Must-have expense management software RFP template for enterprises in 2025

![[Blog - Hero Image] Expense management](http://images.ctfassets.net/k0itp0ir7ty4/36sOZvauN7TR1TLXSFOYo8/b2babbfdcbc3a7b4a26bbd6373bb4991/Header_Expense_Report_03__2_.jpg)

In this article

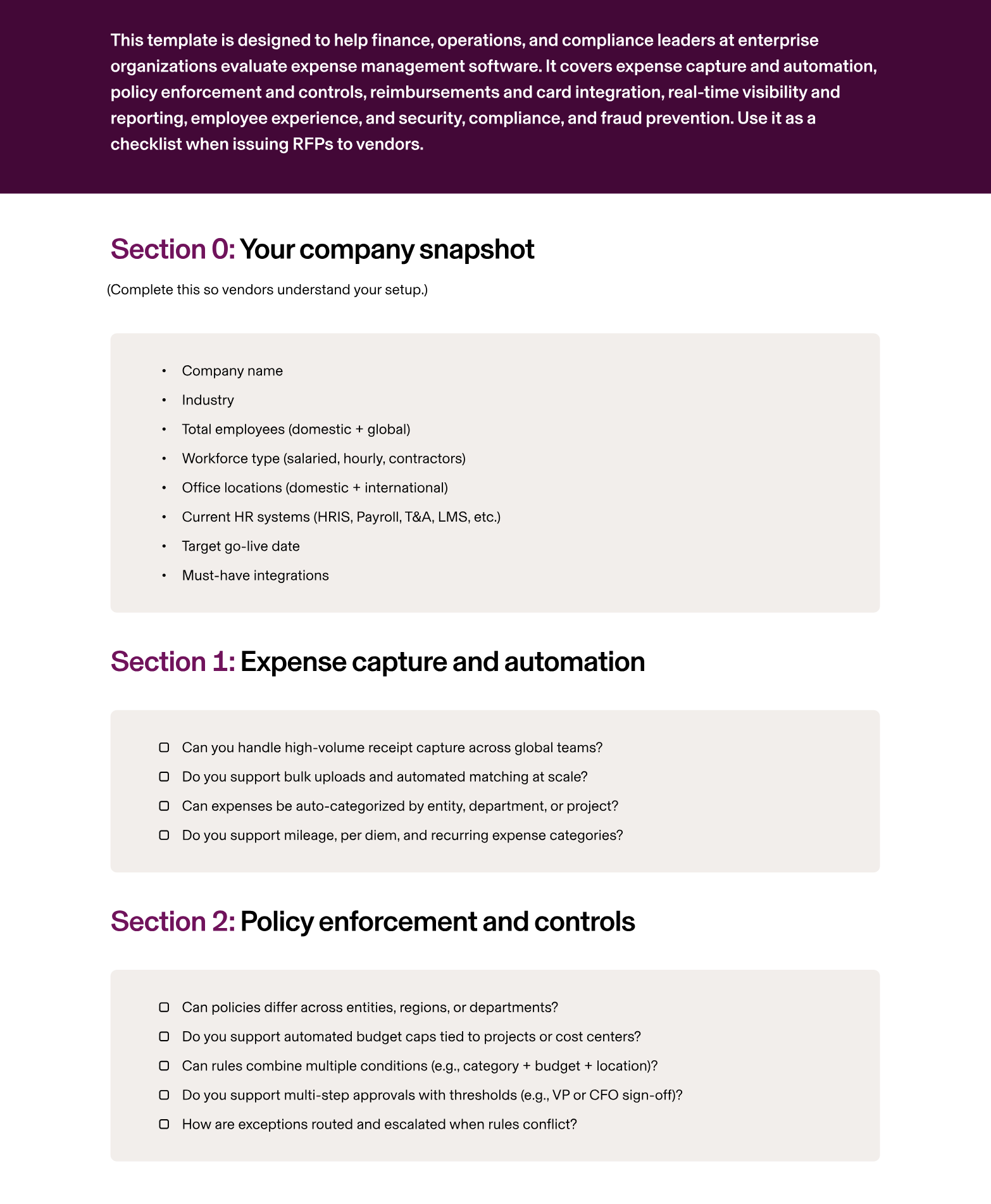

For enterprises, expense management is more than reimbursing employees — it’s about controlling spend across thousands of transactions, enforcing global policies, and ensuring compliance in every jurisdiction. Legacy systems often leave gaps: delayed reimbursements, policy violations slipping through, and endless reconciliation cycles that slow down close.

The right expense management platform should unify reimbursements, corporate cards, and policies into one system connected to HR and ERP data. It should automate compliance, support multi-level approval workflows, provide global visibility, and generate audit-ready reports. Just as importantly, it should deliver a simple employee experience, so adoption doesn’t lag behind.

This guide shows the critical areas enterprises should evaluate in an expense management RFP, what best-in-class looks like, and the RFP questions to ask vendors. Plus, we’ll give you a downloadable template so you can start evaluating expense management software ASAP.

1. Expense capture and automation

At enterprise scale, the volume of receipts and submissions is massive. Manual entry creates errors and compliance risks. A modern system should capture expenses automatically via mobile apps, email, Slack, or direct card matching, and categorize them instantly.

Rippling streamlines capture by auto-matching receipts to Corporate Card transactions, scanning receipts with OCR, and coding expenses by role, department, or project.

RFP questions to ask

Can you handle high-volume receipt capture across global teams?

Do you support bulk uploads and automated matching at scale?

Can expenses be auto-categorized by entity, department, or project?

Do you support mileage, per diem, and recurring expense categories?

2. Policy enforcement and controls

With thousands of employees, policies can’t be applied manually. You need layered, configurable rules tied to roles, budgets, entities, and geographies, enforced in real time at submission.

Rippling enforces policies directly from HR and ERP data, adapting automatically when employees switch roles or entities, and supports complex multi-level approvals for higher-value expenses.

RFP questions to ask

Can policies differ across entities, regions, or departments?

Do you support automated budget caps tied to projects or cost centers?

Can rules combine multiple conditions (e.g., category + budget + location)?

Do you support multi-step approvals with thresholds (e.g., VP or CFO sign-off)?

How are exceptions routed and escalated when rules conflict?

3. Reimbursements and card integration

Disconnected reimbursements, cards, and payroll create reconciliation nightmares at scale. Enterprises need one system that ties spend directly to the GL, processes reimbursements globally, and supports multiple payment rails.

Rippling unifies expense management with corporate cards and payroll, ensuring transactions auto-code to ERPs like SAP, Oracle, or NetSuite and reimbursements flow via payroll or ACH.

RFP questions to ask

Do you support global reimbursements in multiple currencies?

Which ERP systems do you integrate with (SAP, Oracle, NetSuite, Intacct)?

Can expenses auto-code to custom GL dimensions across entities?

Do you support split allocations across multiple cost centers, projects, or regions?

How are exceptions in reimbursements flagged and resolved?

4. Real-time visibility and reporting

Finance leaders can’t wait for close to see spend across thousands of employees and entities. The system should provide consolidated dashboards with drill-downs by department, region, or vendor, anomaly detection for unusual spend, and variance analysis across periods.

Rippling provides real-time dashboards and consolidated reporting across entities and currencies, exportable into ERP and BI tools.

RFP questions to ask

Can dashboards consolidate global spend with drill-down by entity or region?

Do you support multi-currency reporting with FX normalization?

Do you provide anomaly detection for suspicious or duplicate spend?

Can you generate variance reports across time periods, entities, or geographies?

Do reports integrate directly with BI and ERP platforms?

5. Employee experience

Enterprises need high adoption to ensure compliance and reduce manual intervention. Expense tools should be simple, mobile-friendly, and embedded in daily workflows like Slack or Gmail.

Rippling makes it easy for employees to capture receipts, submit expenses, and track reimbursements in real time, while providing a unified portal that ties into HR, payroll, and benefits.

RFP questions to ask

How do employees submit expenses with minimal friction?

Is there a mobile-first experience for field and traveling teams?

Can employees view and manage their reimbursements across multiple entities?

Do you support submissions and approvals through Slack, Gmail, or Outlook?

How do you ensure global adoption and ease of use at scale?

6. Security, compliance, and fraud prevention

Enterprises face high compliance and audit requirements. Your expense system must enforce enterprise-grade security: encryption, SOC 2, ISO 27001, GDPR compliance, and fraud detection. It should flag suspicious spend in real time and provide immutable audit logs across entities and jurisdictions.

Rippling encrypts data, enforces MFA, and generates immutable logs while flagging anomalies across all expenses.

RFP questions to ask

What global compliance certifications do you support (SOC 2, ISO 27001, GDPR)?

What fraud detection and monitoring features are included beyond duplicate detection?

Can admins freeze cards and block spend instantly across multiple entities?

Do you provide immutable, exportable audit logs for global audits?

How do you secure sensitive data at rest and in transit?

How Rippling helps enterprises

Rippling Expense Management is built to handle enterprise complexity at scale. Employees capture receipts seamlessly, policies are enforced at submission, and reimbursements flow globally via payroll or ACH. Every transaction auto-codes into ERPs like SAP, Oracle, or NetSuite, eliminating manual reconciliation.

Finance leaders get consolidated global dashboards with drill-downs by entity or department, anomaly detection for unusual spend, and variance reporting across periods and regions. Employees enjoy a simple, mobile-first experience that ensures high adoption, while security and fraud prevention keep compliance airtight.

With Rippling, enterprises can:

Capture and match receipts automatically across thousands of transactions

Enforce layered, entity-aware policies tied to HR and ERP data

Reimburse employees globally in multiple currencies

Integrate spend directly into SAP, Oracle, or NetSuite

Provide consolidated reporting across entities and geographies

Protect financial data with SOC 2/ISO certifications and fraud detection

Rippling RFP for expense management software for enterprises example

Section | Question to ask | Rippling Answer |

|---|---|---|

Expense capture and automation | Can you handle high-volume receipt capture across global teams? | Yes — Rippling supports high-volume capture through mobile app, email forwarding, Slack, and bulk uploads, automatically matching receipts to card transactions. |

Do you support bulk uploads and automated matching at scale? | Yes — Rippling supports bulk submissions and real-time receipt-to-transaction matching for thousands of users. | |

Can expenses be auto-categorized by entity, department, or project? | Yes — Rippling auto-categorizes expenses by merchant and assigns categories based on HRIS attributes like entity, department, or project. | |

Do you support mileage, per diem, and recurring expense categories? | Yes — Rippling supports mileage tracking, per diem submissions, and recurring expense categories with automated policy enforcement. | |

Policy enforcement and controls | Can policies differ across entities, regions, or departments? | Yes — Rippling allows policies to be customized by entity, geography, department, or role, adapting automatically to HR data changes. |

Do you support automated budget caps tied to projects or cost centers? | Yes — Rippling enforces budget caps tied to projects, cost centers, or categories, blocking spend beyond thresholds. | |

Can rules combine multiple conditions (e.g., category + budget + location)? | Yes — Rippling supports layered conditions such as budget limits, category restrictions, and receipt requirements simultaneously. | |

Do you support multi-step approvals with thresholds (e.g., VP or CFO sign-off)? | Yes — Rippling supports configurable multi-level approvals triggered by spend thresholds or entity rules. | |

How are exceptions routed and escalated when rules conflict? | Exceptions are routed to designated approvers with configurable escalation paths for urgent or conflicting spend. | |

Reimbursements and card integration | Do you support global reimbursements in multiple currencies? | Yes — Rippling supports reimbursements via payroll and ACH globally, with multi-currency support. |

Which ERP systems do you integrate with (SAP, Oracle, NetSuite, Intacct)? | Rippling integrates directly with NetSuite, Intacct, and QuickBooks, and supports API/file-based workflows with SAP and Oracle. | |

Can expenses auto-code to custom GL dimensions across entities? | Yes — Rippling auto-codes expenses to GL dimensions such as entity, cost center, project, and geography in real time. | |

Do you support split allocations across multiple cost centers, projects, or regions? | Yes — Rippling supports split allocations across multiple cost centers, projects, or regions for accurate GL coding. | |

How are exceptions in reimbursements flagged and resolved? | Exceptions are flagged automatically and routed to finance teams for review with full audit logs. | |

Real-time visibility and reporting | Can dashboards consolidate global spend with drill-down by entity or region? | Yes — Rippling dashboards consolidate spend globally with drill-downs by entity, region, department, or vendor. |

Do you support multi-currency reporting with FX normalization? | Yes — Rippling supports multi-currency reporting and applies consistent FX conversions across reports. | |

Do you provide anomaly detection for suspicious or duplicate spend? | Yes — Rippling provides anomaly detection to flag duplicate, suspicious, or unusual spend patterns. | |

Can you generate variance reports across time periods, entities, or geographies? | Yes — Rippling provides variance reporting across entities, geographies, and time periods (e.g., quarter vs. quarter). | |

Do reports integrate directly with BI and ERP platforms? | Yes — Rippling exports reports into BI and ERP platforms such as Tableau, NetSuite, and SAP. | |

Employee experience | How do employees submit expenses with minimal friction? | Employees can snap a receipt in the mobile app, forward it via email, or upload via Slack, with no training required. |

Is there a mobile-first experience for field and traveling teams? | Yes — Rippling provides a mobile-first experience for frequent travelers and field teams to submit expenses instantly. | |

Can employees view and manage their reimbursements across multiple entities? | Yes — Rippling provides a unified portal for employees to view and manage reimbursements across multiple entities and projects. | |

Do you support submissions and approvals through Slack, Gmail, or Outlook? | Yes — employees can submit expenses and managers can approve them directly through Slack, Gmail, or Outlook. | |

How do you ensure global adoption and ease of use at scale? | Rippling delivers a consumer-grade experience through a single app for HR, payroll, and expenses, driving adoption across thousands of employees. | |

Security and fraud prevention | What global compliance certifications do you support (SOC 2, ISO 27001, GDPR)? | Rippling is SOC 2 Type II certified, ISO 27001 certified, and GDPR compliant. |

What fraud detection and monitoring features are included beyond duplicate detection? | Rippling uses anomaly detection to flag duplicates, suspicious patterns, and out-of-policy spend across entities and regions. | |

Can admins freeze cards and block spend instantly across multiple entities? | Yes — admins can freeze Rippling Corporate Cards or block spend instantly across entities or regions. | |

Do you provide immutable, exportable audit logs for global audits? | Yes — Rippling maintains immutable audit logs, exportable by entity, geography, or date range for internal and external audits. | |

How do you secure sensitive data at rest and in transit? | All financial data is encrypted at rest and in transit with enterprise-grade security standards, with MFA enforced for admins. |

Ready to evaluate vendors?

Disclaimer

Rippling and its affiliates do not provide tax, accounting, or legal advice. This material has been prepared for informational purposes only, and is not intended to provide or be relied on for tax, accounting, or legal advice. You should consult your own tax, accounting, and legal advisors before engaging in any related activities or transactions.

Hubs

Author

The Rippling Team

Global HR, IT, and Finance know-how directly from the Rippling team.

Explore more

See Rippling in action

Increase savings, automate busy work, and make better decisions by managing HR, IT, and Finance in one place.

![[Blog - Hero Image] Expense management](http://images.ctfassets.net/k0itp0ir7ty4/6ksT1tyMQlvUcjTJ4gMThI/e863f813b58b66432fb6f2bd2b860475/Header_Expense_Management_hero__1_.jpg)

![[Blog - Hero Image] Expense management image with magnifying glass](http://images.ctfassets.net/k0itp0ir7ty4/4QLqciNALVuIa3RyghYgyk/4a987075ea0215787f6f4c3d517dea84/Header_Expense_Management_02__3_.jpg)

![[Blog - Hero Image] Corporate card policy](http://images.ctfassets.net/k0itp0ir7ty4/5IEfSYdmrcM8Z1OIT50bBh/54d1041fc98926d5584218dd42ccefb0/Blog_Inline_Image_Corporate_Card_Policy.png)

![[Blog - Hero Image] HR Automated Green](http://images.ctfassets.net/k0itp0ir7ty4/joUSqVqlrQpyWsytNfZR7/45783e58431e17bed466facbed5b0e08/Header_HR_Automated.jpg)