Must-have HRIS RFP template for small businesses in 2025

![[Blog - Hero Image] HR automation](http://images.ctfassets.net/k0itp0ir7ty4/6SDKHnjQrSgYRJvG5H8AHE/f29102adb200a5e82e81b880b43fee4c/Header_HR_Automation_01__1_.png)

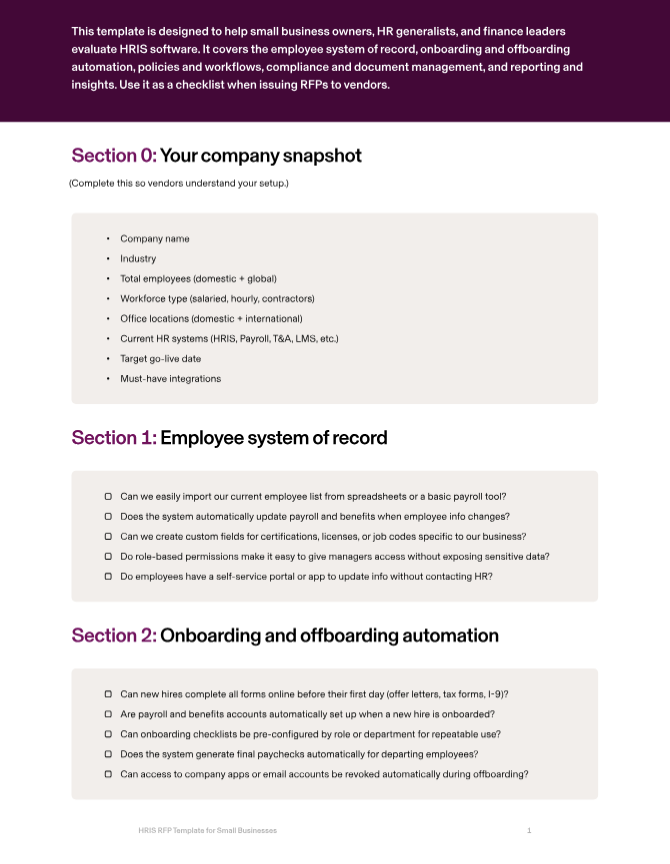

In this article

For small businesses, HR is often run by a single generalist—or split between a founder, office manager, or finance lead. As headcount grows, manual spreadsheets and lightweight payroll tools no longer cut it. PTO requests slip through the cracks, compliance tasks pile up, and employees don’t have one place to manage their information.

The right HRIS for small businesses should save time, keep you compliant, and provide a simple employee experience—without requiring a full HR department. It should be easy to implement, affordable to maintain, and powerful enough to manage payroll, benefits, and compliance as you grow.

This guide outlines the most important areas to evaluate when selecting HRIS software for small businesses, what best-in-class looks like, and the RFP questions to include in your process. Plus, we’ll include a free downloadable PDF so you can start evaluating vendors ASAP.

1. Employee system of record

Small businesses need one system of truth so that an address change, promotion, or new tax form doesn’t mean updating three separate systems. A modern HRIS keeps all employee data in sync with payroll and benefits, and gives employees self-service tools so they aren’t asking HR or finance for every change.

Rippling’s employee graph ensures that every update flows instantly everywhere it needs to—without HR rework. When someone moves or gets promoted, those changes ripple across the entire HRIS automatically

RFP questions to ask

Can we easily import our current employee list from spreadsheets or a basic payroll tool?

Does the system automatically update payroll and benefits when employee info changes?

Can we create custom fields for certifications, licenses, or job codes specific to our business?

Do role-based permissions make it easy to give managers access without exposing sensitive data?

Do employees have a self-service portal or app to update info without contacting HR?

2. Onboarding and offboarding automation

At small businesses, HR doesn’t have time to manually set up every new hire. The HRIS should handle everything: collecting forms, setting up payroll and benefits, and provisioning access automatically. Offboarding should be just as smooth, generating final paychecks and turning off system access so nothing is missed.

Rippling automates both ends of the employee lifecycle, saving hours of manual admin per hire.

RFP questions to ask

Can new hires complete all forms online before their first day (offer letters, tax forms, I-9)?

Are payroll and benefits accounts automatically set up when a new hire is onboarded?

Can onboarding checklists be pre-configured by role or department for repeatable use?

Does the system generate final paychecks automatically for departing employees?

Can access to company apps or email accounts be revoked automatically during offboarding?

3. Policies, approvals, and workflows

Most small businesses rely on ad hoc approvals over email or Slack. That doesn’t scale past 30–50 employees.

A modern HRIS should let you set up workflows that route automatically—like PTO requests, policy sign-offs, or expense approvals—without needing IT.

Rippling’s workflow engine lets small businesses configure approvals in minutes, and they update automatically as managers or teams change.

RFP questions to ask

Can PTO requests be submitted and approved in the system instead of via email?

Can we set up multi-step approvals for expenses or training without coding?

Do workflows adjust automatically if a manager leaves or reporting lines change?

Can reminders be sent to employees or managers when deadlines are missed?

Are approvals logged so we can show proof for audits or disputes?

4. Compliance and document management

Small businesses often don’t have compliance expertise in-house.

HRIS software should handle the basics automatically: I-9 and E-Verify, ACA and COBRA notices, and state-specific trainings. It should also make it easy to distribute and track documents like handbooks, NDAs, and safety policies.

Rippling automates compliance checks, assigns the right documents by role or location, and tracks completions with e-signature.

RFP questions to ask

Does the system support I-9, E-Verify, ACA, and COBRA compliance out of the box?

Can we assign documents (like handbooks or safety policies) by role, department, or state?

Do employees sign documents electronically, and are expirations tracked?

Will the system alert us if we’re missing a required compliance document?

What compliance certifications (SOC 2, ISO, GDPR) do you hold?

5. Reporting and insights

Small business leaders need answers without waiting on consultants: headcount, payroll costs, turnover, and compliance status.

A good HRIS should provide simple dashboards and reports that can be pulled by a non-technical HR generalist or office manager.

Rippling provides real-time reports for headcount, costs, and compliance, and exports easily into spreadsheets for board meetings or investor updates.

RFP questions to ask

What reports are included (headcount, payroll costs, turnover, compliance)?

Can a non-technical admin build and share reports without IT support?

Can reports be segmented by department, location, or manager?

Do you support simple exports into Excel, Google Sheets, or BI tools?

How is sensitive data restricted in shared or exported reports?

How Rippling helps small businesses

Rippling HRIS is built to make life easier for small HR teams—or for the single HR generalist wearing every hat. With Rippling, all employee data lives in one place, flowing automatically into payroll, benefits, and IT systems. That means no more updating spreadsheets, chasing signatures, or manually fixing payroll deductions when employees change benefits.

Onboarding and offboarding are handled automatically: new hires complete forms digitally before day one, payroll and benefits are set up instantly, and final paychecks plus access removal happen automatically when someone leaves.

Rippling also keeps small businesses compliant by automating I-9, E-Verify, ACA, and COBRA workflows, assigning documents by role or location, and surfacing risks before they become fines. Employees get a modern self-service app to view pay stubs, update personal info, and request time off—reducing the constant stream of questions to HR.

And because Rippling unifies HR, payroll, time, and benefits, small businesses can save thousands by consolidating vendors, while cutting the hours spent on admin work by more than 40%. The system scales with you, so when you grow from 25 to 200 employees, you won’t need to rip and replace your HRIS.

With Rippling HRIS, small businesses can:

Centralize HR, payroll, benefits, and time data in one system

Automate onboarding and offboarding workflows, including final paychecks and access removal

Configure PTO and expense approvals that adapt automatically as teams change

Stay compliant with automated I-9, ACA, COBRA, and state-specific policies

Empower employees with mobile self-service tools

Generate real-time reports for board, investor, or lender updates

Rippling RFP for HRIS for small businesses example

Section | Question to ask | Rippling Answer |

Employee system of record | Can we manage multiple entities and jurisdictions in one system of record? | Yes—Rippling supports multi-entity and multi-jurisdiction employee records in a single system of truth. |

| Does the system automatically sync data to payroll, benefits, and IT apps? | Yes—Rippling automatically syncs employee data across payroll, benefits, and IT apps in real time. |

| Can we create and report on custom fields (e.g., certifications, union codes, job grades)? | Yes—Rippling supports unlimited custom fields and reporting across them. |

| Do you support role-based permissions at department, entity, or region level? | Yes—Rippling provides granular role-based permissions at department, entity, and region levels. |

| Do employees have access to a self-service app for updating information? | Yes—employees can use Rippling’s mobile and web apps to update information and access records. |

Onboarding and offboarding automation | Can onboarding workflows be customized by department, entity, or geography? | Yes—Rippling supports configurable onboarding workflows by department, entity, or location. |

| Do payroll, tax setup, and benefits accounts generate automatically during onboarding? | Yes—Rippling automatically generates payroll, tax setup, and benefits accounts during onboarding. |

| Can devices and app access be provisioned/revoked automatically? | Yes—Rippling provisions and deprovisions apps and devices automatically based on onboarding/offboarding status. |

| Does the system automate COBRA notices and compliance at offboarding? | Yes—Rippling automates COBRA notices and compliance workflows at termination. |

| Are final paychecks generated automatically based on local jurisdiction rules? | Yes—Rippling generates compliant final paychecks automatically at offboarding. |

Policies, approvals, and workflows | Can we configure multi-level approval workflows (e.g., for time-off, expenses, promotions)? | Yes—Rippling allows configuration of multi-level, multi-step approval workflows for time-off, expenses, promotions, and more. |

| Do policies auto-update when employees change role, manager, or entity? | Yes—Rippling updates workflows and policies automatically when employee attributes change. |

| Are workflows mobile-friendly and accessible for busy managers? | Yes—Rippling approvals and workflows are accessible via mobile, email, and Slack. |

| Can workflows include deadlines, escalations, and SLA reminders? | Yes—Rippling workflows include SLA timers, escalation paths, and reminders for overdue tasks. |

| Do you provide audit-ready logs of all approvals and actions? | Yes—Rippling maintains immutable, exportable logs of all workflows and approvals. |

Compliance and document management | How do you manage compliance across multiple states and entities? | Rippling automates compliance for multi-state and multi-entity organizations with jurisdiction-specific rules. |

| Do you automate ACA, COBRA, and I-9/E-Verify requirements? | Yes—Rippling automates ACA, COBRA, I-9, and E-Verify compliance workflows. |

| Can we assign and track documents by role, department, or location? | Yes—Rippling allows document assignment and tracking by role, department, entity, or location. |

| Do you provide expiration and renewal alerts for compliance docs? | Yes—Rippling provides expiration alerts and renewal notifications for compliance-related documents. |

| What compliance certifications do you hold (SOC 2, ISO, GDPR)? | Rippling is SOC 2 Type II certified, ISO 27001 certified, and GDPR compliant. |

Reporting and insights | Do you provide entity- and department-level reporting out of the box? | Yes—Rippling includes entity- and department-level reporting and dashboards. |

| Can we build custom dashboards and reports without technical support? | Yes—Rippling provides a no-code report builder for custom dashboards and reports. |

| Do you support variance reporting across time (e.g., headcount trends, comp changes)? | Yes—Rippling supports variance analysis across pay periods, headcount, and compensation. |

| Can reports be scheduled and shared automatically with leadership? | Yes—Rippling allows reports to be scheduled and shared automatically with leadership teams. |

| Do you integrate with ERP and BI tools (e.g., NetSuite, Tableau)? | Yes—Rippling integrates with ERP systems like NetSuite and accounting systems like QuickBooks and Xero, and exports to BI tools. |

Ready to evaluate vendors?

Disclaimer

Rippling and its affiliates do not provide tax, accounting, or legal advice. This material has been prepared for informational purposes only, and is not intended to provide or be relied on for tax, accounting, or legal advice. You should consult your own tax, accounting, and legal advisors before engaging in any related activities or transactions.

Hubs

Author

The Rippling Team

Global HR, IT, and Finance know-how directly from the Rippling team.

Explore more

See Rippling in action

Increase savings, automate busy work, and make better decisions by managing HR, IT, and Finance in one place.

![[Blog - Hero Image] Header HR automation](http://images.ctfassets.net/k0itp0ir7ty4/4IFuamJNogIac56PkCYV3R/4b0ebd36383692820bc1847b400b892f/Header_HR_Automation_03__1_.png)

![[Blog - Hero Image] global compliance](http://images.ctfassets.net/k0itp0ir7ty4/46d2nz6T5coYGhYxJcO9CN/20fce5a5907ff01ba8bf2c209873e69c/global_compliance__1_.jpg)

![[Blog - Hero Image] Generic benefits image](http://images.ctfassets.net/k0itp0ir7ty4/55EsuTUgyraqizAc9lmq5C/d8efce0eba6f08cca3614c7b21731e15/Header_Generic_Benefits_Hero.jpg)