is the source of truth; lifecycle changes update payroll instantly. | |

Governance, controls, and security | Do you support configurable, role-based access by entity, geography, or function? | Yes — Rippling provides configurable, role-based access down to the field level by entity, geography, or team. |

Can we create multi-level payroll approval workflows with conditional logic? | Yes — multi-step approval workflows with conditions are supported for payroll runs. | |

What certifications do you hold (SOC 2 Type II, ISO 27001, GDPR compliance)? | Rippling is SOC 2 Type II and ISO 27001 certified and GDPR compliant. | |

Are audit logs immutable and exportable for audits? | Yes — all payroll actions generate immutable audit logs, fully exportable for audits. | |

How do you handle sensitive data access and separation of duties? | Rippling provides granular role-based access controls and separation of duties by default. | |

Can permissions adapt automatically when employee roles change? | Yes — permissions update dynamically when employee attributes change in Rippling. | |

Global payroll and multi-entity management | Do you support both domestic and international payroll in one system? | Yes — Rippling provides unified domestic and global payroll in one platform. |

Can you pay employees and contractors globally in their local currencies? | Yes — Rippling supports paying employees and contractors in 90+ currencies globally. | |

Do you support multi-entity payroll rules, approval chains, and reporting? | Yes — Rippling supports multi-entity payroll rules, approvals, and consolidated or entity-level reporting. | |

How are compliance updates managed across different countries? | Rippling maintains global compliance rules via in-house experts and local partners, updated continuously. | |

Do you provide consolidated and entity-level payroll reporting? | Yes — Rippling supports both consolidated reporting across entities and granular entity-level breakdowns. | |

How do you ensure accuracy when managing payroll across multiple jurisdictions? | Rippling applies local rules automatically, ensures filings are accurate, and provides error-free guarantees. | |

Reporting and reconciliation | What dashboards do you provide (labor costs, taxes, headcount, entity-level reporting)? | Rippling includes dashboards for labor costs, employer taxes, headcount, overtime, and entity-level spend. |

Do you support consolidated reporting across entities and countries? | Yes — Rippling supports consolidated and segmented reporting across entities, jurisdictions, and geographies. | |

Can we build and schedule custom reports for leadership? | Yes — Rippling offers customizable reporting and scheduled report delivery for leadership teams. | |

Do you provide variance analysis across payroll runs? | Yes — Rippling flags variances across runs automatically and provides line-by-line comparisons. | |

How do payroll journals integrate with ERP/accounting systems? | Rippling posts payroll journals automatically into ERP/accounting systems with full dimensional support. | |

Are payroll records permanently retained and accessible for audits? | Yes — payroll records are permanently retained and can be accessed or exported for audits anytime. |

Ready to evaluate vendors?

Disclaimer

Rippling and its affiliates do not provide tax, accounting, or legal advice. This material has been prepared for informational purposes only, and is not intended to provide or be relied on for tax, accounting, or legal advice. You should consult your own tax, accounting, and legal advisors before engaging in any related activities or transactions.

Hubs

Author

The Rippling Team

Global HR, IT, and Finance know-how directly from the Rippling team.

Explore more

See Rippling in action

Increase savings, automate busy work, and make better decisions by managing HR, IT, and Finance in one place.

![[Blog - Hero Image] Global payroll](http://images.ctfassets.net/k0itp0ir7ty4/6oFsV48ZtQByRWRMg8Prk7/6f6fd768526ba3231ca024d5fd25e36e/Header_Payroll_04_SEO_.png)

![[Blog - Hero Image] Payroll money](http://images.ctfassets.net/k0itp0ir7ty4/70b0IaqkwPFMXVEzVq8SOF/2526e71eef2555079e1df04c371c6267/Header_Payroll_01__2_.png)

![[Blog - Hero Image] Expense management](http://images.ctfassets.net/k0itp0ir7ty4/36sOZvauN7TR1TLXSFOYo8/b2babbfdcbc3a7b4a26bbd6373bb4991/Header_Expense_Report_03__2_.jpg)

![[Blog - Hero Image] Header HR automation](http://images.ctfassets.net/k0itp0ir7ty4/4IFuamJNogIac56PkCYV3R/4b0ebd36383692820bc1847b400b892f/Header_HR_Automation_03__1_.png)