Must-have benefits administration software RFP template in 2025

In this article

Benefits administration is one of the most complex and time-consuming parts of HR. It’s also one of the most expensive — and one of the most critical for attracting and retaining top talent.

Yet many teams are stuck with outdated, disconnected systems that make every step harder: onboarding new hires, running open enrollment, syncing with carriers, handling compliance requirements like COBRA and ACA, and answering endless employee questions.

The right benefits administration software eliminates busywork by unifying benefits with HR and payroll, automating compliance, and giving employees a modern, intuitive experience. The wrong choice leaves HR buried in spreadsheets and employees confused by clunky systems.

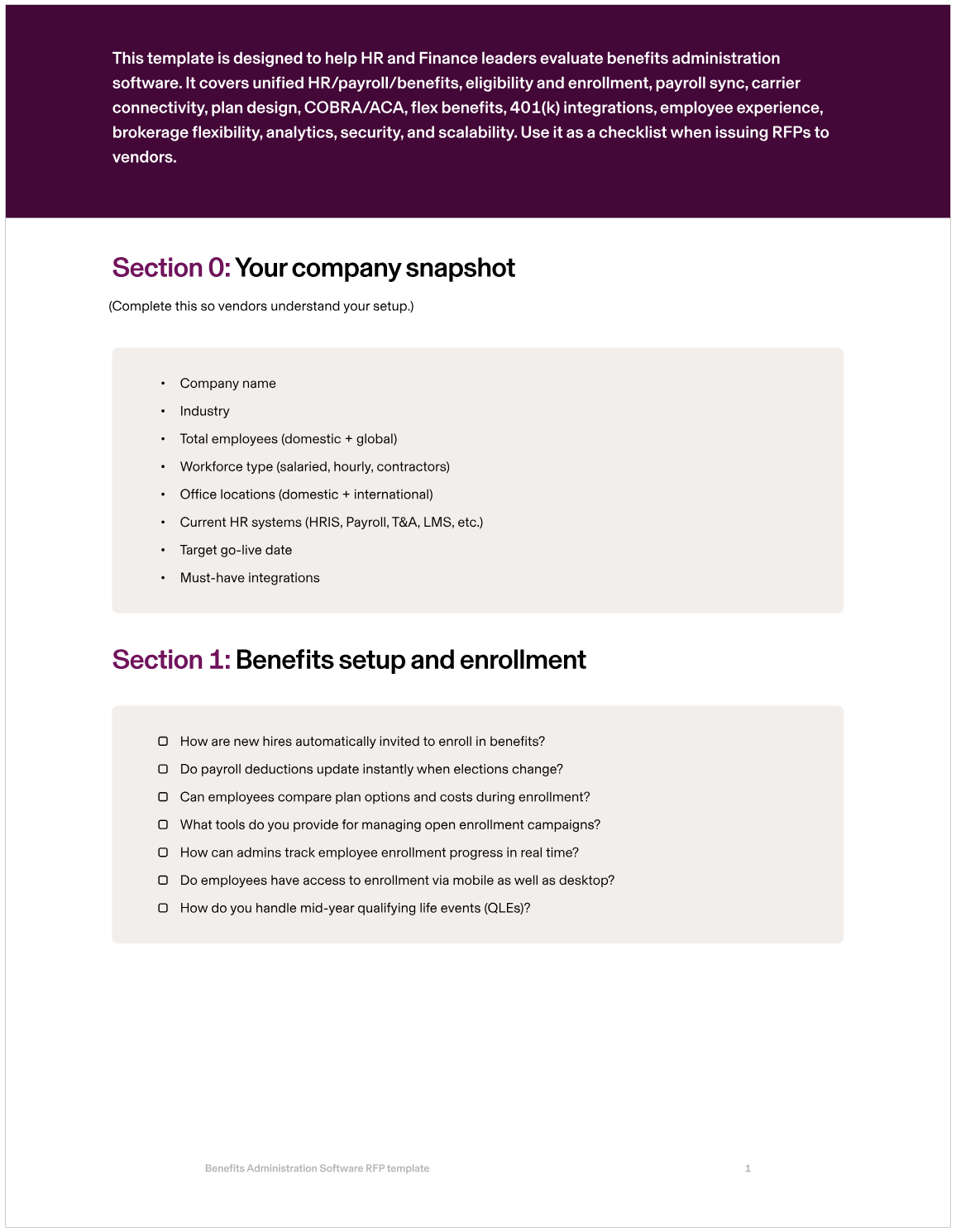

To evaluate providers consistently, many enterprises issue a Request for Proposal (RFP). Below, we outline the most important areas to include in your RFP, why they matter, and sample questions to ask. Plus, you’ll get a free downloadable template so you can start evaluating vendors ASAP.

1. Benefits setup and enrollment

Configuring benefits should be fast and seamless. It shouldn’t require months of manual setup and chasing employees during open enrollment. Employers need confidence that new hires are prompted to enroll automatically, payroll deductions update in real time, and contribution changes don’t require manual work.

Rippling automates the full enrollment lifecycle: new hires are invited to enroll in eligible benefits immediately, payroll deductions update automatically for QLEs, and admins can track enrollment progress against deadlines from one dashboard.

Questions to include in your RFP:

How are new hires automatically invited to enroll in benefits?

Do payroll deductions update instantly when elections change?

Can employees compare plan options and costs during enrollment?

What tools do you provide for managing open enrollment campaigns?

How can admins track employee enrollment progress in real time?

Do employees have access to enrollment via mobile as well as desktop?

How do you handle mid-year qualifying life events (QLEs)?

2. Carrier connectivity and integrations

Most benefits errors come from bad carrier integrations — file feeds breaking, data not syncing, or missing enrollments. A modern platform needs reliable, transparent integrations with the majority of carriers.

Rippling connects with 95% of carriers using in-house EDI and API integrations, giving admins and brokers real-time visibility into transmission history and file status. This reduces errors and provides confidence that data is accurate.

Questions to include in your RFP:

Which carriers do you integrate with directly?

Do you support both EDI and API connections?

How can admins or brokers track the status of file transmissions?

What visibility do you provide into setup progress and file history?

How do you prevent missed or duplicate enrollments?

What tools exist to reconcile discrepancies with carriers?

Do you provide alerts when carrier files fail or need intervention?

3. Compliance automation

COBRA, ACA, and state-level filings are high-stakes compliance areas. Manual processes or separate vendors create risks of penalties and lapses in coverage. Look for benefits administration software that automates compliance to help you stay ahead — whether that’s handling state-specific requirements when you hire an employee in a new state or flagging when a policy is out of line.

Rippling automates COBRA and ACA compliance end-to-end. The system detects QLEs like terminations or hours changes, sends required notices automatically, handles COBRA premium payments, and generates ACA filings without manual work. Because everything lives in one system, payroll, eligibility, and benefits stay in sync.

Questions to include in your RFP:

How do you automate COBRA notifications and premium collection?

Do you support ACA compliance and end-of-year filings?

How are qualifying life events detected and processed automatically?

Can COBRA and ACA notices be tracked in one dashboard?

What audit-ready compliance reports do you provide?

Do you handle state-specific filings (e.g., California Pay Data Report)?

How do you ensure benefits data stays in sync with payroll for compliance?

SurrealDB, a global database company with employees across eight countries, struggled to manage compliance across fragmented systems. Pension obligations and termination rules were mishandled, exposing them to risk. With Rippling, they automated COBRA and ACA compliance, gained real-time alerts for obligations, and unified payroll and benefits data in one system.

RFP criteria: COBRA and ACA automation, unified payroll and benefits data, automated QLE detection, audit-ready compliance reporting, real-time compliance alerts.

4. Flex benefits (HSA, FSA, commuter)

Flex benefits are often siloed into separate systems, requiring manual payroll updates every pay period. This can frustrate both admins and employees when everything is in a different place and feels impossible to keep track of.

Rippling integrates HSA, FSA, and commuter benefits directly with payroll and HR. Deductions sync automatically, enrollments are self-serve, and employees can manage their contributions and expenses from one app.

Questions to include in your RFP:

How do flex benefit elections sync with payroll?

Do you support both employee and employer contributions?

Can employees manage HSA, FSA, and commuter accounts in the same platform as medical and dental?

Do you provide a single card for all pre-tax flex benefits?

How are claims submitted and tracked?

What guardrails exist to prevent conflicting elections (e.g., HSA and general FSA)?

How quickly are reimbursements processed?

5. Broker flexibility

Companies want choice in how they manage benefits — whether that’s through a PEO, Rippling’s own brokerage, or an existing broker relationship. Many legacy systems force a rip-and-replace approach.

Rippling is flexible by design. Employers can start on the Rippling PEO, use Rippling as a broker, or bring their own broker onto the platform. No matter the model, admins and employees get the same seamless experience.

Questions to include in your RFP:

Do you require customers to use your broker, or can we bring our own?

What benefits does your brokerage provide beyond carrier connections?

Can third-party brokers manage plans directly in your platform?

Do you provide transparency into broker commissions and renewals?

How do you handle renewals and contribution changes with external brokers?

If we start on your PEO, can we move off without disrupting our benefits system?

Do you support broker collaboration in open enrollment setup and reporting?

6. Reporting and insights

Benefits represent a huge financial investment, but many teams struggle to get clear, consolidated insights into costs and utilization. Without visibility, it’s impossible to make data-driven benefits decisions.

Rippling consolidates benefits data with payroll and HR, making it easy to run reports on enrollment trends, plan usage, contribution breakdowns, and costs by entity or department. Reports update in real time, without exporting to spreadsheets.

Questions to include in your RFP:

What reporting do you provide on benefits enrollment and utilization?

Can we view costs broken down by employer vs. employee contributions?

Do reports support segmentation by department, entity, or geography?

How often are reports updated?

Can data be exported to BI or finance systems?

Do you provide dashboards for executives to view high-level metrics?

Can reports track benefits engagement and participation over time?

7. Employee experience

Benefits can be confusing and overwhelming — which is even more stressful when they’re providing fundamental services for employees. When they have more questions for HR, it can be a frustrating and difficult process for all. A modern benefits administration software must make enrollment intuitive and ongoing benefits access seamless.

Rippling delivers a consumer-grade experience: employees can compare plans, enroll with cost breakdowns, view ID cards, update contributions, and manage QLEs all from desktop or mobile. Everything is in one login, reducing confusion and boosting engagement.

Questions to include in your RFP:

How do employees view and compare benefit plan options?

Do employees get digital ID cards in the app?

Can employees update contributions and coverage during QLEs without admin intervention?

What mobile features are available for benefits access?

How do you support employees in making smarter benefits decisions?

Can employees track deductions and balances in real time?

What self-service tools exist to reduce benefits-related HR questions?

How Rippling helps enterprises

Rippling makes benefits administration seamless by unifying HR, payroll, and benefits into one platform. Unlike legacy systems with clunky interfaces and fragile integrations, Rippling’s benefits administration software automates enrollment, carrier connections, compliance, and reporting — while giving employees a modern, intuitive experience.

With Rippling, enterprises can:

Automate new hire enrollment, open enrollment, and payroll sync

Connect directly with 95% of carriers via in-house EDI and API integrations

Stay compliant with built-in COBRA and ACA automation

Run real-time reports on costs, usage, and employee engagement

Offer HSA, FSA, and commuter benefits directly in the same system

Work flexibly with Rippling’s PEO, brokerage, or your own broker

Deliver a seamless employee experience on desktop and mobile

By consolidating benefits administration in one system, Rippling helps businesses save time, avoid compliance risks, and deliver benefits that employees actually use and love.

Rippling RFP for benefits administration software example

Question to ask | Example Answer (Rippling) | |

|---|---|---|

Benefits Setup and Enrollment | How are new hires automatically invited to enroll in benefits? | Rippling automatically invites new hires to enroll in benefits during onboarding with smart eligibility logic that ensures they only see the plans they qualify for. |

Do payroll deductions update instantly when elections change? | Yes. All deductions auto-sync with payroll in real time whenever an employee makes a change or has a qualifying life event. | |

Can employees compare plan options and costs during enrollment? | Yes. Rippling provides side-by-side plan comparisons with cost breakdowns for employees to make informed choices. | |

What tools do you provide for managing open enrollment campaigns? | Admins can set up open enrollment, send automated reminders, and track enrollment progress from a single dashboard. | |

How can admins track employee enrollment progress in real time? | Admins can see enrollment progress by employee, department, or entity and send reminders to outstanding employees. | |

Do employees have access to enrollment via mobile as well as desktop? | Yes. Rippling’s mobile and desktop apps both support full enrollment functionality. | |

How do you handle mid-year qualifying life events (QLEs)? | Rippling detects QLEs automatically, prompts employees to update benefits, and syncs any changes directly to payroll. | |

Carrier Connectivity and Integrations | Which carriers do you integrate with directly? | Rippling connects with 95% of major carriers through in-house EDI and API integrations. |

Do you support both EDI and API connections? | Yes. Rippling manages both EDI and API integrations in-house for reliability and speed. | |

How can admins or brokers track the status of file transmissions? | Rippling provides real-time visibility into file transmission history, including confirmation of successful sends. | |

What visibility do you provide into setup progress and file history? | Admins can see the status of integrations, track setup progress, and view detailed file history logs. | |

How do you prevent missed or duplicate enrollments? | Rippling validates data against carrier requirements and automatically flags or corrects errors before transmission. | |

What tools exist to reconcile discrepancies with carriers? | Admins and brokers can view integration dashboards with alerts for any discrepancies to resolve quickly. | |

Do you provide alerts when carrier files fail or need intervention? | Yes. Rippling automatically flags failed file transmissions and alerts admins in real time. | |

Compliance Automation | How do you automate COBRA notifications and premium collection? | Rippling detects COBRA QLEs, sends election notices, manages payments, and cancels coverage automatically if premiums aren’t paid. |

Do you support ACA compliance and end-of-year filings? | Yes. Rippling automates ACA compliance, including eligibility detection, notices, and year-end filings. | |

How are qualifying life events detected and processed automatically? | Rippling monitors employee data (job changes, location changes, hours worked) to detect QLEs and trigger updates. | |

Can COBRA and ACA notices be tracked in one dashboard? | Yes. Rippling centralizes COBRA and ACA compliance workflows in one dashboard with full visibility. | |

What audit-ready compliance reports do you provide? | Rippling provides exportable reports for COBRA, ACA, and other benefit-related compliance requirements. | |

Do you handle state-specific filings (e.g., California Pay Data Report)? | Yes. Rippling automates dozens of state and local filings, including California Pay Data and EEO-1. | |

How do you ensure benefits data stays in sync with payroll for compliance? | Because Rippling is unified, all benefit elections and deductions auto-update payroll in real time. | |

Flex Benefits (HSA, FSA, Commuter) | How do flex benefit elections sync with payroll? | Rippling automatically syncs flex benefit deductions with payroll every pay period, no manual updates required. |

Do you support both employee and employer contributions? | Yes. Rippling manages both contributions in payroll automatically. | |

Can employees manage HSA, FSA, and commuter accounts in the same platform as medical and dental? | Yes. Flex benefits are managed directly within Rippling alongside all other benefits. | |

Do you provide a single card for all pre-tax flex benefits? | Yes. Employees receive one debit card for HSA, FSA, and commuter expenses, with Apple Pay support. | |

How are claims submitted and tracked? | Employees can submit and track reimbursement claims directly in Rippling, with approvals typically within one business day. | |

What guardrails exist to prevent conflicting elections (e.g., HSA and general FSA)? | Rippling uses smart eligibility logic to prevent invalid elections and maintain compliance. | |

How quickly are reimbursements processed? | Approved claims are reimbursed within 1–2 business days. | |

Broker Flexibility | Do you require customers to use your broker, or can we bring our own? | Rippling supports three models: Rippling PEO, Rippling Brokerage, or bring-your-own broker. |

What benefits does your brokerage provide beyond carrier connections? | Rippling Brokerage provides quoting, plan comparisons, carrier submissions, and dedicated benefits specialists. | |

Can third-party brokers manage plans directly in your platform? | Yes. Third-party brokers can set up and manage plans directly in Rippling. | |

Do you provide transparency into broker commissions and renewals? | Yes. Rippling provides transparency into renewal rates and broker fees. | |

How do you handle renewals and contribution changes with external brokers? | Rippling syncs contribution updates across benefits and payroll and works with brokers for renewals. | |

If we start on your PEO, can we move off without disrupting our benefits system? | Yes. Rippling uniquely allows seamless transitions off PEO without needing to switch systems. | |

Do you support broker collaboration in open enrollment setup and reporting? | Yes. Brokers can collaborate in Rippling with real-time visibility into enrollment data. | |

Reporting and Insights | What reporting do you provide on benefits enrollment and utilization? | Rippling provides pre-built and custom reports on enrollment trends, participation rates, and plan usage. |

Can we view costs broken down by employer vs. employee contributions? | Yes. Reports show both employer and employee contributions across all benefits. | |

Do reports support segmentation by department, entity, or geography? | Yes. Reports can be segmented by department, entity, location, or role. | |

How often are reports updated? | All reports are updated in real time with live benefits and payroll data. | |

Can data be exported to BI or finance systems? | Yes. Data can be exported or connected via APIs to BI and finance tools. | |

Do you provide dashboards for executives to view high-level metrics? | Yes. Rippling provides executive dashboards with high-level benefits cost and utilization metrics. | |

Can reports track benefits engagement and participation over time? | Yes. Rippling’s reporting engine tracks participation, enrollment trends, and utilization longitudinally. | |

Employee Experience | How do employees view and compare benefit plan options? | Employees can compare plans with side-by-side breakdowns of coverage and costs during enrollment. |

Do employees get digital ID cards in the app? | Yes. Employees can view and download benefit ID cards from the Rippling mobile or desktop app. | |

Can employees update contributions and coverage during QLEs without admin intervention? | Yes. Employees can self-serve QLE updates, with all deductions syncing to payroll automatically. | |

What mobile features are available for benefits access? | Rippling’s mobile app supports enrollment, QLE updates, ID card access, contribution changes, and more. | |

How do you support employees in making smarter benefits decisions? | Rippling provides plan comparison tools, cost breakdowns, and eligibility guardrails to help employees choose the right coverage. | |

Can employees track deductions and balances in real time? | Yes. Employees can view payroll deductions and flex balances in real time in Rippling. | |

What self-service tools exist to reduce benefits-related HR questions? | Rippling provides a unified self-service portal where employees can access benefits, pay, PTO, and HR data without going through HR. |

Ready to evaluate vendors?

This blog is based on information available to Rippling as of September 18, 2025.

Disclaimer

Rippling and its affiliates do not provide tax, accounting, or legal advice. This material has been prepared for informational purposes only, and is not intended to provide or be relied on for tax, accounting, or legal advice. You should consult your own tax, accounting, and legal advisors before engaging in any related activities or transactions.

Hubs

Author

Vanessa Kahkesh

Content Marketing Manager, HR

Vanessa Kahkesh is a content marketer for HR passionate about shaping conversations at the intersection of people, strategy, and workplace culture. At Rippling, she leads the creation of HR-focused content. Vanessa honed her marketing, storytelling, and growth skills through roles in product marketing, community-building, and startup ventures. She worked on the product marketing team at Replit and was the founder of STUDENTpreneurs, a global community platform for student founders. Her multidisciplinary experience — combining narrative, brand, and operations — gives her a unique lens into HR content: she effectively bridges the technical side of HR with the human stories behind them.

Explore more

See Rippling in action

Increase savings, automate busy work, and make better decisions by managing HR, IT, and Finance in one place.

![[Blog - Hero Image] Header HR automation](http://images.ctfassets.net/k0itp0ir7ty4/4IFuamJNogIac56PkCYV3R/4b0ebd36383692820bc1847b400b892f/Header_HR_Automation_03__1_.png)

![[Blog - Hero Image] Generic benefits image](http://images.ctfassets.net/k0itp0ir7ty4/1FKLpp8uQwSQPnsVFGH2uC/b42287f4e9f74195cd21b106bdf18f6c/Header_Generic_Benefits_03.jpg)

![[Blog - Hero Image] Generic benefits image](http://images.ctfassets.net/k0itp0ir7ty4/55EsuTUgyraqizAc9lmq5C/d8efce0eba6f08cca3614c7b21731e15/Header_Generic_Benefits_Hero.jpg)

![[Blog - Hero Image] HR General](http://images.ctfassets.net/k0itp0ir7ty4/4OlpX0mvNywi2YUXa2Y8mp/4341646e2a4f923aed4fdda5b9ea5467/Header_HR_General.jpg)

![[Blog - Hero Image] HR Automated Green](http://images.ctfassets.net/k0itp0ir7ty4/joUSqVqlrQpyWsytNfZR7/45783e58431e17bed466facbed5b0e08/Header_HR_Automated.jpg)