Must-have benefits administration software RFP template for small businesses in 2025

![[Blog - Hero Image] Generic benefits image](http://images.ctfassets.net/k0itp0ir7ty4/55EsuTUgyraqizAc9lmq5C/d8efce0eba6f08cca3614c7b21731e15/Header_Generic_Benefits_Hero.jpg)

In this article

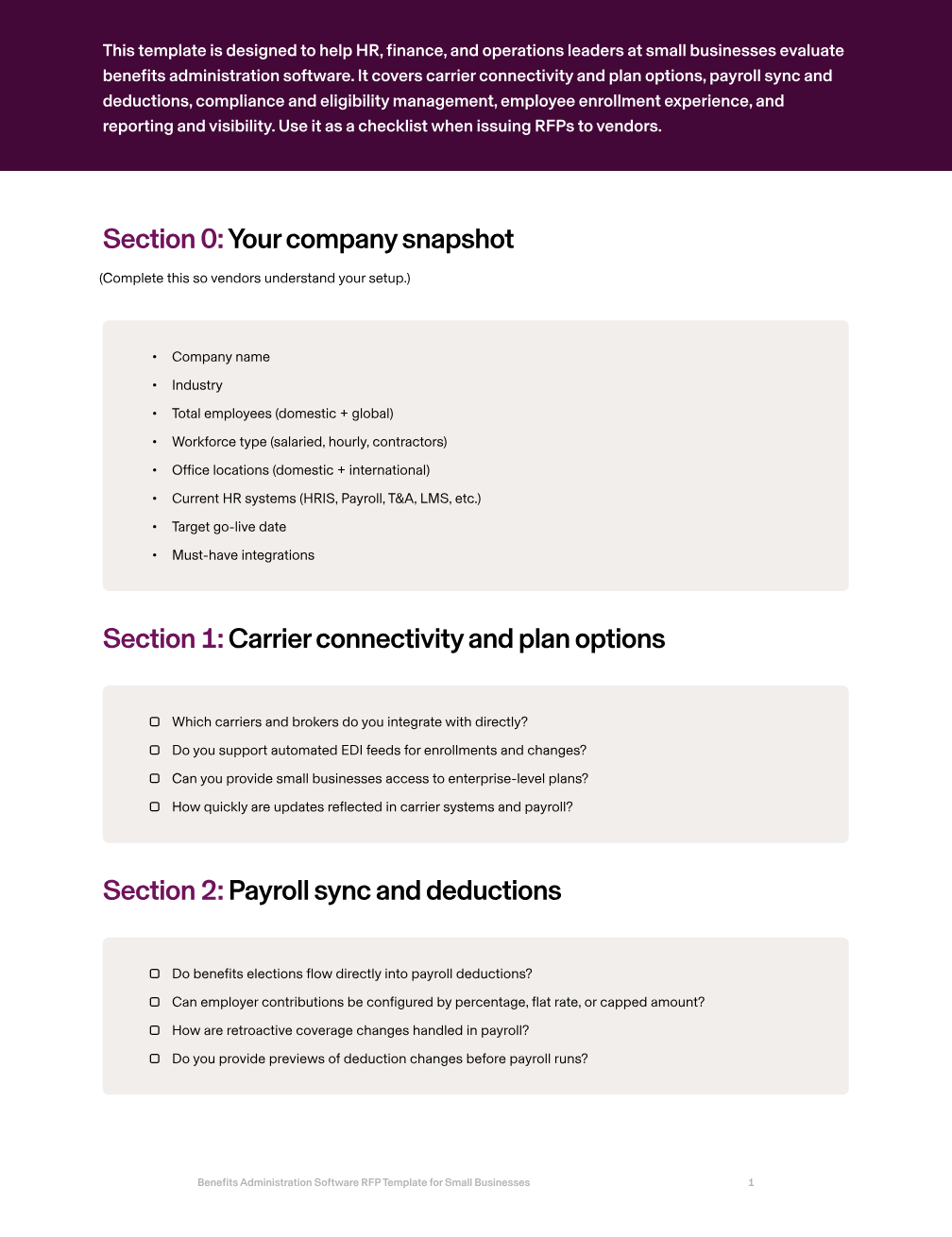

For small businesses, benefits can quickly become overwhelming. As headcount grows, so do the challenges: managing multiple carriers, syncing payroll deductions, tracking eligibility, and keeping up with compliance requirements like ACA and COBRA. Without the right system, HR and finance teams get buried in manual updates, while employees get frustrated with clunky enrollment processes and slow reimbursements.

The right benefits administration platform should unify everything — from carrier connections to payroll sync — into one simple system. It should automate compliance, give employees a modern self-service experience, and provide finance and HR leaders with real-time visibility into costs and enrollment trends.

This guide shows the critical areas small businesses should evaluate in a benefits administration RFP, what best-in-class looks like, and the RFP questions to ask vendors. Plus, we’ll give you a downloadable template so you can start evaluating benefits software ASAP.

1. Carrier connectivity and plan options

As small businesses grow, they need access to competitive plans while keeping administration simple. Benefits systems should connect directly with carriers to automate enrollments and changes, eliminating manual errors and delays.

Rippling integrates directly with top carriers and brokers, ensuring employees can access affordable, high-quality plans while HR avoids double-entry.

RFP questions to ask

Which carriers and brokers do you integrate with directly?

Do you support automated EDI feeds for enrollments and changes?

Can you provide small businesses access to enterprise-level plans?

How quickly are updates reflected in carrier systems and payroll?

2. Payroll sync and deductions

Payroll and benefits have to stay perfectly aligned as employees enroll, change coverage, or experience life events. Errors in deductions can mean compliance violations and upset employees.

Rippling unifies payroll and benefits in a single system, so deductions and contributions update instantly and automatically across every payroll cycle.

RFP questions to ask

Do benefits elections flow directly into payroll deductions?

Can employer contributions be configured by percentage, flat rate, or capped amount?

How are retroactive coverage changes handled in payroll?

Do you provide previews of deduction changes before payroll runs?

3. Compliance and eligibility management

With multiple states, employees, and plan types, compliance becomes a growing burden for small businesses. Missing ACA reporting or COBRA notices can result in steep penalties.

Rippling automates ACA measurement and reporting, manages COBRA notifications, and provides I-9/E-Verify compliance — all tied directly to the employee record for accuracy.

RFP questions to ask

Do you automate ACA tracking and reporting?

How do you handle COBRA enrollment and notices?

Do you support I-9 and E-Verify as part of benefits workflows?

Can we export compliance reports for audits or regulators?

4. Employee enrollment experience

Employees expect an easy, modern enrollment experience. If benefits are confusing, they’ll turn to HR for support, creating extra work and slowing down enrollment.

Rippling gives employees a guided, digital experience to compare plans, add dependents, and update coverage from their mobile device or desktop — all in the same app they use for payroll and HR tasks.

RFP questions to ask

Can employees compare plan costs and coverage before enrolling?

Do you support mobile-friendly enrollment with e-signatures?

How are qualifying life events managed in the platform?

Can employees update dependents and coverage through self-service?

5. Reporting and visibility

Small businesses need clear visibility into benefits costs to manage budgets and make strategic decisions. Reporting should show enrollment trends, employer contributions, and costs by team or department. Rippling provides real-time dashboards and exportable reports so HR and finance leaders always have accurate, up-to-date insights.

RFP questions to ask

Do you provide dashboards that show benefits costs and enrollment trends?

Can reporting be segmented by department, location, or role?

Do you support variance analysis across different open enrollment cycles?

Can benefits data export into Excel, Google Sheets, or BI tools?

How Rippling helps small businesses

Rippling Benefits Administration is designed to make managing benefits simple and stress-free for small businesses. It connects directly to carriers, syncs deductions automatically into payroll, and enforces compliance by default. Employees get a smooth, mobile-friendly enrollment experience, while HR and finance leaders get dashboards that show costs and enrollment status in real time.

With Rippling, small businesses can:

Access competitive health, dental, and vision plans through top carriers

Sync payroll deductions automatically with benefits elections

Automate ACA, COBRA, and I-9 compliance workflows

Give employees a guided, self-service enrollment experience

Report instantly on costs, contributions, and enrollment trends

Rippling RFP for benefits administration software for small businesses example

Section | Question to ask | Rippling Answer |

|---|---|---|

Carrier connectivity and plan options | Which carriers and brokers do you integrate with directly? | Rippling integrates with top national and regional carriers and leading brokers, giving small businesses access to competitive plan options. |

Do you support automated EDI feeds for enrollments and changes? | Yes — Rippling supports automated EDI and API feeds so enrollment changes sync to carriers instantly. | |

Can you provide small businesses access to enterprise-level plans? | Yes — Rippling pools buying power across customers to help small businesses access affordable, large-company-style benefits. | |

How quickly are updates reflected in carrier systems and payroll? | Updates are reflected in Rippling Payroll in real time, ensuring deductions and contributions stay accurate. | |

Payroll sync and deductions | Do benefits elections flow directly into payroll deductions? | Yes — Rippling automatically syncs elections into payroll deductions with no manual work. |

Can employer contributions be configured by percentage, flat rate, or capped amount? | Yes — Rippling supports contributions by percentage, flat amount, or capped limit. | |

How are retroactive coverage changes handled in payroll? | Rippling applies retroactive changes automatically and generates adjustment previews for review. | |

Do you provide previews of deduction changes before payroll runs? | Yes — Rippling provides pre-submit previews of all deduction and contribution changes. | |

Compliance and eligibility management | Do you automate ACA tracking and reporting? | Yes — Rippling automates ACA measurement tracking, reporting, and alerts for compliance. |

How do you handle COBRA enrollment and notices? | Rippling automates COBRA notices and manages enrollment directly in the system. | |

Do you support I-9 and E-Verify as part of benefits workflows? | Yes — Rippling includes built-in I-9 completion and E-Verify support tied to the employee record. | |

Can we export compliance reports for audits or regulators? | Yes — Rippling provides compliance dashboards with exportable, audit-ready reports. | |

Employee enrollment experience | Can employees compare plan costs and coverage before enrolling? | Yes — employees can compare costs and coverage side by side directly in Rippling before making elections. |

Do you support mobile-friendly enrollment with e-signatures? | Yes — Rippling supports mobile-first enrollment with digital signatures for all required forms. | |

How are qualifying life events managed in the platform? | Rippling detects life events and automatically prompts employees to update coverage and dependents. | |

Can employees update dependents and coverage through self-service? | Yes — employees can manage dependents, coverage, and elections in Rippling’s self-service portal. | |

Reporting and visibility | Do you provide dashboards that show benefits costs and enrollment trends? | Yes — Rippling provides dashboards showing costs, contributions, and enrollment status in real time. |

Can reporting be segmented by department, location, or role? | Yes — Rippling allows segmentation of reports by department, role, and location. | |

Do you support variance analysis across different open enrollment cycles? | Yes — Rippling tracks changes and variance across multiple enrollment periods for trend analysis. | |

Can benefits data export into Excel, Google Sheets, or BI tools? | Yes — Rippling supports exports to Excel, Google Sheets, and BI tools for deeper analysis. |

Ready to evaluate vendors?

Disclaimer

Rippling and its affiliates do not provide tax, accounting, or legal advice. This material has been prepared for informational purposes only, and is not intended to provide or be relied on for tax, accounting, or legal advice. You should consult your own tax, accounting, and legal advisors before engaging in any related activities or transactions.

Hubs

Author

Vanessa Kahkesh

Content Marketing Manager, HR

Vanessa Kahkesh is a content marketer for HR passionate about shaping conversations at the intersection of people, strategy, and workplace culture. At Rippling, she leads the creation of HR-focused content. Vanessa honed her marketing, storytelling, and growth skills through roles in product marketing, community-building, and startup ventures. She worked on the product marketing team at Replit and was the founder of STUDENTpreneurs, a global community platform for student founders. Her multidisciplinary experience — combining narrative, brand, and operations — gives her a unique lens into HR content: she effectively bridges the technical side of HR with the human stories behind them.

Explore more

See Rippling in action

Increase savings, automate busy work, and make better decisions by managing HR, IT, and Finance in one place.

![[Blog - Hero Image] Generic benefits image](http://images.ctfassets.net/k0itp0ir7ty4/1FKLpp8uQwSQPnsVFGH2uC/b42287f4e9f74195cd21b106bdf18f6c/Header_Generic_Benefits_03.jpg)

![[Blog - Hero Image] Header HR automation](http://images.ctfassets.net/k0itp0ir7ty4/4IFuamJNogIac56PkCYV3R/4b0ebd36383692820bc1847b400b892f/Header_HR_Automation_03__1_.png)