Must-have expense management software RFP template for global companies in 2025

![[Blog - Hero Image] Expense management](http://images.ctfassets.net/k0itp0ir7ty4/6ksT1tyMQlvUcjTJ4gMThI/e863f813b58b66432fb6f2bd2b860475/Header_Expense_Management_hero__1_.jpg)

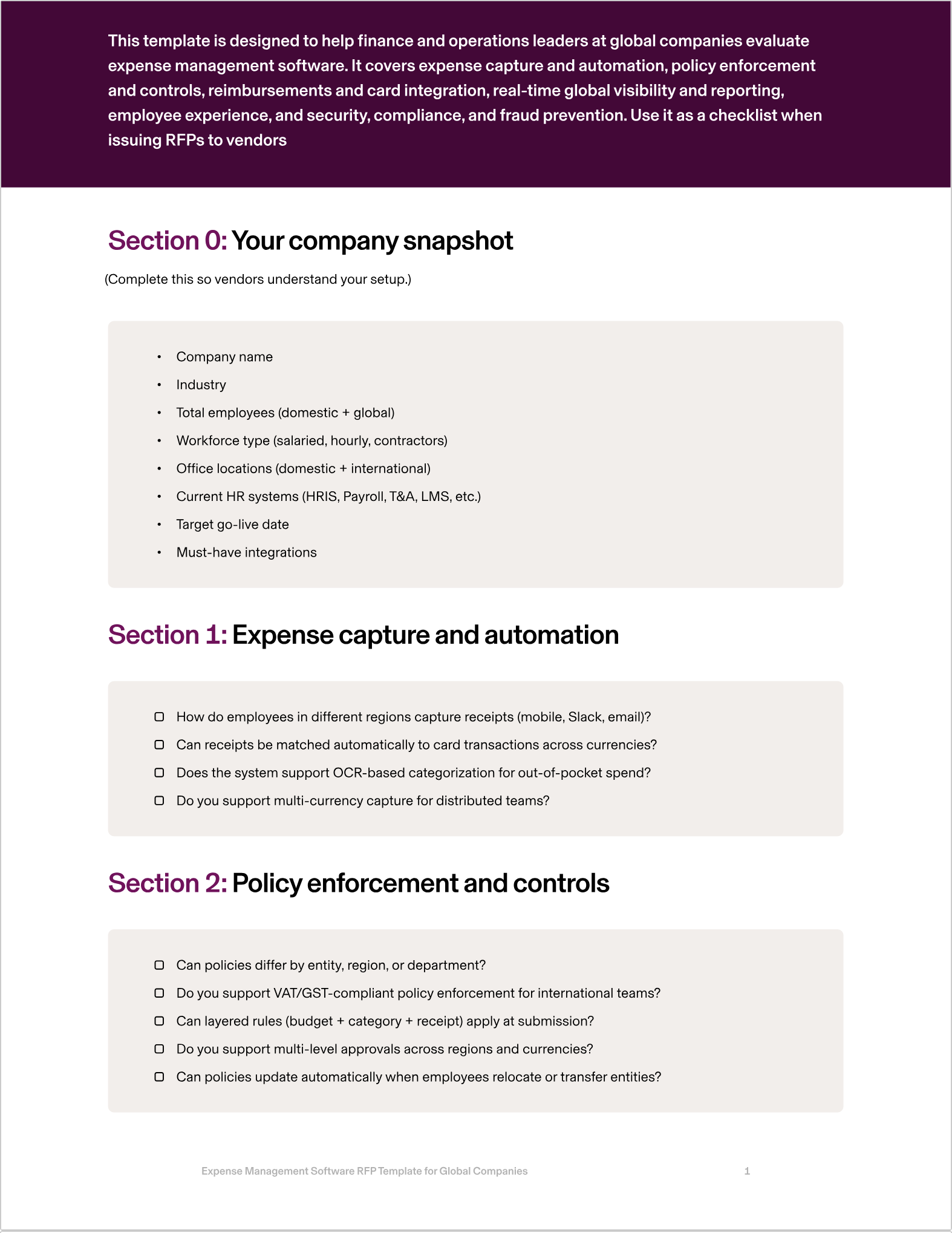

In this article

Managing expenses at a global scale comes with unique challenges. Employees in different countries submit expenses in multiple currencies, tax requirements vary by region, and finance leaders need to consolidate spend across entities without losing local detail. Legacy expense tools often leave gaps: manual FX conversions, fragmented reporting, and policies that can’t adapt across geographies.

The right expense management software should unify card spend, reimbursements, and policies into one global system. It must support multi-currency transactions, enforce region-specific rules like VAT/GST compliance, and integrate seamlessly into global ERP systems. Finance leaders should get consolidated dashboards across entities and currencies while local managers have the tools to enforce policies regionally. Employees should enjoy a consistent, mobile-first experience worldwide.

This guide shows the critical areas global companies should evaluate in an expense management RFP, what best-in-class looks like, and the RFP questions to ask vendors. Plus, we’ll give you a downloadable template so you can start evaluating expense management software ASAP.

1. Expense capture and automation

With distributed teams, capturing receipts consistently is critical. Employees should be able to submit expenses from anywhere via mobile, Slack, or email, and the system should auto-match receipts to card transactions. For out-of-pocket spend, OCR should categorize expenses automatically.

Rippling makes this easy by auto-matching receipts to Rippling Corporate Card transactions and capturing multi-currency expenses through its mobile app.

RFP questions to ask

How do employees in different regions capture receipts (mobile, Slack, email)?

Can receipts be matched automatically to card transactions across currencies?

Does the system support OCR-based categorization for out-of-pocket spend?

Do you support multi-currency capture for distributed teams?

2. Policy enforcement and controls

Expense policies must reflect both global standards and local rules. The system should allow layered controls — budgets, categories, and receipt requirements — that vary by entity, department, or region. Policies should be enforced instantly, flagging or blocking out-of-policy spend at submission.

Rippling enforces policies dynamically by tying them to HR and location data, ensuring compliance across entities and geographies.

RFP questions to ask

Can policies differ by entity, region, or department?

Do you support VAT/GST-compliant policy enforcement for international teams?

Can layered rules (budget + category + receipt) apply at submission?

Do you support multi-level approvals across regions and currencies?

Can policies update automatically when employees relocate or transfer entities?

3. Reimbursements and card integration

Global companies can’t afford to manage card spend, reimbursements, and payroll in silos. A modern platform should unify all three, ensuring employees are reimbursed in local currencies while transactions flow into the GL automatically.

Rippling integrates corporate cards, payroll, and expense management, supporting reimbursements via payroll or ACH globally with multi-currency support.

RFP questions to ask

Do you support reimbursements in local currencies across multiple countries?

Which ERP systems do you integrate with for global reconciliation (SAP, NetSuite, Oracle)?

Can reimbursements be processed via payroll and ACH internationally?

Do you support split allocations across projects, cost centers, or entities?

How do you handle FX conversions and surface them in reporting?

4. Real-time global visibility and reporting

Finance leaders need to see global spend at a glance while retaining the ability to drill down by country, department, or entity. Dashboards should consolidate spend in multiple currencies, normalize FX, and flag anomalies across regions.

Rippling delivers consolidated dashboards with multi-currency reporting, variance analysis across entities, and exportable data into ERP or BI systems.

RFP questions to ask

Can you provide consolidated dashboards across entities and currencies?

Do you support FX normalization for global reporting?

Can reports be segmented by country, department, or cost center?

Do you provide anomaly detection for suspicious spend globally?

Can reports integrate into ERP and BI tools for global analysis?

5. Employee experience

Employees worldwide need a consistent, mobile-first tool that adapts to local workflows. Submitting receipts should be quick and intuitive, reimbursements should be transparent, and approvals should be localized to the right managers.

Rippling provides employees with mobile and Slack-based submission options, multi-language support, and real-time reimbursement tracking — all in the same platform they use for HR and payroll.

RFP questions to ask

Is the employee experience consistent across countries and languages?

Can employees track reimbursements in their local currency?

Do you support mobile-first submissions for distributed teams?

Can approvals route to managers based on location or entity?

Do you support integrations with global collaboration tools (Slack, Gmail, Outlook)?

6. Security, compliance, and fraud prevention

Global companies need airtight security and compliance — from SOC 2 and ISO certifications to GDPR adherence. Fraud detection must flag anomalies across currencies, entities, and geographies. Audit logs must be immutable and exportable for local or global audits. Rippling secures data in transit and at rest, complies with SOC 2, ISO 27001, and GDPR, and provides anomaly detection and immutable logs across all transactions.

RFP questions to ask

What global compliance certifications do you hold (SOC 2, ISO 27001, GDPR)?

Do you support VAT/GST-compliant expense reporting by region?

What fraud detection is available across multiple currencies and entities?

Can admins freeze cards and block spend globally in real time?

Do you provide immutable, exportable audit logs for local and global audits?

How Rippling helps global companies

Rippling Expense Management unifies card spend, reimbursements, and policies into one global system. Employees capture receipts via mobile, Slack, or email, with expenses matched to card transactions automatically. Policies are enforced instantly across entities and regions, reimbursements flow via payroll or ACH in local currencies, and every transaction codes automatically into ERP systems like SAP, Oracle, or NetSuite.

Finance leaders get global dashboards with drill-downs by entity, country, or project, anomaly detection for unusual spend, and multi-currency reporting with FX normalization. Employees enjoy a consistent, mobile-first experience worldwide, while security and compliance standards ensure peace of mind for finance and audit teams.

With Rippling, global companies can:

Capture expenses consistently across regions and currencies

Enforce policies tied to HR and location data globally

Reimburse employees in local currencies through payroll or ACH

Integrate directly into SAP, Oracle, and NetSuite for reconciliation

Provide real-time dashboards across entities and countries

Protect financial data with SOC 2/ISO certifications and fraud detection

Rippling RFP for expense management software for global companies example

Section | Question to ask | Rippling Answer |

|---|---|---|

Expense capture and automation | How do employees in different regions capture receipts (mobile, Slack, email)? | Rippling supports receipt capture via mobile app, Slack, email forwarding, and OCR scanning, available globally. |

Can receipts be matched automatically to card transactions across currencies? | Yes — Rippling automatically matches receipts to Rippling Corporate Card transactions in any supported currency. | |

Does the system support OCR-based categorization for out-of-pocket spend? | Yes — Rippling OCR scans receipts and categorizes out-of-pocket expenses automatically by merchant and policy. | |

Do you support multi-currency capture for distributed teams? | Yes — Rippling supports capturing expenses in multiple currencies across global teams. | |

Policy enforcement and controls | Can policies differ by entity, region, or department? | Yes — Rippling policies can be customized by entity, region, department, or role, adapting automatically as employee data changes. |

Do you support VAT/GST-compliant policy enforcement for international teams? | Yes — Rippling supports VAT/GST-compliant expense reporting and enforcement across supported regions. | |

Can layered rules (budget + category + receipt) apply at submission? | Yes — Rippling enforces layered rules at submission, flagging or blocking expenses before approval. | |

Do you support multi-level approvals across regions and currencies? | Yes — Rippling supports configurable multi-level approvals triggered by region, currency, or spend thresholds. | |

Can policies update automatically when employees relocate or transfer entities? | Yes — policies adapt automatically based on HRIS-linked changes in employee role, entity, or geography. | |

Reimbursements and card integration | Do you support reimbursements in local currencies across multiple countries? | Yes — Rippling reimburses employees via payroll or ACH in their local currencies. |

Which ERP systems do you integrate with for global reconciliation (SAP, NetSuite, Oracle)? | Rippling integrates directly with NetSuite and Intacct, and supports API/file-based workflows with SAP and Oracle. | |

Can reimbursements be processed via payroll and ACH internationally? | Yes — Rippling processes reimbursements through both payroll and ACH globally. | |

Do you support split allocations across projects, cost centers, or entities? | Yes — Rippling supports split allocations across projects, cost centers, and entities for accurate coding. | |

How do you handle FX conversions and surface them in reporting? | Rippling applies transparent FX rates and displays converted values alongside local currency transactions in reports. | |

Real-time visibility and reporting | Can you provide consolidated dashboards across entities and currencies? | Yes — Rippling provides consolidated dashboards across entities with multi-currency support. |

Do you support FX normalization for global reporting? | Yes — Rippling applies consistent FX normalization across all reporting. | |

Can reports be segmented by country, department, or cost center? | Yes — Rippling reports can be segmented by entity, country, department, project, or cost center. | |

Do you provide anomaly detection for suspicious spend globally? | Yes — Rippling anomaly detection flags duplicate or suspicious spend across entities, currencies, and geographies. | |

Can reports integrate into ERP and BI tools for global analysis? | Yes — Rippling integrates reporting into ERP and BI systems, including SAP, NetSuite, and Tableau. | |

Employee experience | Is the employee experience consistent across countries and languages? | Yes — Rippling provides a consistent, localized employee experience across multiple languages and currencies. |

Can employees track reimbursements in their local currency? | Yes — employees can track reimbursement status in real time in their local currency. | |

Do you support mobile-first submissions for distributed teams? | Yes — employees can capture and submit expenses via mobile app globally. | |

Can approvals route to managers based on location or entity? | Yes — Rippling routes approvals based on org structure, location, or entity data. | |

Do you support integrations with global collaboration tools (Slack, Gmail, Outlook)? | Yes — Rippling integrates with Slack, Gmail, and Outlook for global expense submission and approval. | |

Security and fraud prevention | What global compliance certifications do you hold (SOC 2, ISO 27001, GDPR)? | Rippling is SOC 2 Type II certified, ISO 27001 certified, and GDPR compliant. |

Do you support VAT/GST-compliant expense reporting by region? | Yes — Rippling generates VAT/GST-compliant expense reports in supported jurisdictions. | |

What fraud detection is available across multiple currencies and entities? | Rippling anomaly detection flags duplicate spend, suspicious transactions, and policy violations across currencies and entities. | |

Can admins freeze cards and block spend globally in real time? | Yes — admins can freeze Rippling Corporate Cards or block transactions instantly across entities and geographies. | |

Do you provide immutable, exportable audit logs for local and global audits? | Yes — Rippling provides immutable, exportable audit logs filterable by entity, geography, or date range. |

Ready to evaluate vendors?

Download our comprehensive Expense Management Software RFP Template for Global Companies

Disclaimer

Rippling and its affiliates do not provide tax, accounting, or legal advice. This material has been prepared for informational purposes only, and is not intended to provide or be relied on for tax, accounting, or legal advice. You should consult your own tax, accounting, and legal advisors before engaging in any related activities or transactions.

Hubs

Author

The Rippling Team

Global HR, IT, and Finance know-how directly from the Rippling team.

Explore more

See Rippling in action

Increase savings, automate busy work, and make better decisions by managing HR, IT, and Finance in one place.

![[Blog - Hero Image] Expense management](http://images.ctfassets.net/k0itp0ir7ty4/36sOZvauN7TR1TLXSFOYo8/b2babbfdcbc3a7b4a26bbd6373bb4991/Header_Expense_Report_03__2_.jpg)

![[Blog - Hero Image] Corporate card policy](http://images.ctfassets.net/k0itp0ir7ty4/5IEfSYdmrcM8Z1OIT50bBh/54d1041fc98926d5584218dd42ccefb0/Blog_Inline_Image_Corporate_Card_Policy.png)

![[Blog - Hero Image] Independent contractors](http://images.ctfassets.net/k0itp0ir7ty4/38jNHBPJlCn8MHVsokTeSt/0e65ded958fe996e6b5f8593e352232c/Header_Independent_Contractors_01__1_.png)