Must-have benefits administration software RFP template for midsize businesses in 2025

In this article

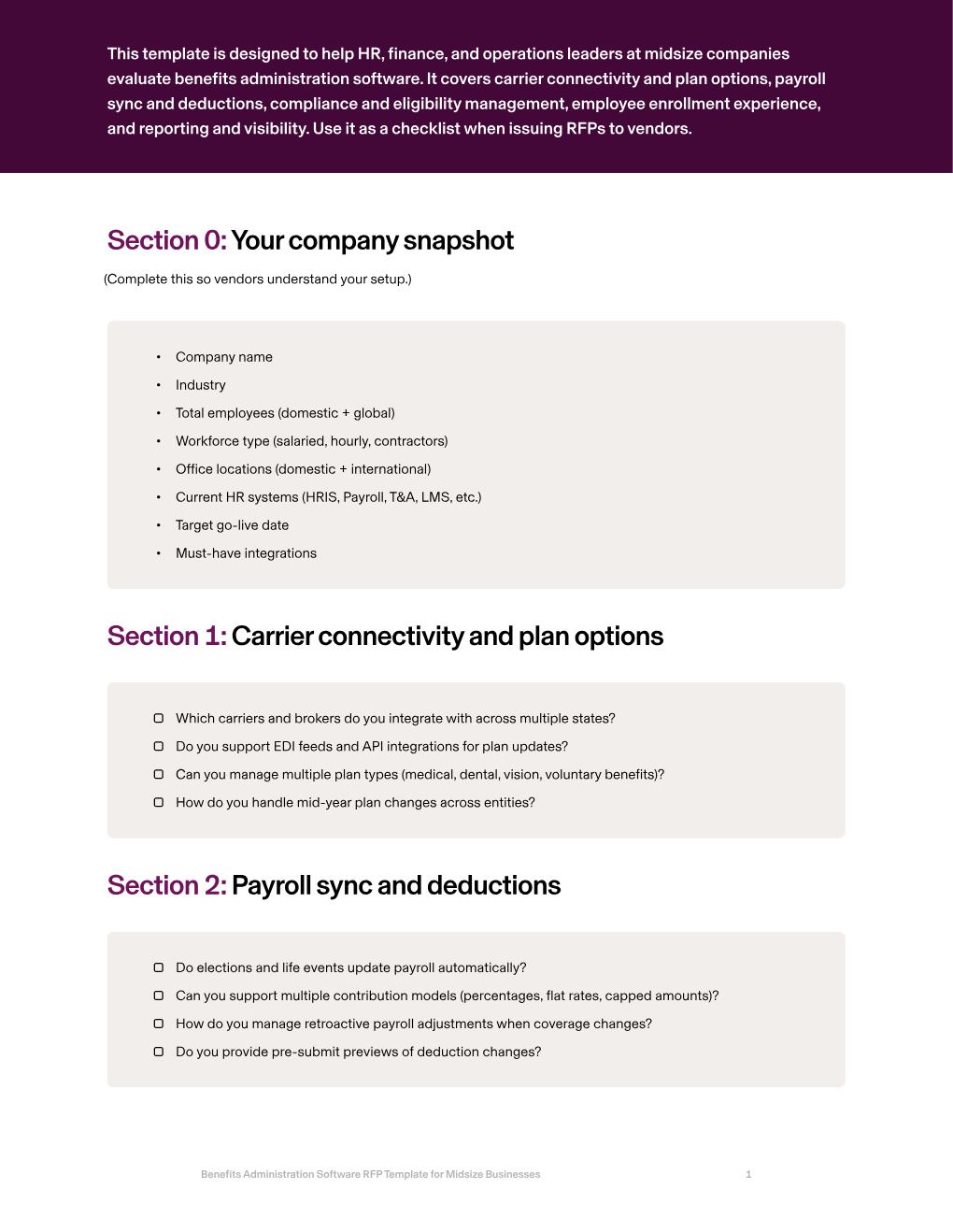

As companies grow into the midsize stage, benefits management gets exponentially more complicated. What used to be a handful of enrollments can quickly become hundreds across multiple plans, entities, and states. Without the right system, HR and finance teams spend countless hours reconciling payroll deductions, chasing compliance requirements, and manually answering employee questions during open enrollment.

The right benefits administration platform should centralize everything: connect directly with carriers, keep payroll in sync automatically, enforce compliance by default, and give employees a guided, mobile-first enrollment experience. It should also provide finance and HR leaders with dashboards that show costs, participation, and enrollment trends across entities and departments.

This guide shows the critical areas midsize businesses should evaluate in a benefits administration RFP, what best-in-class looks like, and the RFP questions to ask vendors. Plus, we’ll give you a downloadable template so you can start evaluating benefits software ASAP.

1. Carrier connectivity and plan options

Midsize organizations often work with multiple carriers and brokers across different states. Benefits software should integrate with all of them to automate enrollments and eliminate manual entry.

Rippling connects directly with major carriers and brokers, syncing elections and updates automatically so HR doesn’t spend days reconciling data across systems.

RFP questions to ask

Which carriers and brokers do you integrate with across multiple states?

Do you support EDI feeds and API integrations for plan updates?

Can you manage multiple plan types (medical, dental, vision, voluntary benefits)?

How do you handle mid-year plan changes across entities?

2. Payroll sync and deductions

At midsize scale, payroll errors multiply if benefits aren’t perfectly synced. Systems must automatically update payroll deductions and employer contributions in real time, with support for multiple contribution models. Rippling unifies benefits with payroll so every change — from open enrollment to a qualifying life event — updates payroll instantly and retroactively when required.

RFP questions to ask

Do elections and life events update payroll automatically?

Can you support multiple contribution models (percentages, flat rates, capped amounts)?

How do you manage retroactive payroll adjustments when coverage changes?

Do you provide pre-submit previews of deduction changes?

3. Compliance and eligibility management

With multiple entities and states, compliance requirements expand dramatically. Benefits administration software should automate ACA, COBRA, and HIPAA compliance, track eligibility automatically, and provide audit-ready reports.

Rippling automates measurement periods, notifications, and reporting for ACA and COBRA, while surfacing compliance risks in real time so HR teams can act before issues become penalties.

RFP questions to ask

How do you automate ACA, COBRA, and HIPAA compliance for midsize businesses?

Can the platform detect and alert admins to eligibility gaps?

Do you generate audit-ready compliance reports by entity and state?

Do you support exporting compliance records for third-party audits or regulators?

4. Employee enrollment experience

At midsize scale, benefits enrollment and life events happen constantly. Employees need a guided experience that reduces confusion and minimizes questions to HR. Rippling gives employees a self-service portal where they can compare plans, enroll digitally, and manage dependents from mobile or desktop — all in the same system they use for payroll and HR tasks.

RFP questions to ask

Can employees compare plans side by side with projected costs?

Do you support mobile enrollment and digital forms?

How are life events like marriage, childbirth, or relocation handled?

Can employees add dependents and update elections directly through self-service?

5. Reporting and visibility

Midsize finance and HR leaders need detailed reporting to understand participation, contributions, and costs by entity, department, or location. Dashboards should provide variance analysis and export to ERP or BI systems.

Rippling delivers real-time dashboards for benefits costs, enrollment trends, and employer contributions, giving leaders visibility across the entire organization.

RFP questions to ask

Do you provide dashboards that show benefits costs and participation by entity or department?

Can reports be segmented by location, role, or cost center?

Do you support variance analysis across open enrollment cycles?

Can data export into ERP systems or BI tools for deeper analysis?

How Rippling helps midsize businesses

Rippling Benefits Administration is built to handle the complexity of midsize companies. It connects directly to carriers across states, syncs payroll deductions in real time, and automates ACA, COBRA, and HIPAA compliance. Employees get a seamless enrollment and life-event experience, while finance and HR leaders get dashboards and reports that track costs and participation across entities and departments.

With Rippling, midsize businesses can:

Connect to multiple carriers and brokers across states

Sync benefits and payroll automatically with no manual work

Automate ACA, COBRA, HIPAA, and eligibility compliance

Give employees mobile-first, guided enrollment and life-event updates

Report on benefits costs and enrollment trends by entity, department, or location

Rippling RFP for benefits administration software for midsize businesses example

Section | Question to ask | Rippling Answer |

|---|---|---|

Carrier connectivity and plan options | Which carriers and brokers do you integrate with across multiple states? | Rippling integrates with major national and regional carriers and brokers, ensuring multi-state coverage and automation. |

Do you support EDI feeds and API integrations for plan updates? | Yes — Rippling supports EDI and API integrations so plan updates and enrollments sync automatically. | |

Can you manage multiple plan types (medical, dental, vision, voluntary benefits)? | Yes — Rippling supports medical, dental, vision, life, disability, and voluntary benefits. | |

How do you handle mid-year plan changes across entities? | Rippling automatically updates enrollments and deductions for mid-year plan changes across multiple entities. | |

Payroll sync and deductions | Do elections and life events update payroll automatically? | Yes — Rippling updates payroll instantly when employees enroll, change coverage, or experience a life event. |

Can you support multiple contribution models (percentages, flat rates, capped amounts)? | Yes — Rippling supports contribution models such as percentages, flat rates, and caps. | |

How do you manage retroactive payroll adjustments when coverage changes? | Rippling applies retroactive payroll adjustments automatically and generates previews before processing. | |

Do you provide pre-submit previews of deduction changes? | Yes — Rippling provides pre-submit previews so admins can verify deductions before payroll runs. | |

Compliance and eligibility management | How do you automate ACA, COBRA, and HIPAA compliance for midsize businesses? | Rippling automates ACA measurement periods, COBRA notifications, HIPAA protections, and compliance reporting. |

Can the platform detect and alert admins to eligibility gaps? | Yes — Rippling flags eligibility gaps in real time and alerts admins proactively. | |

Do you generate audit-ready compliance reports by entity and state? | Yes — Rippling generates compliance reports that can be filtered by entity, state, or department. | |

Do you support exporting compliance records for third-party audits or regulators? | Yes — Rippling allows compliance records and reports to be exported for audits or regulatory reviews. | |

Employee enrollment experience | Can employees compare plans side by side with projected costs? | Yes — Rippling provides guided plan comparisons with cost projections for employees. |

Do you support mobile enrollment and digital forms? | Yes — Rippling supports mobile-first enrollment and digital signatures for benefits forms. | |

How are life events like marriage, childbirth, or relocation handled? | Rippling detects life events and automatically triggers the appropriate enrollment workflows. | |

Can employees add dependents and update elections directly through self-service? | Yes — employees can add dependents, update elections, and manage coverage through self-service in Rippling. | |

Reporting and visibility | Do you provide dashboards that show benefits costs and participation by entity or department? | Yes — Rippling provides dashboards that show costs, contributions, and participation segmented by entity, department, or location. |

Can reports be segmented by location, role, or cost center? | Yes — Rippling supports reporting segmentation by location, role, cost center, or department. | |

Do you support variance analysis across open enrollment cycles? | Yes — Rippling supports variance analysis across open enrollment periods to track cost and participation trends. | |

Can data export into ERP systems or BI tools for deeper analysis? | Yes — Rippling exports benefits data into ERP and BI systems for advanced reporting and analysis. |

Ready to evaluate vendors?

This blog is based on information available to Rippling as of October 6, 2025.

Disclaimer

Rippling and its affiliates do not provide tax, accounting, or legal advice. This material has been prepared for informational purposes only, and is not intended to provide or be relied on for tax, accounting, or legal advice. You should consult your own tax, accounting, and legal advisors before engaging in any related activities or transactions.

Hubs

Author

The Rippling Team

Global HR, IT, and Finance know-how directly from the Rippling team.

Explore more

See Rippling in action

Increase savings, automate busy work, and make better decisions by managing HR, IT, and Finance in one place.

![[Blog - Hero Image] Generic benefits image](http://images.ctfassets.net/k0itp0ir7ty4/55EsuTUgyraqizAc9lmq5C/d8efce0eba6f08cca3614c7b21731e15/Header_Generic_Benefits_Hero.jpg)

![[Blog - Hero Image] Header HR automation](http://images.ctfassets.net/k0itp0ir7ty4/4IFuamJNogIac56PkCYV3R/4b0ebd36383692820bc1847b400b892f/Header_HR_Automation_03__1_.png)

![[Blog - Hero Image] Generic benefits image](http://images.ctfassets.net/k0itp0ir7ty4/1FKLpp8uQwSQPnsVFGH2uC/b42287f4e9f74195cd21b106bdf18f6c/Header_Generic_Benefits_03.jpg)