Must-have payroll software RFP template for small businesses

In this article

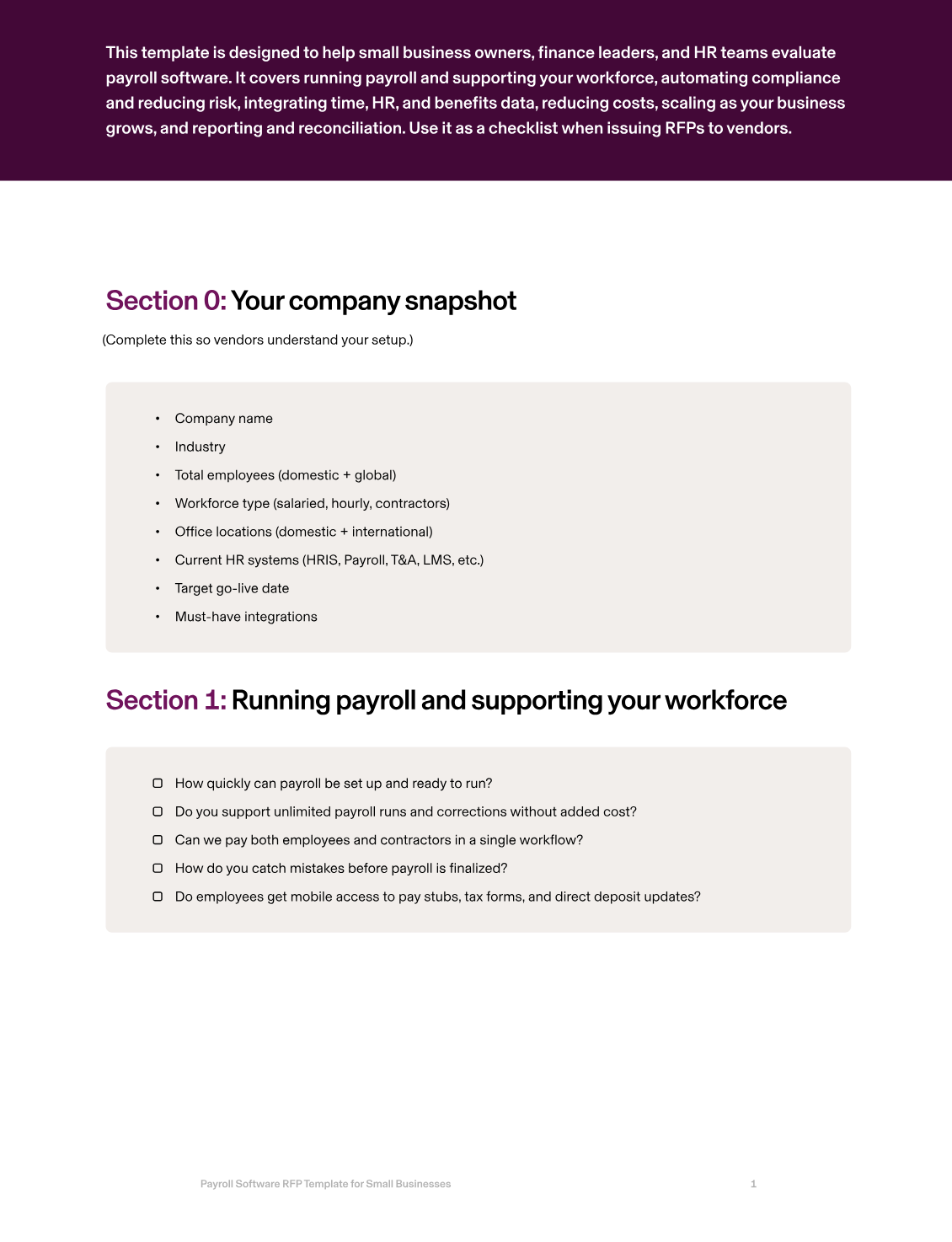

For small businesses, payroll isn’t just an admin task — it’s the heartbeat of the employee relationship. If paychecks are late, deductions are wrong, or taxes aren’t filed properly, trust erodes quickly. But with lean teams, no dedicated payroll specialist, and limited time, many small businesses end up buried in manual work, spreadsheets, and constant double-checks.

The right payroll platform for small businesses should take the burden off teams by automating tax filings, integrating HR and benefits data automatically, and making it simple for employees to self-serve. It should be easy to set up, affordable, and reliable — without requiring a full HR department to run it.

This guide lays out the areas you should focus on when evaluating payroll software for small businesses, what best-in-class looks like, and the specific RFP questions to ask vendors. Plus, we’ll give you a free downloadable template so you can start assessing vendors ASAP.

1. Running payroll and supporting your workforce

Small businesses need payroll to “just work.” With little margin for error, software should allow unlimited pay runs, handle bonuses or off-cycle adjustments, and support both W-2 employees and 1099 contractors in one place. It should also catch anomalies before submission so owners don’t waste hours reconciling mistakes later.

Rippling delivers exactly this: fast, accurate payroll runs, line-by-line comparisons with past runs to catch discrepancies, and one workflow to pay employees and contractors together.

RFP questions to ask

How quickly can payroll be set up and ready to run?

Do you support unlimited payroll runs and corrections without added cost?

Can we pay both employees and contractors in a single workflow?

How do you catch mistakes before payroll is finalized?

Do employees get mobile access to pay stubs, tax forms, and direct deposit updates?

2. Automating compliance and reducing risk

For small businesses, compliance can feel overwhelming. Between registering in new states, tracking local wage laws, and filing payroll taxes, the risk of penalties is high — and the time cost is steep.

Great payroll software should automate registrations, file and remit taxes, and apply the right rules as employees relocate or policies change. Rippling guarantees accuracy in every pay run, automatically files all federal, state, and local taxes, and generates audit-ready records by default.

RFP questions to ask

Do you handle state and local payroll tax registrations for us?

Are federal, state, and local tax filings automated?

Do you guarantee timeliness and accuracy for filings and remittances?

How do you handle compliance updates when laws or rates change?

Do you provide a permanent audit trail of payroll actions and filings?

3. Integrating time, HR, and benefits data

Many small businesses patch together separate systems — or worse, spreadsheets — for HR, time, and benefits. That creates duplication, errors, and wasted time.

Payroll should integrate directly with these functions so changes flow automatically. For example, when an employee is onboarded, promoted, or leaves, payroll should update instantly.

Rippling unifies HR, time tracking, and benefits into payroll, ensuring deductions, contributions, and approved hours always sync automatically.

RFP questions to ask

Do timecards sync directly into payroll once approved?

Do onboarding events (new hires, promotions, terminations) update payroll automatically?

Are benefit deductions and employer contributions reflected in payroll in real time?

Do you integrate with accounting systems like QuickBooks or Xero for easy reconciliation?

Can permissions be set so managers only see payroll data for their teams?

4. Reducing costs

Small businesses can’t afford hidden fees or expensive consultants to keep payroll running. The right payroll solution should be affordable, transparent, and reduce the need for manual work.

Rippling eliminates vendor sprawl by combining payroll, HR, time, and benefits in one platform, and it doesn’t nickel-and-dime you with fees for off-cycle runs or year-end forms.

RFP questions to ask

What’s included in your base price, and what features cost extra?

Do you charge for off-cycle runs, corrections, or year-end forms?

How does your platform help reduce administrative time for small teams?

Can your system replace separate HR, time, and benefits tools to save vendor costs?

Do you provide ROI metrics for small businesses?

5. Scaling with your business

Even small businesses plan to grow. The payroll system you choose should support you today and scale as you add headcount, expand into new states, or start hiring globally.

Rippling supports 50-state compliance out of the box and lets you upgrade to global payroll when you need it, without switching systems.

RFP questions to ask

Can your system handle multi-state compliance from day one?

Do you manage new tax accounts automatically as we grow?

Can payroll rules adapt automatically as employees relocate?

Do you support paying contractors or employees internationally when needed?

What’s the effort to scale from a handful of employees to hundreds?

6. Reporting and reconciliation

Small business owners and finance leaders need fast answers: payroll costs, taxes owed, and employee headcount. The right payroll solution should provide easy-to-use dashboards, customizable reports, and automated journal entries into accounting software — no spreadsheets required. Rippling provides real-time payroll dashboards, automated GL syncs, and variance reports to help small teams close the books quickly and confidently.

RFP questions to ask

Which dashboards are included (payroll costs, headcount, taxes)?

Can non-technical users create and schedule reports?

How do payroll journals sync into our accounting system?

Do you provide variance analysis across payroll cycles?

How long are records retained, and can they be exported for audits?

How Rippling helps small businesses

Rippling Payroll is built to take payroll off your plate so you can focus on running your business. With Rippling, you can run payroll in minutes — not days — while being confident every employee and contractor is paid accurately and on time. Our payroll engine is designed to handle all the complexity small businesses face as they grow: garnishments, custom pay types, off-cycle runs, and multi-state compliance.

Because Rippling is the only payroll system built on a unified HR platform, every change flows everywhere it needs to — automatically. New hires are onboarded in 90 seconds, benefits deductions update instantly when elections change, and approved hours sync straight into payroll with no manual data entry. Year-end forms (W-2s and 1099s) are generated automatically, tax filings are submitted on time with a 100% accuracy guarantee, and audit trails are always available.

Rippling also cuts costs for small businesses by consolidating HR, payroll, time, and benefits into one platform. That means fewer vendors to manage, fewer logins to reconcile, and fewer errors to fix. Employees get a modern app where they can view pay stubs, download tax forms, and update direct deposit themselves — reducing the number of questions that land on your desk.

And when your small business grows, you won’t need to rip and replace. Rippling scales seamlessly from 5 to 500 employees, supports 50-state compliance from day one, and adds native global payroll when you need it — so you can keep the same system as your business evolves.

With Rippling Payroll, small businesses can:

Run payroll in minutes with 100% accuracy guaranteed

Automate federal, state, and local tax filings with error-free remittance

Pay employees and contractors together in one workflow

Eliminate manual work with HR, time, and benefits integrations

Replace multiple point solutions with one unified platform

Empower employees with self-service pay and tax tools

Scale seamlessly across states and countries without migrating systems

Rippling RFP for payroll software for small businesses example

Question to ask | Rippling Answer | |

|---|---|---|

Running payroll and supporting your workforce | How quickly can payroll be set up and ready to run? | Rippling can have payroll live in days, with automated data imports and guided onboarding. |

Do you support unlimited payroll runs and corrections without added cost? | Yes — Rippling supports unlimited regular, off-cycle, and correction runs at no extra cost. | |

Can we pay both employees and contractors in a single workflow? | Yes — Rippling pays W-2 employees and 1099 contractors together in one system. | |

How do you catch mistakes before payroll is finalized? | Rippling compares each pay run line-by-line with prior runs and flags anomalies like duplicate entries or missing hours. | |

Do employees get mobile access to pay stubs, tax forms, and direct deposit updates? | Yes — employees can self-serve via Rippling’s mobile app to view stubs, download W-2s/1099s, and update direct deposit details. | |

Automating compliance and reducing risk | Do you handle state and local payroll tax registrations for us? | Yes — Rippling registers and maintains state and local tax accounts automatically. |

Are federal, state, and local tax filings automated? | Yes — Rippling calculates, files, and remits all payroll taxes automatically with a 100% accuracy guarantee. | |

Do you guarantee timeliness and accuracy for filings and remittances? | Yes — Rippling guarantees every filing is correct and on time, indemnifying clients against system-caused penalties. | |

How do you handle compliance updates when laws or rates change? | Rippling’s compliance team continuously updates tax and labor rules, applied automatically in payroll. | |

Do you provide a permanent audit trail of payroll actions and filings? | Yes — Rippling creates immutable audit logs for every payroll action, exportable on demand. | |

Do timecards sync directly into payroll once approved? | Yes — approved timecards flow automatically into payroll, with overtime/break rules enforced by jurisdiction. | |

Do onboarding events (new hires, promotions, terminations) update payroll automatically? | Yes — Rippling HRIS updates payroll instantly when lifecycle events occur. | |

Are benefit deductions and employer contributions reflected in payroll in real time? | Yes — deductions and contributions sync automatically with payroll each cycle. | |

Do you integrate with accounting systems like QuickBooks or Xero for easy reconciliation? | Yes — Rippling integrates directly with QuickBooks, Xero, and NetSuite, posting journals automatically with GL dimensions. | |

Can permissions be set so managers only see payroll data for their teams? | Yes — Rippling supports dynamic, role-based access controls. | |

Reducing costs | What’s included in your base price, and what features cost extra? | Base payroll includes unlimited runs, filings, and year-end forms. Optional modules (Time, Benefits, Global Payroll) can be added. |

Do you charge for off-cycle runs, corrections, or year-end forms? | No — Rippling includes off-cycle runs, corrections, W-2s, and 1099s at no additional cost. | |

How does your platform help reduce administrative time for small teams? | Rippling automates over 95% of payroll admin work, cutting manual entry, reconciliation, and filings. | |

Can your system replace separate HR, time, and benefits tools to save vendor costs? | Yes — Rippling consolidates HR, time, payroll, and benefits into one system, reducing vendor spend. | |

Do you provide ROI metrics for small businesses? | Yes — Rippling provides benchmarks and case studies showing typical time and cost savings. | |

Scaling your business | Can your system handle multi-state compliance from day one? | Yes — Rippling supports compliance in all 50 states immediately, including automated registrations. |

Do you manage new tax accounts automatically as we grow? | Yes — Rippling registers and maintains new tax accounts as you add employees in new states. | |

Can payroll rules adapt automatically as employees relocate? | Yes — Rippling automatically applies the correct state and local rules when employee addresses change. | |

Do you support paying contractors or employees internationally when needed? | Yes — Rippling includes native global payroll to pay international employees and contractors in local currencies. | |

What’s the effort to scale from a handful of employees to hundreds? | Minimal — Rippling scales seamlessly, with no need to migrate systems or rebuild payroll. | |

Reporting and reconciliation | Which dashboards are included (payroll costs, headcount, taxes)? | Rippling includes real-time dashboards for payroll burn, headcount, employer costs, and taxes. |

Can non-technical users create and schedule reports? | Yes — Rippling has a simple reporting builder where admins can create and schedule reports to email or Slack. | |

How do payroll journals sync into our accounting system? | Rippling posts automated journals directly to QuickBooks, Xero, and NetSuite with GL dimensions. | |

Do you provide variance analysis across payroll cycles? | Yes — Rippling compares pay runs line-by-line to highlight deltas in gross pay, deductions, and taxes. | |

How long are records retained, and can they be exported for audits? | Payroll records are retained permanently, with full exportability for audits and due diligence. |

Ready to evaluate vendors?

Disclaimer

Rippling and its affiliates do not provide tax, accounting, or legal advice. This material has been prepared for informational purposes only, and is not intended to provide or be relied on for tax, accounting, or legal advice. You should consult your own tax, accounting, and legal advisors before engaging in any related activities or transactions.

Hubs

Author

The Rippling Team

Global HR, IT, and Finance know-how directly from the Rippling team.

Explore more

See Rippling in action

Increase savings, automate busy work, and make better decisions by managing HR, IT, and Finance in one place.

![[Blog - Hero Image] Payroll money](http://images.ctfassets.net/k0itp0ir7ty4/70b0IaqkwPFMXVEzVq8SOF/2526e71eef2555079e1df04c371c6267/Header_Payroll_01__2_.png)

![[Blog - Hero Image] Payroll](http://images.ctfassets.net/k0itp0ir7ty4/ETvyHP3pmEXRExpvQNdWq/004bbf55d4815bf1eb846c8996d67fc0/payroll.jpg)

![[Blog - Hero Image] Global payroll](http://images.ctfassets.net/k0itp0ir7ty4/6oFsV48ZtQByRWRMg8Prk7/6f6fd768526ba3231ca024d5fd25e36e/Header_Payroll_04_SEO_.png)